"When was the last time you looked at the blue, unfettered sky and wondered about the power of the unfettered ‘blue sky’ thinking?" These were the words of the chief economic adviser when India’s Economic Survey was released in 2019 with the central theme of blue sky thinking to realise the dream of India becoming a $5 trillion economy by 2025. Taking this vision forward, in 2022, the Economic Advisory Council to the Prime Minister launched the Competitiveness Roadmap for India@100 to guide the path for India to become a higher-income economy by 2047, when the country will mark the 100th year of independence.

While these are relatively recent growth themes, the Make in India initiative launched in 2014 paved the way for a wider set of nation-building initiatives devised to transform India into a global design and manufacturing hub.

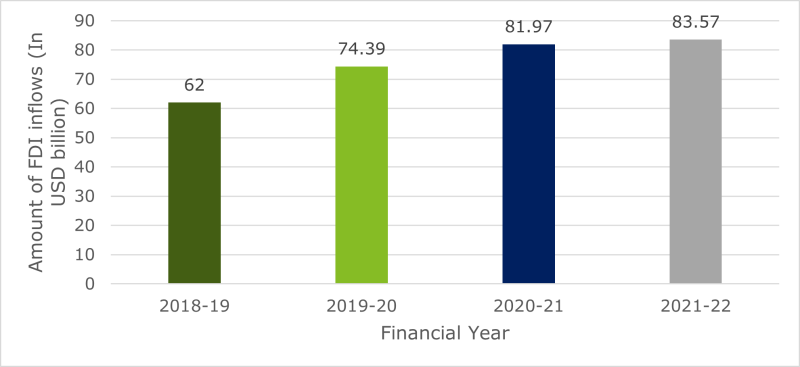

The positive impact of all these growth themes is evident from the ever-increasing volumes of foreign direct investment (FDI) inflow into the country, which has set records. India is rapidly emerging as a preferred investment destination. FDI inflows into India have increased 20-fold in the past 20 years, with a highest annual FDI of $83.57 billion in FY 21–22.

The total FDI inflows reported during the past four financial years are given below.

The above statistics warrant a deeper understanding of the dynamic business and tax landscape in India in recent years for foreign investors investing in India.

I. Investment in India

Impetus to domestic manufacturing

Production Linked Incentive scheme

The Production Linked Incentive (PLI) scheme of the government of India was launched in 2020, which gives companies incentives on incremental sales from products manufactured in domestic units. The PLI scheme aims to boost the manufacturing sector through the Make in India scheme; reduce imports, incentivising foreign manufacturers to start production in India; and facilitate domestic manufacturers to expand their production and exports. The government has earmarked approximately INR 1.97 trillion (approximately $24 billion) for the PLI scheme in 13 sectors:

Auto components;

Automobile;

Aviation;

Chemicals;

Electronic systems;

Food processing;

Medical devices;

Metals and mining;

Pharmaceuticals;

Renewable energy;

Telecoms;

Textiles and apparel; and

White goods.

Concessional income tax regime for new domestic manufacturing companies

Aligning with the focus of the PLI scheme of providing impetus to domestic manufacturing, a concessional income tax regime was introduced in 2020. The income of in-scope companies will be taxed at a lower rate of 15%, subject to the fulfilment of certain conditions. The benefit of this regime is available to any new domestic manufacturing company set up on or before March 31 2024.

Focus on innovation

Eligible start-ups engaged in the innovation, development or improvement of products, processes or services, or a scalable business model with a high potential of employment generation or wealth creation, are entitled to an income tax holiday for a specified number of years if they meet the eligibility criteria.

International Financial Services Centre

Background

While, on one hand, measures are being targeted at increasing domestic manufacturing, on the other hand, in a bid to reinforce India’s strategic position as a global hub for financial services, an International Financial Services Centre (IFSC) has been set up at Gujarat International Finance Tec-City (GIFT City). The IFSC, apart from providing a financial platform to global investors to set up businesses in areas such as banking, investments (especially green finance and social impact capital), insurance and reinsurance, capital markets and asset management, also provides easy access to the Indian economy, which is ranked among the largest and fastest-growing economies in the world, according to The Economic Times, of India, on January 11 2023.

The IFSC is poised to emerge as a leading fundraising destination for Indian and foreign issuers, and as a global hub for fintech start-ups. The government is thus attempting to bring financial services and transactions to India that are now carried out in offshore financial centres by local corporate entities and overseas branches or subsidiaries of financial institutions. The latest Global Financial Centres Index, London (September 2020), places the IFSC at GIFT City at the top among 15 centres globally.

Income tax benefits

The IFSC offers a competitive income tax regime, the salient features of which are given below.

Units in the IFSC

A 100% tax exemption on income from business carried out in the IFSC (for any 10 out of 15 years); and

A minimum alternate tax/alternate minimum tax at 9% of book profits applies to companies/non-corporate entities set up in the IFSC. This tax is not applicable to companies opting for the concessional income tax regime, in which a domestic company is taxed at a lower tax rate of 22% provided it does not avail of any tax holidays, exemptions, etc.

Investors

Interest paid to non-residents on:

Money lent to IFSC units is not taxable; and

Long-term bonds and rupee-denominated bonds listed on IFSC exchanges is taxable at a lower rate of 4% on bonds issued on or before July 1 2023.

The transfer of specified securities listed on IFSC exchanges by a non-resident is not to be treated as a transfer. Therefore, gains accruing thereon are not chargeable to tax in India.

Impact of Budget 2023

As expected, further impetus was given to the IFSC in Budget 2023.

Increase in the scope of exempted income

The income of non-residents on a transfer of offshore derivative instruments (ODI) entered into with an IFSC banking unit (IBU) is exempt under the Income-tax Act, 1961. Under the ODI contract, the IBU makes the investments in permissible Indian securities. Income earned by the IBU on such investments is in the nature of capital gains, interest, or dividends. After the payment of tax, the IBU passes the income to the ODI holders.

Presently, the exemption is provided only on the transfer of ODIs and not on the distribution of income to non-resident ODI holders. Hence, this distributed income is taxed twice in India; i.e., when received by the IBU and when the same income is distributed to non-resident ODI holders. Therefore, to remove the double taxation, an exemption will also be provided to any income distributed on the ODI entered with an offshore IBU which fulfils such conditions as may be prescribed.

Extension of the timeline for relocation of a fund

The timeline for funds to relocate to the IFSC at GIFT City is now March 31 2025.

Increased tax holiday for offshore banking units

Offshore banking units enjoy a tax holiday in the following manner:

A deduction of 100% of the qualifying income for five consecutive years beginning with the year in which relevant approval is obtained; and

50% of such income thereafter, for five consecutive years.

This provision has been amended to provide a deduction of 100% of income instead of 50% for the second set of five consecutive years which begins on or after April 1 2023.

Aircraft leasing

A new provision has been inserted providing for an exemption on the income of a non-resident or a unit of an IFSC engaged in the leasing of aircraft business that arises from capital gains on the transfer of equity shares of a domestic company which is a unit of the IFSC and engaged in the business of leasing aircraft and that commences operations on or before March 31 2026. The exemption from capital gains is available for a period of ten assessment years (AYs) starting from:

An AY relevant to the previous year in which the above-mentioned domestic company commenced its operations; or

AY 2024–25 (if the period of ten AYs ends before April 1 2034).

Dividend income received from an IFSC unit

The dividend income of an IFSC unit primarily engaged in aircraft leasing where the dividend is also from an IFSC unit primarily engaged in aircraft leasing is exempt from tax.

When dividend distribution tax (DDT) was applicable on the dividend-paying company, there was a provision exempting units in the IFSC from the applicability of DDT. However, when the DDT regime was replaced by tax payments on dividends by the shareholders, the benefit was not extended to shareholders in respect of dividends received from an IFSC unit. In a welcome move, a dividend received from an IFSC unit will be taxable at 10%, as against 20%.

Tax deducted at source on certain interest income payable to a non-resident by an Indian company

The tax deducted at source rate on interest in respect of money borrowed from a source outside India by way of the issuance of a long-term bond or a rupee-denominated bond on or after July 1 2023, and listed only on recognised stock exchanges located in an IFSC, would be 9%.

The finance minister’s speech also alluded to the following measures in relation to IFSCs:

The banking units of foreign banks will be permitted to undertake acquisition financing;

The establishment of a subsidiary of EXIM Bank for trade refinancing; and

For countries looking for digital continuity solutions, India will facilitate the setting up of their data embassies at the IFSC at GIFT City.

Efforts are being made to provide as many facilities and incentives as possible to enable the Indian IFSC to compete with the global standards offered by other financial service centres.

II. Repatriation of funds from India

Despite the incentives being provided on one hand, it is disheartening to note that the recent Budget 2023 did not consider favourably representations made on certain aspects for making tax consequences unfavourable, as discussed below.

Debt funds

Foreign funds play a critical role in a developing economy such as India. More than a decade ago, a concessional interest withholding tax regime (i.e., a beneficial withholding tax rate of 5% instead of 20%) was introduced in respect of foreign currency borrowings outside India under loan agreements or by way of long-term infrastructure bonds issued in foreign currency or rupee-denominated bonds. To provide a broad-based incentive and to encourage greater offshore investment in the debt market by foreign institutional investors and qualified foreign investors, the same benefit was extended to interest on investments made in bonds issued by Indian companies and in government securities.

The reduction in rates and a simplification of the withholding tax norms led to greater subscription in Indian debt securities by foreign investors and the development of the Indian debt market, and accelerated the pace of growth of the Indian economy.

Contrary to expectations, the sunset clause of July 23 has not been extended, which could adversely impact the returns of investors post tax.

Supreme Court ruling on the applicability of the most favoured nation clause on dividends

In the event of income repatriation in the form of a dividend, it is interesting to note that the judgment of the Supreme Court is reserved on the issue of applicability of the most favoured nation (MFN) clause to lower the tax rate/withholding tax rate on dividends payable by Indian companies to respective non-resident shareholders from certain jurisdictions; namely:

The Netherlands;

France;

Switzerland;

Sweden;

Hungary; and

Finland.

The issue revolves around the availability of the benefit of MFN clauses, since the MFN benefit is sought to be derived from an Indian tax treaty with a country which was not an OECD member at the time of signing the convention.

Recent move to tax share premiums received from non-resident investors

Budget 2023 extended ‘angel taxation’ to foreign investors, which is a surprising move. A tax on a premium received by a closely held company in excess of the fair market value (FMV) of the shares (to prevent the circulation of unaccounted money as a share premium) is commonly referred to as angel tax.

Currently, as per the provisions of the domestic tax laws, consideration received by an unlisted company from a resident investor, towards the issuance of shares, in excess of the FMV of the shares, is taxable in the hands of the company. Budget 2023 has removed the residency requirement, bringing parity in the levy of angel taxation between resident and non-resident investors. An issue that could arise in determining the FMV of shares is the interplay between regulations that stipulate different valuation mechanisms. Under the regulations of the Foreign Exchange Management Act, 1999 (FEMA), shares to be issued by an unlisted company should not be at a price less than the fair valuation of shares calculated by a merchant banker or a chartered accountant as per any internationally accepted pricing methodology.

Under the Income-tax Act, 1961, any consideration in excess of the FMV of shares would entail taxability, where the FMV is to be determined by a merchant banker as per the discounted cash flow (DCF) method. Thus, while one will have to look at the minimum issue price for the purpose of the FEMA, income tax will seek to tax the issue price in excess of the FMV determined as per the DCF method. An interplay with the transfer pricing guidelines also needs to be factored in. Press reports indicate that the government is looking at the interplay of these valuation rules closely.

Payment of royalties and fees for technical services in the case of a non-resident

Income by way of royalties and fees for technical services are to be taxed at 20% instead of the earlier rate of 10%. There has been a flip-flop in the domestic tax rate for the taxation of royalties and fees for technical services in the recent past. This change may once again require access to the favourable tax rate for the taxation of royalties and fees for technical services in tax treaties that India has signed with other countries.

Presently, there is a dispensation from income tax return filing if the tax on royalties or fees for technical services is charged at the domestic tax law rates, which are higher than tax treaty rates. Therefore, this change in rates may also trigger an income tax return filing requirement if favourable treaty rates that are lower than domestic tax law rates are adopted.

III. Tax transformation initiatives

A discussion on the tax landscape in India would be incomplete without acknowledging the technological advances in the tax administration.

Goods and services tax

With the introduction of the goods and services tax (GST) law under the One Nation, One Tax regime for the first time in the country in July 2017, the Indian indirect tax regime underwent a revolution.

Despite a few hiccups that India experienced while adopting the new tax structure, GST is widely regarded as one of the most important reforms that the country has implemented since independence (this was widely reported during the introduction of a GST in 2017). During this time, India has witnessed changes in the effective tax rates and improved supply-chain efficiencies.

A tax regime founded on a technology-based monitoring system – such as e-returns, e-invoices, and e-way bills – has been one of the biggest achievements regarding GST in India.

It is laudable that over the past six years since its implementation, GST has helped to achieve significant changes and objectives in a unified indirect tax regime.

Tax technology initiatives

In an era when digitalisation has become all pervasive, the implementation of technology-based initiatives by tax authorities has become the trend of the times.

Not only have several tax filings (returns, reports, forms, etc.) become electronic and increased ease of compliance, digitalisation has also reduced the processing time and effort needed to file the same, besides addressing the requirement to maintain, track, and scroll through vast physical records. Each taxpayer has digital tax accounts to view and manage information in one place and see their tax calculation. Assessment in specified cases (i.e., in an audit by revenue authorities) and certain appellate or dispute resolution forums are also now online (i.e., in a faceless mode).

Project Insight is another programme being undertaken in which data analytics are being employed to share data among tax authorities and to make meaningful reconciliations, and thereby detect non-compliance, under-reporting of income, sales, etc., or tax evasion by taxpayers.

IV. Final thoughts

India has assumed the presidency of the G20 for a year from December 2022, which is a watershed moment in the country’s history. It is a unique opportunity to showcase India’s strengths and has heightened global curiosity about India. Against this backdrop, a broad overview of high-impact tax and policy changes in India impacting investments into India is timely for investors keen on India as an investment destination.