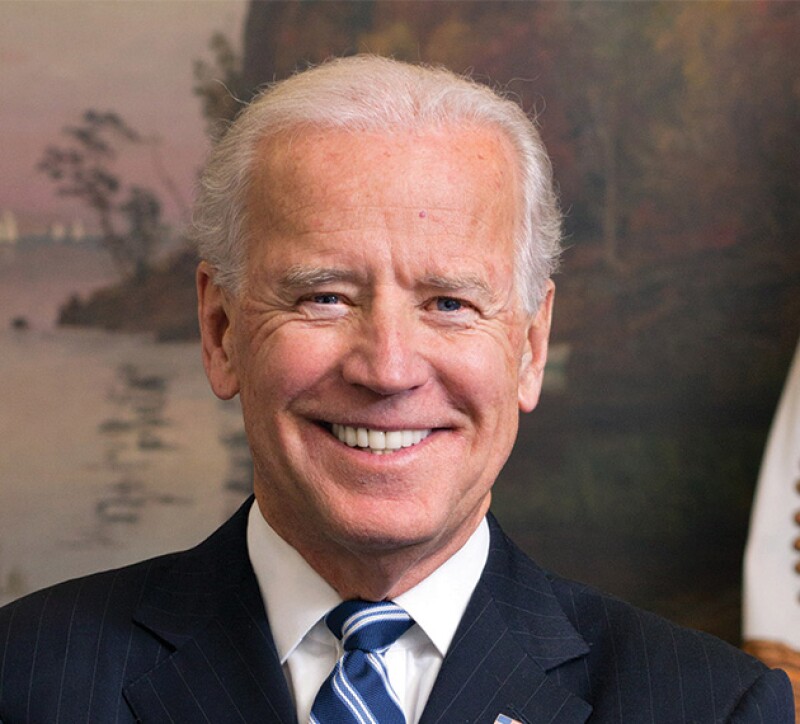

US President Joe Biden came to power promising to reform the country’s tax system as part of an ambitious economic platform. No Tax 50 would be complete without the US president, but especially this time as Biden was crucial to securing a global minimum corporate tax rate in 2022.

Biden favoured a global minimum rate of 21% back in 2021, but he eventually compromised with his opponents and settled on 15% in July 2022. This was a historic moment because the US has the power to make or break global agreements. It sent a message worldwide and helped secure broad support for the OECD’s tax deal.

However, this was the easy part. Over the course of a year, US lawmakers squabbled over the details of a higher minimum rate. The US already had a minimum of 10.5% thanks to the Tax Cuts and Jobs Act, but the higher rate met strong opposition from conservative Democrats like Joe Manchin.

The Inflation Reduction Act was not approved until August 2022, but this secured the 15% minimum rate in the US and made it much more likely for pillar two to succeed worldwide. Since Biden may now face a divided Congress, this will go down in history as his legacy in tax policy.

President Biden faces the difficulty of securing wider tax reform to stop the rise of the digital services tax against US technology companies in countries such as France and India. But his work just got much harder going into 2023.