The EU added the Hong Kong SAR to its grey list of non-cooperative jurisdictions for tax purposes in October 2021 due to the EU’s concerns about Hong Kong’s tax exemption for offshore passive income.

The EU’s main concern is that corporates with no substantial economic activity in Hong Kong are not subject to tax in respect of certain offshore passive income in Hong Kong and other tax jurisdictions, resulting in potential ‘double non-taxation’ of such income.

The Hong Kong government committed to amending the region’s tax law to address the EU’s concern by the end of 2022 in order for Hong Kong to be removed from the EU grey list. The revised law will likely apply to in-scope income accrued and received in Hong Kong on or after January 1 2023.

The Hong Kong government circulated a consultation paper in June 2022 and a tax bill was gazetted on October 28 2022 (with subsequent amendments) to implement the revised foreign-sourced income exemption (FSIE) regime from January 1 2023. The Legislative Council has formed a Bills Committee to scrutinise the bill and invited submissions on the bill. The Hong Kong government subsequently provided its responses to the issues raised in the submissions. As part of this process, the Hong Kong Inland Revenue Department (IRD) has provided administrative guidance on the practical application of the FSIE regime.

The following sections summarise the key features of the new FSIE regime, offer observations on issues requiring further consideration, and discuss the actions required for businesses.

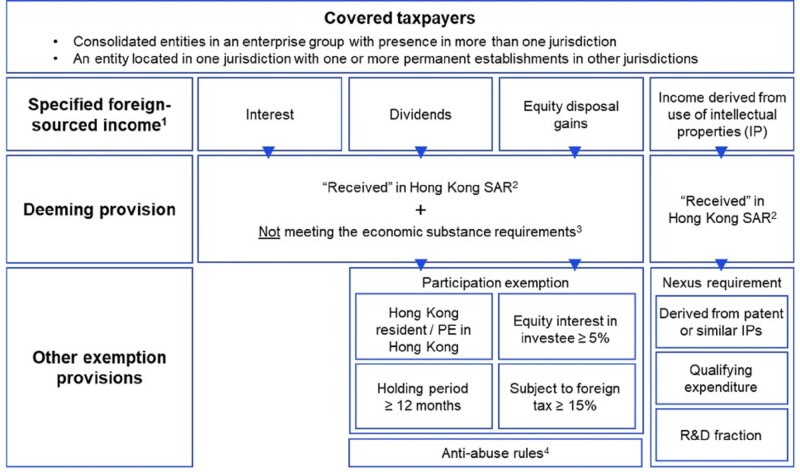

An overview of the FSIE regime

(1) Exclude interest, dividends, and equity disposal gains derived from/incidental to:

The regulated businesses of regulated financial entities;

The activities producing the tax-exempt assessable profits of entities benefitting from the unified fund exemption/non-resident person tax exemption;

The activities producing the assessable profits of entities benefitting from a preferential tax regime in Hong Kong; and

The activities producing the tax-exempt sums of entities benefitting from the special tax exemption under the tax regime for shipowners.

(2) A sum is ‘received in Hong Kong’ if it is:

Remitted to, transmitted to, or brought into Hong Kong;

Used to satisfy any debt incurred in respect of a trade, profession, or business carried on in Hong Kong; or

Used to buy movable property that is brought into Hong Kong.

(3) For a pure equity holding entity (PEHE): (i) having adequate human resources and premises in Hong Kong for holding and managing its equity participations in other entities and (ii) complying with all applicable entity/business registration and filing requirements in Hong Kong. For a non-PEHE: (i) having an adequate number of qualified employees and (ii) incurring an adequate amount of operating expenditures in Hong Kong to carry out the specified economic activities in Hong Kong; namely, (a) making necessary strategic decisions in respect of any assets the entity acquires or disposes of and (b) managing and bearing principal risks in respect of such assets.

(4) The anti-abuse rules are:

The switch-over rule – switching from a tax exemption to a tax credit if the applicable foreign tax rate is less than 15%;

The main purposes rule – the participation exemption does not apply if there is an arrangement of which the main purpose, or one of the main purposes, is to obtain a tax benefit; and

The anti-hybrid mismatch rule – the participation exemption does not apply if the dividend payment is deductible by the investee company.

The deeming provision

Under the new FSIE regime, the four types of specified foreign-sourced income received in Hong Kong by an entity within the multinational enterprise (MNE) group carrying on a trade or business in Hong Kong will be deemed as arising in, or derived from, Hong Kong and non-capital in nature. This overturns the strict territorial source approach to such passive type of income that has traditionally been applied to all corporate taxpayers in Hong Kong.

The regime only applies to income that is offshore sourced under the existing rules so leaves open the potential for continued dispute as to whether such income is onshore or offshore sourced. This will be most problematic with interest, royalties, and gains.

Covered taxpayers

The new FSIE regime does not affect individuals; it only applies to entities that are part of a group operating in more than one jurisdiction. The concept of a covered group is based on, but has significant deviations from, the rules developed under pillar two of BEPS 2.0. Of particular importance is that there is no group turnover de minimis threshold when applying the regime.

The economic substance requirement

For foreign-sourced interest, dividends, and equity disposal gains (non-intellectual property, or non-IP, income), a tax exemption is still available if the economic substance (ES) requirement is met. Essentially, this requires that key decision making and management of the relevant asset is conducted in Hong Kong and that the relevant entity can show it has adequate employees and operating expenditure conducting those activities.

A reduced ES requirement applies to a PEHE, which is defined as an entity that only:

Holds equity interests in other entities; and

Earns dividends, disposal gains, and incomes incidental to the acquisition, holding, or sale of such equity interests.

Outsourcing of the economic activities specified under the ES requirement is permissible provided that the activities are conducted in Hong Kong and adequately monitored by the MNE entity.

The participation exemption for dividends and equity disposal gains

For dividends and equity disposal gains, if the MNE entity cannot fulfil the ES requirement, it can rely on the participation requirement to benefit from a tax exemption. For dividends, a ‘look-through’ approach will be adopted in applying the ‘15% subject to tax’ condition; i.e., the applicable foreign income tax rates of the dividends and the underlying profits out of which the dividends are paid will be taken into account. The look-through approach applies to a maximum of five tiers of investee entities of the MNE entity.

The nexus requirement for IP income

For income derived from the use of IP (‘IP income’), the nexus requirement is adopted, which is similar to the OECD’s nexus approach under Action 5 of the BEPS 1.0 Action Plan. A tax exemption is available for income derived from the use of a qualifying IP (i.e., a patent or copyrighted software) if the MNE entity has incurred qualifying expenditure on R&D activities related to the qualifying IP.

The combined effect of Hong Kong’s source rules for IP income and the nexus requirement under the FSIE regime is that, going forward, a tax exemption for offshore IP income would only be available:

If the IP income is a royalty derived from the use of a patent or copyrighted software; and

When the MNE entity has itself conducted R&D activities outside Hong Kong or engaged an unrelated party to conduct such R&D activities outside Hong Kong.

Double tax relief by way of a foreign tax credit

Where an MNE entity fails to meet any of the above-mentioned exemptions and needs to pay tax in respect of the specified foreign-sourced income in Hong Kong and a foreign jurisdiction, double taxation relief in the form of a bilateral tax credit (when there is an applicable tax treaty) or unilateral tax credit (in the absence of an applicable tax treaty) will be provided, subject to certain conditions.

A look-through approach will again be applicable to dividends, under which the foreign taxes paid on the dividends and the underlying profits of up to five tiers of investee companies (with an equity interest of not less than 10%) can be taken into account.

Issues for further consideration

The FSIE regime represents a significant change to the Hong Kong tax system. Most, if not all, businesses in Hong Kong with cross-border investments generating offshore passive income will be impacted by the new regime.

While it is expected that businesses subject to the FSIE regime should be able to continue to benefit from a tax exemption for their offshore dividends and equity disposal gains, there are open issues relating to investment funds, offshore claims on interest income, and the practical application of the new rules under the FSIE regime. Below are a few key issues of which further clarification will be welcomed.

Impact on investment funds

The Hong Kong government intends to exclude investment funds (and their special purpose vehicles) from the scope of the FSIE regime. An investment fund that does not prepare consolidated accounts on its investee entities would generally not be an MNE group and therefore would be out of scope of the FSIE regime. A publicly offered fund that is eligible for the profits tax exemption under the present tax law will continue to be tax exempt despite the FSIE regime.

Based on the existing drafting of the FSIE income exclusion, it is not clear whether foreign-sourced non-IP income of privately offered funds can be excluded in a tax year when no tax-exempt profit has been derived by the funds. In addition, funds investing predominantly in immovable property in Hong Kong cannot benefit from the FSIE income exclusion because they would not qualify for the unified fund exemption.

Sums deemed to be received in Hong Kong

Although it is clear from the tax bill that the ‘deemed received approach’, which is the same as that under Singapore’s FSIE regime, will be adopted, further guidance will be required to address situations such as where the specified foreign-sourced income is received outside Hong Kong but the sum is then used for onward dividend distribution by the MNE entity in Hong Kong or an equity contribution of the MNE entity to an investee entity (without physical remittance of the funds into Hong Kong). Arguably, the sum is not used to satisfy a ‘trade debt’ in Hong Kong in these situations.

Scope of interest income

The term ‘interest’ is not defined in the tax bill. Reference can be made to the Hong Kong government’s response that interest generally refers to the sum payable for the use of money and is in the nature of compensation for the deprivation of such use. However, it is unclear whether finance lease income and a factoring charge on trade receivables, etc. are regarded as interest income.

Definition of a PEHE

The narrow definition of a PEHE (i.e., an entity that only holds equity interest in other entities) suggests that an investment holding entity that provides a shareholder loan to a subsidiary will fall outside the definition of a PEHE, even if the loan is non-interest bearing. If it lends the surplus funds arising from the foreign-sourced dividends to a group treasury company or uses the surplus funds to participate in a group cash pooling arrangement to earn interest income, it would also not qualify as a PEHE.

Interpretation of the ‘applicable rate’ under the participation exemption

For the purpose of assessing whether a foreign-sourced equity disposal gain is subject to foreign tax at not less than 15%, the Hong Kong government has indicated in a letter addressed to the Bills Committee that the applicable rate will generally refer to the headline rate (i.e., the highest corporate tax rate) of the foreign jurisdiction, unless the income concerned is taxable under a special tax legislation at a lower rate than in the main legislation.

However, it is yet to be seen how the ‘headline rate’ approach will be adopted in situations where:

The tax rate applicable to equity disposal gains derived by non-residents is lower than the headline corporate tax rate;

A foreign jurisdiction provides a tax exemption on capital gains; and

A reduced tax rate or tax exemption is applicable for equity disposal gains under a tax treaty.

Taking the offshore gains from the sale of a Chinese entity by a Hong Kong resident company as an example, one of the conditions for the participation exemption to apply is the gains must be subject to corporate income tax (CIT) in the mainland at an applicable rate of not less than 15%.

Although the statutory CIT rate in the mainland is 25%, disposal gains are only subject to a 10% withholding tax under the mainland’s CIT law. Furthermore, if the double tax arrangement (DTA) between the mainland and Hong Kong applies and the gains are exempt from tax in the mainland under the DTA, it is unclear whether the applicable rate could be taken as 0%. In both scenarios, the applicable rate is below 15% and the 15% subject to tax condition cannot be met.

ES requirement v source of interest income

The IRD determines the source of interest income by applying the ‘provision of credit test’ or the ‘operation test’ at present. The former focuses on whether the funds from which the interest is derived were first made available to the borrower outside Hong Kong, whereas the latter looks at what the taxpayer has done to earn the interest in question and where they have done it.

Under the FSIE regime, an MNE entity has to build up substance and perform the specified economic activities in Hong Kong to fulfil the ES requirement. Where the operation test (instead of the provision of credit test) applies, the challenge for the MNE entity will be how it can meet the ES requirement and secure an offshore claim on the interest income at the same time.

The Commissioner’s Opinion

To provide tax certainty to affected businesses on their compliance with the ES requirement under the FSIE regime before the regime becomes effective, the IRD has introduced an interim measure for taxpayers to apply for the Commissioner’s Opinion on compliance with the ES requirement.

The Commissioner’s Opinion mechanism is available before the tax bill is enacted into law. After that, taxpayers can apply for an advance ruling if they want to obtain certainty on the tax treatment under the FSIE regime.

Actions required for businesses

The issues surrounding the practical implementation of the FSIE regime are complex and evolving. Although the IRD has issued some administration guidance together with illustrative examples and FAQs on the draft legislation, open issues relating to the practical application of the regime remain. The IRD is updating the illustrative examples and FAQs from time to time. It is understood that when the tax bill is enacted into law, the IRD will publish a Departmental Interpretation and Practice Note on the new FSIE regime to provide further guidance to taxpayers.

Given that the FSIE regime will almost certainly take effect from January 1 2023, business groups should act now to assess whether they are impacted by the new regime and if so, what the potential options are and whether they have sufficient resources to implement the preferred option (for example, building up the required ES in Hong Kong). They should also consider whether it is desirable to apply for the Commissioner’s Opinion before the end of 2022 to obtain certainty on their compliance with the ES requirement under the FSIE regime. Business groups should closely monitor future developments in this area.

Large MNE groups within the scope of pillar two under BEPS 2.0 should consider the interaction between the FSIE regime and the pillar two rules and the combined effect of the two.