On September 19 2023, the Egyptian Tax Authority issued an Explanatory Guide on the Unified Tax Procedures Law, Law No. 206 of 2020, and its amendments under Law No. 211 of 2020 (the Law) related to the specific transfer pricing (TP) law articles; i.e., articles 12 and 13. This article will analyse the key aspects of the explanatory guide.

In detail

The explanatory guide (separate from the Egyptian TP guidelines) sheds some light on the application of articles 12 and 13 of the Law, whereby the guide reaffirms some existing concepts, and provides clarity and extended guidance with regard to other aspects mentioned under articles 12 and 13.

Local file deadline

The guide clarifies local file deadlines and provides examples to demonstrate how these are driven by the corporate tax return submission. The Law states that TP local files are to be filed within two months from the date of filing the annual corporate income tax returns (CTR).

Delay fines

It has finally been confirmed that penalties for failure to submit TP documentation, as outlined under Article 13 of the Unified Tax Procedures Law, are not subject to delay fines as outlined under Article 110 of the Corporate Income Tax Law.

Dividends distribution

It has been confirmed that dividends distributions are not considered related-party transactions.

Transactions impacting the financial position statement (balance sheet)

It has been confirmed that related-party transactions that have an impact on a taxpayer’s financial position statement (balance sheet transactions) must be disclosed under Schedule 508 of the CTR.

It is important to note that according to Article 14 of the Law’s executive regulations, the determined threshold above which local and master files are required to be maintained (currently EGP 8 million) should be calculated in terms of revenues and expenses during the fiscal year; i.e., based on income statement items. This should mean that, while balance sheet transactions should be disclosed within table 508 and would likely be inspected upon audit, these transactions should not have an effect on the calculation of the EGP 8 million threshold.

Another important point when disclosing balance sheet transactions is that they should represent the effect of the financial year being documented; i.e. the movement and not the balance.

Payments on behalf transactions

It has been confirmed that transactions involving payments made on behalf of related parties – along with any remuneration, if applicable – must be disclosed under Schedule 508 of the CTR and within the local file.

Joint ventures

The guide defines a joint venture (JV) as a contractual arrangement resulting from an agreement between resident persons, between branches of non-resident companies, or between a resident person and a branch of a foreign company, each according to the percentage of participation in the profits for the purpose of implementing a project. This arrangement expires with the completion of this project, and the rights and duties for this project are limited to the division of profits and losses that arise from the work of this JV.

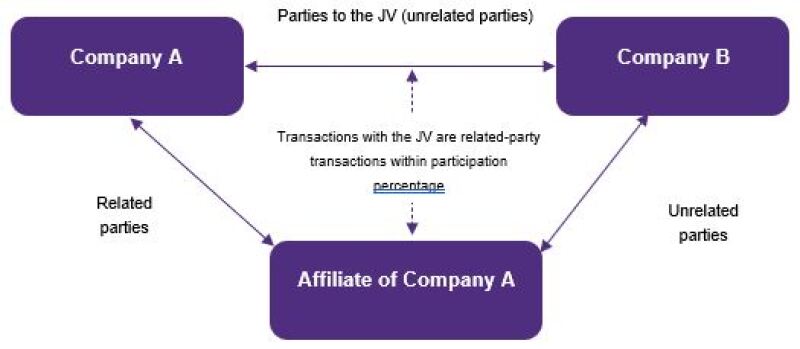

It further clarifies that group affiliates to any one of the parties of the JV are considered related to the JV party, as per the definition of a ‘related person’ under the Unified Tax Procedures Law. As such, any transactions between the JV and the group affiliates should be disclosed under Schedule 508 of the party’s CTR, within the percentage of participation in the JV. Likewise, the affiliated entity to the JV party should also disclose the transaction under table 508. Please see the diagram below for ease of reference.

According to the above diagram, Company A should disclose the transaction with the JV under Schedule 508 in its CTR, within its percentage of participation in the JV. Typically, Company B and the affiliate of Company A are also not related parties, unless any of the conditions pertaining to the definition of a related person applies to them.

Free zone entities

Affiliate entities of a free zone parent or holding company must prepare and submit the master file at the time of local file submission.

Key takeaway

The explanatory guide provides guidelines regarding obligations for compliance with articles 12 and 13 of the Unified Tax Procedures Law. Compliance with this guide is essential for businesses operating in Egypt to ensure accurate and timely submission of relevant documentation and disclosures related to intercompany transactions.