Real estate investment structures in Austria, France, Germany, Poland, and Luxembourg may be affected by the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting.

Article 3 of the MLI addresses the treatment of income received by fiscally transparent entities, while Article 5 covers the methods for the elimination of double taxation.

This is the second article in a three-part series from Deloitte that will dissect the impact of the MLI on real estate investments (the first article was published on August 3 2022).

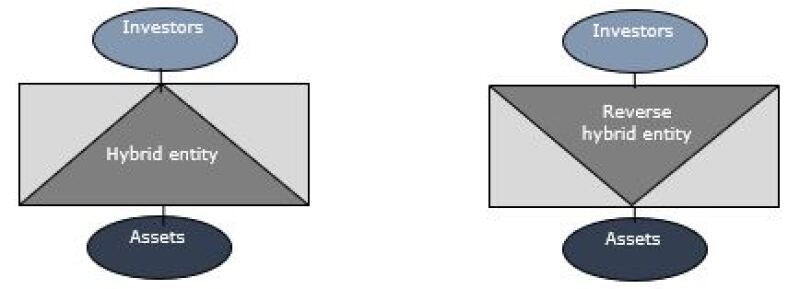

Transparent entities

Article 3 may affect investors that are not resident in the same country as the real estate fund.

Based on Article 3.1, a covered tax agreement (CTA) would not apply to an investor residing in a contracting jurisdiction (CJ) that considers the foreign entity as non-tax transparent (i.e., tax opaque) while the jurisdiction of the entity considers the income realised by that entity as income of the investor (i.e., it considers the entity as tax transparent).

Article 3.2 intends to modify the provisions on the application of methods to eliminate double taxation (i.e., exemption, deduction, or tax credit).

A CTA would not apply to an investor treating the foreign entity as resident for CTA purposes such that the investor would not benefit from an exemption, a deduction, or a tax credit on the income received from that resident while the jurisdiction of the foreign entity treats the entity as tax transparent. Another application example would be when the source country treats the foreign investor as tax transparent while the jurisdiction of the foreign investor treats it as tax opaque.

MLI Article 3: Illustration

Specifics per country

Article 3 may not be the most salient provision of the MLI relative to the real estate market for the countries within the scope of this article. From a Luxembourg and a Polish tax perspective, a limited impact on real estate investment structures is expected following the adoption of Article 3.1 and a decreased interest in Polish closed-end investment funds in recent years.

Unsurprisingly, France and Germany have not opted to apply Article 3, although they may implement the provision bilaterally.

Interestingly, Austria did not opt to apply Article 3.1. According to legislative materials, Austria’s position is meant to ensure that it would not be required to grant treaty relief to foreign funds that are treated as tax opaque and eligible for tax treaty benefits in their state of establishment but that are treated as fiscally transparent from an Austrian income tax perspective.

Methods for the elimination of double taxation

The purpose of Article 5 of the MLI is to eliminate double non-taxation resulting from disagreements between the state of residence and the source state regarding the facts of a case or the interpretation of the provisions of the convention. It should apply to the extent that the source state and the state of residence have applied the provisions of the convention to exempt an item of income or capital.

Option | Summarised methodology | Countries’ choice |

A | In a CJ, disallowance of the exemption method (EM) for income/capital that is exempt or subject to a reduced treaty rate in the other CJ. | Austria Luxembourg |

B | In a CJ, disallowance of the EM for dividends that are deductible in the other CJ. This scenario was already addressed in an EU context by the amended Parent-Subsidiary Directive. |

|

C | In a CJ, automatic switch-over from the EM to the credit method (CM). Noticeable reserve: a party to the MLI that does not choose to apply option C may reserve the right – with respect to one or more, or all, identified CTAs – not to permit the other CJs to apply option C. | Poland |

No option |

| France Germany |

Specifics per country

Because Germany and France have not selected any option, the option chosen by the other CJ applies to that CJ’s residents only.

Option C, chosen by Poland, seems to ‘automate’ the switch-over from the EM to the CM. This means that the other CJ to a CTA can refuse to allow the CJ to apply option C, which is what Luxembourg does.

Forecast for assets held by a Luxembourg company | ||

Shares in EU property companies (‘propcos’), except Luxembourg propcos) | Interest in a non-Luxembourg real estate investment trust (REIT) | Non-Luxembourg real estate asset |

Outside a treaty, the exemption system under Luxembourg domestic legislation may be considered | (i) Tax-transparent non-Luxembourg REIT: exemption expected based on the relevant treaty because the Luxembourg shareholder would be considered as directly holding the property. In a situation where the foreign REIT distribution is exempt or benefits from a reduced withholding tax in its country of residence under a treaty, the switch-over clause may apply. (ii) Tax-opaque non-Luxembourg REIT: if the country of residence of the REIT exempts the distribution income under the relevant treaty (or provides for a reduced rate), while an exemption may also be claimed in Luxembourg under a treaty, the switch-over clause may apply. Some treaties already anticipate and address double exemption scenarios. | No impact, because tax treaties generally do not allocate the taxing right to Luxembourg. |

A deeper analysis of Article 5 leads to the conclusion that close scrutiny of real estate structures is recommended when the application of methods to eliminate double taxation comes into play.

Deloitte’s detailed analysis of the land-rich clause and an overall conclusion will be available in the final article of this series.

The authors would like to thank several Deloitte colleagues for their contributions to this article: Sarvi Keyhani (France), Daniel Blum (Austria), Dr. Alexander Linn (Germany), Benedikt Pignot (Germany), Piotr Maculewicz (Poland), Michal Siekierzynski (Poland), and Rafael Lourenço (Luxembourg).