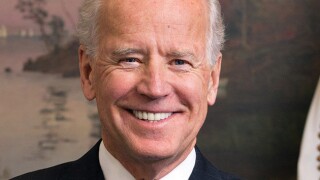

Janet Yellen was instrumental in securing the landmark international tax agreement at the OECD, which was signed by 137 countries in October 2021.

The OECD’s two-pillar solution represents the most wide-reaching set of reforms to the global tax environment. The reforms set a minimum corporate tax floor of 15% and aim to ensure that multinationals pay a fair share of tax in the countries in which they operate.

However, securing this agreement appears to have been the easy part – the key challenge now will be getting it past a wall of resistance from both political and business groups in the US.

Yellen has had a busy 2022 as US treasury secretary.

Washington passed the Inflation Reduction Act, both a significant and controversial piece of legislation. The law included an $80 billion boost for the beleaguered Internal Revenue Service (IRS). The IRS aims to narrow the US’s $7 trillion tax gap.

While the legislation contains important clean energy tax incentives, it failed to incorporate key provisions for implementing pillar two’s global minimum tax rate.

Yellen has also steered the world’s wealthiest nations during global challenges, including the war in Ukraine, and energy and inflation crises.

She has played a pivotal role in uniting the West and G7 nations, particularly finance ministers, behind a series of sanctions on Russia. This has included G7 nations imposing punitive duties and tariffs on Russian goods imported into G7 markets.

Yellen has also played a hand in US domestic policy in recent years. This has included the passage of vital legislation such as the Infrastructure Investment and Jobs Act in 2021 and the Tax Cuts and Jobs Act in 2017. These measures lowered US corporate tax rates, modernised international tax rules and attempted to shore up anti-base erosion rules.

Yellen’s influence on global economic and tax policy casts an even longer shadow. It dates back to her role as chair of the Economic Policy Committee of the OECD and US President Bill Clinton’s Council of Economic Advisers in the late 1990s.

She then went on to serve as head of the Federal Reserve System from 2014 to 2018. Since January 2021, Yellen has been the secretary of the US Department of Treasury.