As discussed in an article by KPMG China published in December 2022, in response to the inclusion of Hong Kong SAR (Hong Kong) by the EU in its grey list of non-cooperative jurisdictions for tax purposes in October 2021, the Hong Kong government has implemented a foreign-sourced income exemption (FSIE) regime (i.e., FSIE 1.0 regime) for dividends, interest, income from the use of intellectual property (IP), and equity disposal gains since January 1 2023. The FSIE 1.0 regime complies with the guidance on FSIE regimes originally published by the EU in 2019.

During the technical examination of the FSIE reforms of various jurisdictions, the EU’s Code of Conduct Group decided to update its guidance on FSIE regimes in respect of the tax treatment of foreign-sourced capital gains. The updated guidance issued in late 2022 explicitly requires such regimes to cover gains from the disposal of all types of assets.

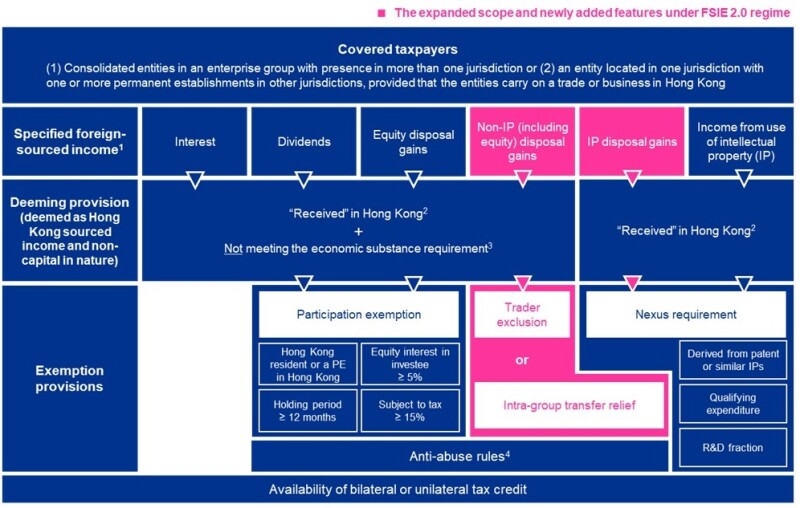

As a result of the EU’s updated guidance, Hong Kong had to expand the scope of the FSIE 1.0 regime to cover foreign-sourced gains from the disposal of assets other than equity interests by the end of 2023. The tax law implementing the expanded FSIE regime (i.e., the FSIE 2.0 regime) was enacted on December 8 2023. The FSIE 2.0 regime applies to in-scope income accrued and received in Hong Kong on or after January 1 2024.

A webinar held in December 2023 explored the impact of the FSIE regime in Hong Kong and the changes under FSIE 2.0.

The following sections of this article:

Provide an overview of the taxation of foreign-sourced passive income in Hong Kong under the FSIE 2.0 regime;

Highlight the key changes effective from January 1 2024; and

Share observations on the practical application of the FSIE 2.0 regime from a business perspective.

An overview of the FSIE 2.0 regime in Hong Kong

Notes:

Excluding interest, dividends, and non-IP (including equity) disposal gains derived from/incidental to:

The regulated businesses of regulated financial entities;

The activities producing the tax-exempt assessable profits of entities benefiting from the unified fund exemption/non-resident person tax exemption;

The activities producing the assessable profits of entities benefiting from a preferential tax regime in Hong Kong; and

The activities producing the tax-exempt sums of entities benefiting from the tax exemption under the special tax regime for shipowners.

A sum is ‘received in Hong Kong’ if it is:

Remitted to, transmitted to, or brought into Hong Kong;

Used to satisfy any debt incurred in respect of a trade, profession, or business carried on in Hong Kong; or

Used to buy movable property that is brought into Hong Kong.

For a pure equity holding entity (PEHE): (i) having adequate human resources and premises in Hong Kong for holding and managing its equity participations in other entities and (ii) complying with all applicable entity/business registration and filing requirement in Hong Kong. For a non-PEHE (i): having an adequate number of qualified employees and (ii) incurring an adequate amount of operating expenditures in Hong Kong to carry out the specified economic activities in Hong Kong; namely, (a) making necessary strategic decisions in respect of any assets the entity acquires or disposes of and (b) managing and bearing principal risks in respect of such assets.

The anti-abuse rules are:

The switch-over rule – switching from a tax exemption to a tax credit if the applicable foreign tax rate is less than 15%;

The main purposes rule – the participation exemption does not apply if there is an arrangement with the main purpose, or one of the main purposes, of obtaining a tax benefit; and

The anti-hybrid mismatch rule – participation exemption does not apply to the extent the dividend payment is deductible by the investee company.

In a nutshell, specified foreign-sourced incomes (other than those specifically excluded in Note 1 above) derived by covered taxpayers that are received, or deemed received, in Hong Kong will be deemed as Hong Kong sourced and non-capital in nature. Such income will therefore be taxable in Hong Kong unless the economic substance requirement or the nexus requirement (whichever is applicable) is met or the relevant exemption, exclusion, or relief in the above diagram is applicable.

As for the computation of asset disposal gains, it is understood that the EU did not accept the Hong Kong government’s proposal of rebasing the costs of assets as those at the effective date (i.e., January 1 2024) of the regime. The disposal gains will therefore be computed based on the historical acquisition cost of the disposed assets and the entire amount of such disposal gains will therefore fall within the scope of the FSIE 2.0 regime.

Key changes effective from January 1 2024

Expanded scope of covered income

Commencing on January 1 2024, the scope of covered income has been expanded to cover foreign-sourced gains from the disposal of all types of assets (i.e., movable property and immovable property), regardless of whether they are capital or revenue in nature and whether the assets are financial or non-financial in nature.

Although the Inland Revenue Ordinance does not explicitly define ‘immovable property’ and ‘movable property’, reference can be made to the definition of these terms in the Interpretation and General Clauses Ordinance (IGCO). Pursuant to the IGCO, ‘immovable property’ refers to (i) land, (ii) any estate, right, interest, or easement in or over any land, and (iii) things attached to land or permanently fastened to anything attached to land, and ‘movable property’ refers to property of every description except immovable property.

The trader exclusion for non-IP disposal gains

A new exclusion introduced under the FSIE 2.0 regime is the trader exclusion. This exclusion is applicable to foreign-sourced gains from the disposal of non-IP assets (including equity interests) that are derived from, or incidental to, a Hong Kong multinational enterprise (MNE) entity’s business as a trader. In this context, a ‘trader’ refers to an entity that sells, or offers to sell, property in the entity’s ordinary course of business.

The rationale behind this exclusion is that active business income generated by traders should be outside the scope of the FSIE regimes reviewed by the EU (which focuses on passive income). Such active income should therefore be excluded from the scope of the FSIE 2.0 regime.

Intra-group transfer relief for all types of disposal gains

An intra-group transfer relief has also been introduced to offer the deferral of taxation on a foreign-sourced disposal gain from a sale of an asset within a group that is received in Hong Kong until the time when the asset leaves the group, subject to the fulfilment of certain conditions.

To qualify for this tax deferral, the following two conditions must be met:

The selling entity (i.e., the MNE entity that sells the asset) and the acquiring entity (i.e., the group entity that acquires the asset) are, at the time of the sale, both chargeable to Hong Kong profits tax; and

The selling entity and the acquiring entity are, at the time of the sale, associated with each other.

For the purpose of intra-group transfer relief, two entities are considered as ‘associated’ if:

One entity has at least 75% of direct or indirect beneficial interest in the other entity or is directly or indirectly entitled to exercise or control the exercising of at least 75% of the voting rights of the other entity; or

A third entity has at least 75% of direct or indirect beneficial interest in each of the two entities or is directly or indirectly entitled to exercise, or control the exercising of, at least 75% of the voting rights of each of them.

When intra-group transfer relief applies, the selling entity is deemed to have sold the asset for a consideration that gives rise to neither a gain nor a loss for it for tax purposes and the acquiring entity is deemed to have acquired the asset at the same cost and on the same date as the selling entity.

However, the relief will be revoked if:

The selling entity or the acquiring entity ceases to be chargeable to Hong Kong profits tax within two years after the asset transfer; or

The selling entity and the acquiring entity cease to be associated within two years after the asset transfer.

Upon withdrawal of the relief, the relevant disposal gain will be subject to the FSIE 2.0 regime as if it was received in Hong Kong by the selling entity in the year of assessment in which event (1) or (2) above occurred, and a corresponding adjustment of the tax cost base of the asset transferred will be available for the acquiring entity.

Any profits tax chargeable upon withdrawal of the intra-group transfer relief would be chargeable in the name of the selling entity or acquiring entity and recoverable from the selling entity or acquiring entity.

The Hong Kong tax authority’s administrative guidance

The Hong Kong Inland Revenue Department (IRD) has published administrative guidance, FAQs, and illustrative examples on its website to help businesses in Hong Kong to better understand its interpretation and application of the FSIE 2.0 regime. These materials will be updated by the IRD from time to time so businesses should refer to the latest information on the IRD’s website.

Businesses can also apply for an advance ruling on the tax treatment of their specified foreign-sourced income under the FSIE 2.0 regime if they would like to obtain greater tax certainty.

Considerations from a business perspective

The FSIE 2.0 regime represents a significant change to the taxation of foreign-sourced passive income in Hong Kong. It has a wide-ranging impact, as many businesses in Hong Kong are likely to have cross-border investment or business operations and derive foreign-sourced passive income. The following are a few observations on the practical application of the regime that businesses should consider.

The trader exclusion

While taxpayers can continue to enjoy a tax exemption for foreign-sourced non-IP disposal gains (for example, gains from the disposal of overseas-listed shares) based on an offshore claim without meeting the additional requirements imposed by the FSIE 2.0 regime under this exclusion, they should consider the following eventuality.

If the exclusion is applied by a taxpayer and accepted by the IRD, a subsequent capital claim by the taxpayer on any future disposal gains on the same type of asset that are Hong Kong sourced (for example, gains from the disposal of Hong Kong-listed shares) will likely be rigorously challenged by the IRD given the taxpayer has previously been regarded as a trader of the asset.

Intra-group transfer relief

In cases where the taxation of the disposal gain derived by the selling entity from an intra-group asset transfer was initially deferred pursuant to this relief but the relief is subsequently revoked because the selling entity and the acquiring entity ceased to be associated within two years after the asset transfer, the acquiring entity may become liable for any tax payable on the disposal gain derived by the selling entity. An example is when the IRD is unable to recover the tax payable from the selling entity. The situation arises as any profits tax chargeable upon withdrawal of the intra-group transfer relief would be chargeable in the name of, and recoverable from, the selling entity or acquiring entity.

FSIE 2.0 regime versus the tax certainty scheme for onshore equity disposal gains

In addition to the FSIE 2.0 regime, Hong Kong has implemented a tax certainty scheme for onshore equity disposal gains from January 1 2024. Under the scheme, onshore equity disposal gains will be regarded as capital in nature and non-taxable if the investor entity has held at least 15% of the equity interests in the investee entity continuously for at least 24 months before the disposal, subject to certain exclusions.

When structuring a disposal of equity interests, taxpayers should now consider the Hong Kong tax exposure under the FSIE 2.0 regime (if the disposal gain is regarded as foreign sourced) as opposed to that under the tax certainty scheme (if the disposal gain is regarded as Hong Kong sourced and eligible for the scheme).

Interaction between the FSIE 2.0 regime and pillar two of BEPS 2.0

Hong Kong is planning to implement the global minimum tax and a domestic minimum top-up tax (DMTT) from 2025. The DMTT in Hong Kong would apply to both foreign- and Hong Kong-headquartered in-scope MNE groups.

Large MNE groups that are within the scope of pillar two and that have subsidiaries operating in Hong Kong should therefore consider the potential impacts of the DMTT in Hong Kong on any tax-exempt foreign-sourced income under the FSIE 2.0 regime. These include whether the benefit of the tax exemption under the FSIE 2.0 regime would be neutralised by the top-up tax charged under the DMTT and whether a foreign tax credit can be claimed in respect of the foreign withholding tax paid on the foreign-sourced passive income if the income is tax exempt under the FSIE 2.0 regime but subject to the DMTT in Hong Kong in the future.