The policy effort to design a more efficient withholding tax (WHT) system has been high on the agenda of international bodies – including the OECD and the European Commission (EC) – and local tax authorities for more than a decade.

At the OECD level, the 2013 approval of the Treaty Relief and Compliance Enhancement (TRACE) implementation package for the adoption of the authorised intermediary (AI) system created a standardised system for effective WHT relief procedures for cross-border portfolio income.

The objectives of this initiative were twofold: to develop treaty relief systems that are as efficient as possible, with the aim of minimising administrative costs and allocating the costs to the appropriate parties, and to identify solutions that enhance the ability of source and residence countries and territories to ensure proper compliance with tax obligations.

At the EU level, in its July 15 2020 Tax Package for fair and simple taxation supporting the recovery strategy, the EC proposed actions for improving the business taxation environment as part of its package of initiatives on increasing the efficiency of tax payments in the EU.

The EC noted that tax barriers to cross-border investment continue to exist and that the commission will propose a legislative initiative for introducing a common, standardised, EU-wide system for WHT relief at source, accompanied by an exchange of information and cooperation mechanism among tax administrations. The EC also noted that legislative and non-legislative options will be considered and that the OECD TRACE initiative will be taken into consideration in the design options.

The EU public consultation

The latest EC initiative, which commenced in September 2021, concerns a roadmap consultation for a directive proposal for the introduction of a common EU-wide system for relief from WHT on dividend and interest payments. The objective of this initiative is, among others, to reduce the complexity and tax compliance costs associated with WHT relief procedures to make these procedures more efficient for cross-border investors, while also preventing abusive tax practices.

In spring 2022, the EC released the second step in the consultation process in a questionnaire format. The EC received close to 1,700 responses (92% from EU citizens), including 51 valid position papers. In their June 26 2022 response, KPMG member firms noted that, in their view, policy efforts should focus on the gradual transition to a fully fledged relief at source (RAS) system, along with a more efficient harmonised EU refund system acting as a backstop. KPMG professionals also noted that the first step of such an approach should ensure digitisation and standardisation of forms, guidance and coordination of requirements for proving beneficial ownership, and consistent timelines (see KPMG’s EU Tax Centre E-News issue 157 for details).

The responses received by the EC highlighted the challenges faced by cross-border investors in the EU. Responders generally agreed that, among the existing WHT refund procedure problems, those that are considered to be of “high importance” are the lengthy WHT refund procedures (highlighted by 88.69% of responders), lack of digitalisation and non-user-friendly forms (88.13% of responders), and costly WHT refund procedures in monetary terms (79.59% of responders).

As regards the consequences of the challenges associated with WHT refund procedures, stakeholders noted permanent double taxation (91.29% of responders) and the forfeiting of the right to submit a WHT refund claim (74.76%) as the most important results.

KPMG member firm survey

Against this background, KPMG’s EU Tax Centre launched an internal survey this year across the network of KPMG member firms based in Europe (a selection of EU countries, Iceland, Norway, Switzerland, and the UK).

The aim of the exercise was to explore differences in the procedural and practical approaches taken by jurisdictions within the EU/EEA and the UK and to provide a high-level overview of the administrative practice and digitalisation trends. This was not an exhaustive exercise but rather an attempt to gather insights on the current landscape that would help the firm to understand the magnitude of the problem that lack of harmonisation presents.

This article presents some trends identified based on the responses received, summarises a wish list for an efficient WHT relief system, and highlights some lessons learnt from Finland, the only member state that implemented the OECD’s TRACE system.

Please note that the information is generally valid as at August 2022, unless stated otherwise. The data presented is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although KPMG endeavours to provide accurate and timely information, there can be no guarantee that such information will continue to be accurate in the future.

Availability of WHT relief procedures

The responses received highlighted the challenges faced by cross-border investors in the EU having to deal with diverging approaches, particularly as regards the availability of digitalised procedures (e-filing, acceptance of e-documents, e-signatures, etc.) and the complexity of documentation requirements.

Insight: WHT relief and refund procedures relevant in the majority of EU countries, but no consistent practice

The responses received highlighted that WHT relief and refund procedures are relevant in all EU/EEA countries and the UK, with the exception of Cyprus, Hungary, and Malta, which generally do not apply WHT.

While all responders to the internal KPMG survey reported that their jurisdictions provide for a RAS mechanism where WHT applies on cross-border payments, some countries reported that, in practice, RAS is not available for all payments or in all instances. This is the case in Denmark, for example, where RAS is generally not available in relation to WHT on dividend payments, whereas the WHT refund procedure typically requires extensive documentation, including a tax residence certificate and information confirming beneficial ownership.

Similarly, France requires several standardised forms to be stamped by the tax authority of the receiving company’s state of residence before the payment is made. If such forms cannot be provided in time, a WHT refund claim would be required.

In addition, some countries reported that for obtaining RAS on certain payments, a system of pre-approval or clearance is in place (mandatory or optional). In those instances, some countries also reported that pre-approvals and clearances may be obtained prior to any payment made (for example, Iceland). The period of validity for pre-approvals and clearances varies from one year to as long as three years – for example, in Germany, Poland and Switzerland (with Switzerland noting that this period will be extended to five years from 2023) – or even four years in the Netherlands.

For an overview of the RAS practice across the covered jurisdictions, please refer to the map below.

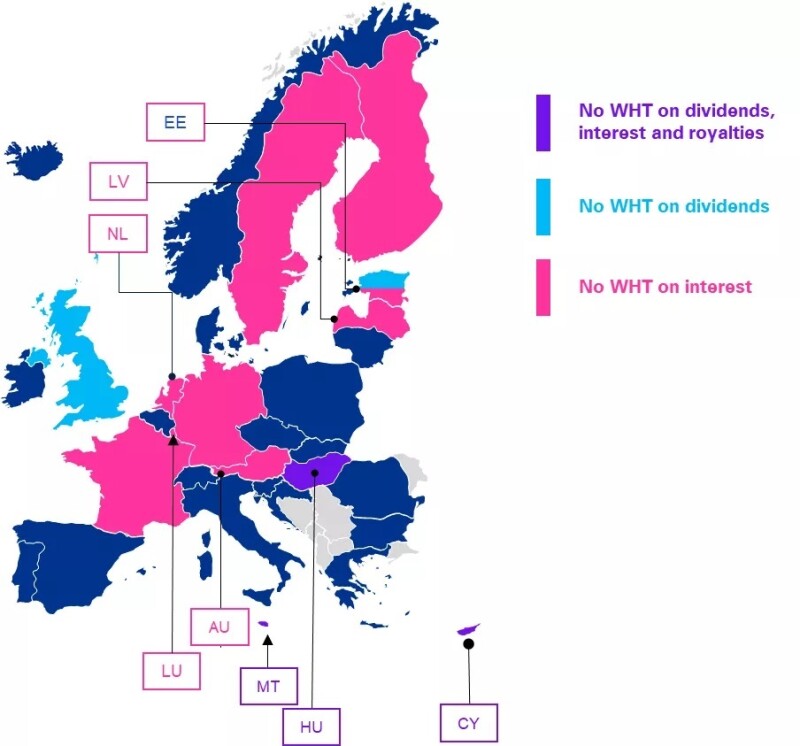

Setting the scene: countries that apply WHT on cross-border payments

With the exception of Cyprus, Hungary, and Malta, all EU/EEA countries and the UK apply WHT on either dividends, interest, or royalties

Five countries reported that, generally, no WHT applies on dividends: Cyprus, Estonia, Hungary, Malta, and the UK.

Twelve countries reported that, generally, no WHT applies on interest: Austria, Cyprus, Estonia, Finland, France, Germany, Hungary, Latvia, Luxembourg, Malta, the Netherlands, and Sweden.

Source: KPMG’s EU Tax Centre survey on withholding tax procedures aspects, concluded in August 2022 across the network of KPMG firms based in Europe.

Digitalisation trends

Even though there are still countries where WHT relief procedures remain largely paper based, most countries reported that, in practice, e-documents and e-signatures are accepted by tax authorities. It has been noted, however, that these are not always available in all cases or for all procedures. WHT refund claims, rather than RAS, are generally more likely to involve hard-copy documentation.

Practices related to e-signatures differ widely as well. For example, the Belgian tax authorities accept pdf documents with e-signatures protected by use of a Belgian eID, while in Poland it may be problematic if e-signatures are not compliant with the EU eIDAS Regulation.

Several countries reported that, even though e-documents or e-signatures are accepted under the administrative practice of their tax authorities, no relevant formal guidance has been issued. For instance, this is the case in France and the UK, whereas in Germany the WHT procedure is electronic as of 2023. In the absence of formal guidance, several countries have noted that hard copies of relevant documents may nevertheless be requested by tax authorities.

Documentation requirements

Generally, all countries and territories require by default a tax residency certificate, or a form signed by the tax authorities of the recipient, to allow for RAS to be applied or for a WHT refund claim to be processed.

However, the responses received highlighted the divergent approaches in the absence of standardised tax residency certificates. For example, certain source countries (such as Belgium) require specific local forms to be completed and stamped by the local tax authorities of the beneficiary applying for relief from WHT, instead of, or in addition to, a typical tax residency certificate.

Furthermore, in line with the increased focus on beneficial ownership information (see the report on beneficial ownership trends across the EU from KPMG’s EU Tax Centre), several countries reported that increased information and documentation requirements are in place, in addition to the typical tax residency certificate, to provide sufficient proof with respect to the beneficial owner of the payment. For example, Bulgaria and the Czech Republic reported that their respective tax authorities require a declaration confirming that the income recipient is the beneficial owner to allow RAS to be applied.

On a similar note, Austria reported that the tax authorities require a declaration by the recipient of the income confirming that the latter carries out a business activity that goes beyond the scope of asset management, employs its own employees, and has its own business premises to carry out its business. These differences in approach also stem from the variation in the interpretation of the beneficial ownership concept across countries.

WHT refund claims

Where RAS is not available or investors are not able to meet the appropriate documentation requirements, countries reported that they generally allow for WHT refund claims to be filed. The responses received highlighted that the procedures and deadlines for WHT refund claims are, however, not harmonised across the EU.

A few countries reported that non-residents need to register with local tax authorities or to appoint an agent or a proxy to submit the WHT claim. For example, in France it is compulsory for foreign claimants to elect domicile in France, meaning that a French tax resident agent must be appointed in order for the non-resident claimant to be able to provide a French address.

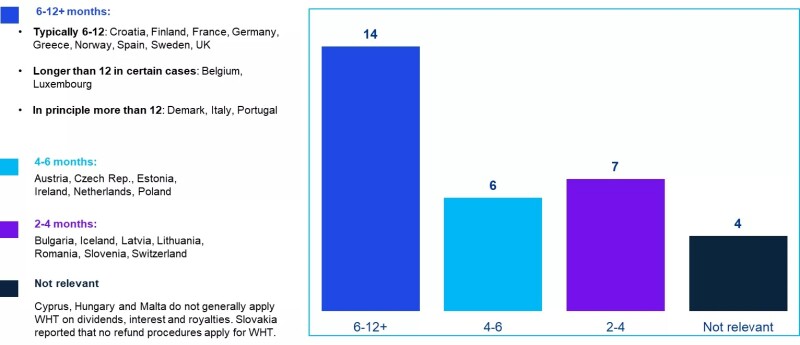

In addition, the responses received highlighted that the timeframe for processing WHT refund claims, where relevant, varies between countries, with more than half of the surveyed countries reporting that the WHT refund process may typically take from six months to more than a year to complete. For example, in Germany the waiting period to receive WHT refunds could be up to one year (amounts received are not interest bearing). In Finland and Spain, complex reclaims could take up to two years to be processed, whereas in Italy the process can take longer than three years.

Furthermore, responses also varied in relation to the applicable statute of limitation period in each jurisdiction.

For an overview of the WHT refund claim process timing and the statute of limitation, please refer to the graph below.

Estimate of time required for the refund process to be completed

Source: KPMG’s EU Tax Centre survey on withholding tax procedures aspects, concluded in August 2022 across the network of KPMG firms based in Europe.

The example of Finland

Finland is the only member state and the first country in the world that has implemented the OECD’s TRACE system (as of 2021).

The purpose of introducing the TRACE model was to ensure that correct WHT on dividends would be levied at source from non-Finnish resident investors and that the Finnish tax authorities would receive detailed information on the dividend beneficiaries.

Previously, Finland had applied a so-called simplified procedure in levying WHT on dividends, which were held on omnibus accounts. The simplified procedure enabled granting treaty benefits at source down to 15%. Under the previous system, details of the dividend beneficiary did not have to be reported to the Finnish tax authorities (FTA) on a regular basis when 15% WHT was levied – only the name of the custodian that held the shares under nominee registration was reported. However, the FTA considered that the system did not permit the collection of sufficient information on the dividend beneficiaries.

The TRACE-based process includes stricter requirements for granting treaty benefits at source than were previously applied. The key concept of the TRACE model is an AI; ie, a Finnish or a foreign custodian that registers in the AI register of the FTA. In most cases, only AIs can grant treaty benefits to investors. AIs are subject to tax liability in Finland if the WHT levied was incorrect. Furthermore, the AI is liable to comply with detailed guidance issued by the FTA, which sets the conditions under which treaty benefits can be granted to investors. AIs are also required to report the details of the dividend beneficiaries to the FTA on an annual basis.

Only approximately 84 custodians have registered as an AI, which includes Finnish custodians and local branches of non-Finnish custodians. Due to the stringent requirements set by the FTA – which go, to some extent, beyond the OECD TRACE model requirements – investors are, in practice, often no longer able to receive treaty benefits at source or benefits below 15% cannot be granted. Investors will therefore need to file reclaims with the FTA. Furthermore, investors are treated differently based on whether their custodian has registered as an AI or not. Finnish issuers consider that the current TRACE model creates obstacles to investment in Finnish companies.

On June 30 2022, the FTA issued a report detailing statistics and experience in relation to the application of the TRACE procedure to withhold tax at source on dividends. According to the report, a reduced WHT was applied to over 50% of the dividends paid on nominee-registered shares in 2021 and more than 70% of the AIs granted reduced WHT rates at the time when dividends were paid.

Based on the experience of the FTA, after the introduction of the TRACE procedure, tax revenues have grown – in part due to the new systems and improved control. The FTA expect this growth to slow down once the TRACE procedure is established. The FTA have also experienced a moderate growth in the number of WHT at source relief applications, especially as regards individual taxpayers, and expect that this will continue for the next few years.

Furthermore, according to the FTA report, the first year of TRACE procedure has shown that the system works as intended and can yield the benefits expected.

What can we expect next?

Responses to the EC’s public consultation highlight that a vast majority of stakeholders (94.1% of the responders) strongly support the need for EU action to make WHT procedures more efficient, with 94.3% responding that action at EU level – i.e., putting in place an EU-wide framework – would add high value.

An EU-wide WHT relief mechanism could be based on existing initiatives such as the OECD’s TRACE implementation package, while ensuring a harmonised interpretation and approach within the EU.

The Finnish experience shows that the introduction of unilateral mechanisms is unlikely to be beneficial for investors. A unified WHT levying or reporting model applicable across the EU would help to alleviate obstacles to cross-border investment in the internal market, if registration and compliance costs do not outweigh the benefits for custodians registering as an AI.

In addition to harmonised registration requirements and allowing electronic submission of forms (without the requirement for a wet signature), a common set of guidance and evidence – for example, of entity classification and beneficial ownership – would allow AIs to efficiently determine and apply the correct treaty rate.

Although the EC’s efforts in designing a common EU-wide system for WHT are going in the right direction, a proposed directive tackling only WHT refund procedures would not be expected to solve the difficulties faced by cross-border investors.

Read the original version of the article on KPMG’s website.

Click here to access more KPMG Future of Tax content.