Regulation of the European Parliament and of the Council establishing a carbon border adjustment mechanism

Carbon border adjustment mechanism (CBAM) reporting obligations commence from October 1 2023, meaning it is urgent for importers to the EU, and EU companies producing or importing goods with high embedded emissions, to prepare for these developments.

It is critical for companies and importers of CBAM goods in the EU to remain well informed of these developments and begin evaluating the overall impact on their business activity, which may not be limited to a view on their customs data only, but also the impact on their sourcing and supply chain.

Summary of the CBAM regulation

The regulation establishes a CBAM for regulating greenhouse gas emissions embedded in certain goods, upon their importation into the customs territory of the EU, with the purpose of preventing the risk of carbon leakage.

Covered goods

Under Article 2, ‘covered goods’ applies to goods listed in Annex I, originating in countries and territories outside the customs territory of the EU, with the exception of the countries and territories listed in Annex II.

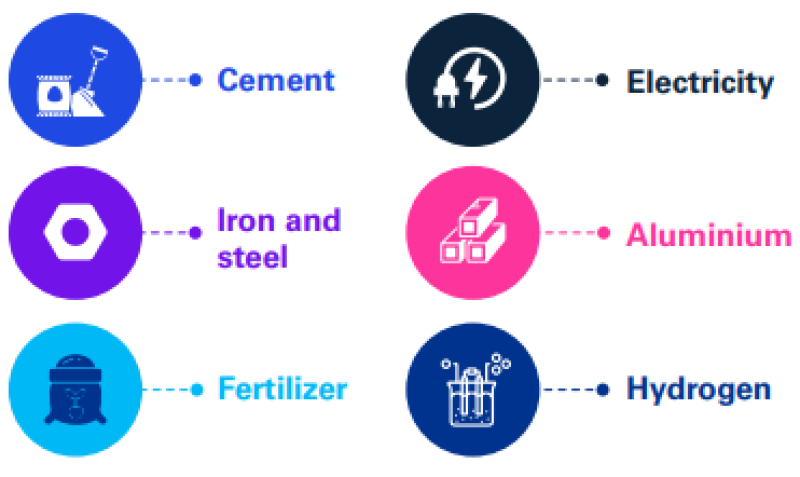

Although the scope will not change before 2026, it is intended that the scope of the covered goods includes all sectors covered by the EU Emissions Trading System (ETS) by 2030.

Annex I goods

Indirect emissions under certain conditions, certain precursors, and some downstream products (for example, screws and bolts) are also included.

Annex II exception countries and territories

Process

Under Article 4, the importation of goods shall only be made by a declarant that is authorised by the competent authority (authorised declarant). ‘Importation’ is defined as meaning the release for free circulation (Article 3).

The customs authorities shall not allow the importation of goods unless the declarant is authorised by a competent authority at the latest at the release for free circulation of the goods, according to Article 25.

The authorised declarant shall, by May 31 each year, submit a CBAM declaration to the competent authority containing the total emissions embedded in imported covered goods during the previous calendar year, and the corresponding total number of CBAM certificates to be surrendered (Article 6).

Calculating embedded emissions

Annex III sets out the approach for calculating the specific actual direct, and, where applicable, indirect embedded emissions of goods other than electricity. Embedded emissions in imported electricity shall be determined by reference to default values in accordance with the method set out in Annex III.

Under Article 7(2), where actual emissions cannot be adequately determined, the number of CBAM certificates to be surrendered shall be determined using default values, based on the average emission intensity of each exporting country and for the goods listed in Annex I (excluding electricity), increased by a proportionately designed mark-up to be determined in the implementing acts of the regulation.

When reliable data for the exporting country cannot be applied, these default values will be based on the average emission intensity of a percentage (to be determined in the implementing acts) of the worst performing EU ETS installations for that type of goods (Annex III, 4.1).

Verification

Declared embedded emissions must be verified by an independent, accredited verifier, according to articles 8(1) and 18(1).

How KPMG can help

The EU CBAM is associated with significant increases in ambition within the EU ETS, with implications for the future carbon price pathway and the amount of free permits received by European producers. It is important to understand the impact of these measures together for the particular industry you are in.

Whether based within the EU or trading with the EU, KPMG encourages companies to consider their own decarbonisation strategies, whether it be to ensure that they are prepared for compliance with upcoming legislation or to ensure that operations are future-proofed against medium- and long-term global developments.

KPMG has developed a leading global climate change and decarbonisation practice. Working alongside KPMG’s global trade and customs practice and ESG sustainability and tax and legal teams, the firm can deliver leading approaches as it works collaboratively with clients on the journey to a low-carbon future.

KPMG ESG professionals can assist you with a climate risk and decarbonisation strategy that includes helping you to gain strategic foresight and operational value in your decarbonisation journey, from emissions measurement to implementation, monitoring and reporting. This is supported by an array of options, such as renewable energy procurement, energy efficiency, circular economy and supply chain management, and includes assessing and understanding the underlying tax and legal impacts.

Through KPMG’s climate risk advisory services, the firm can help you to measure, quantify and assess risks and opportunities across supply chains under a wide range of scenarios, and understand the impact on business performance.

KPMG also advises clients on the financing and investment aspects of the low-carbon agenda, including fundraising and identifying investment partners, and merger and acquisition opportunities, which consist of both debt and equity approaches.

Some or all of the services described herein may not be permissible for KPMG audit clients and their affiliates or related entities.

Read the original version of the article on KPMG’s website.

Click here to access more KPMG Future of Tax content.