Large multinational enterprises with a global turnover of at least €750 million ($820 million) will be within the scope of pillar two.

The income inclusion rule (IIR) of the OECD’s pillar two proposal will generally impose an additional tax on the (ultimate or designated surrogate) parent company of the MNE group if a foreign subsidiary is effectively taxed below 15%. In this way, pillar two introduces a global minimum tax system with a minimum effective tax rate (ETR) of 15% at the jurisdictional level.

In numerous domestic tax regimes, local participation exemptions provide for a corporate income tax exemption for dividends and capital gains between group companies. Pillar two also provides for an exemption for ‘excluded dividends’ when calculating the net qualifying income used to determine the ETR.

The way that the pillar two exemption works will not, however, always align with the domestic law participation exemption, which can lead to a mismatch. This means that additional top-up tax may become due under pillar two in cases where the domestic participation exemption applies but there is no exemption under the pillar two rules.

This article discusses the treatment of dividends and capital gains that qualify for exemption under pillar two and offers suggestions for effectively managing dividends and gains in key jurisdictions such as the Netherlands, France, Germany and Luxembourg.

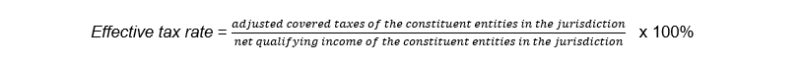

Calculation of the ETR

Under pillar two, additional tax obligations may arise if the ETR of a group entity in a specific jurisdiction is lower than 15%. The ETR is calculated by dividing the adjusted covered taxes (essentially, the taxes on the income or profit of all group entities in a state) by the net qualifying income, also referred to as GloBE income (essentially, the adjusted net profit or loss of all group entities in a state):

Net qualifying income includes the qualifying income of all group entities established in a specific state, minus the qualifying losses incurred by group entities located within that state. Qualifying income or loss is ascertained from the net profit or loss of an entity based on financial reporting standards (this is calculated at the level of each group entity before the consolidation process and elimination of intra-group transactions).

Under pillar two, underlying profits are adjusted for excluded dividends and equity gains or losses.

Excluded dividends

The pillar two legislation broadly describes an excluded dividend as any dividend or similar distribution other than those arising as a result of an interest that is a short-term, portfolio holding.

A portfolio interest exists if the multinational group holds an interest entitling it to less than 10% of the profit, capital, reserves or voting rights of an entity.

That portfolio interest will be a short-term interest if it has been held by the member for less than one year. The holding period is assessed on a member-by-member basis, so where an interest is transferred between members of the group, a period for which a previous member held the interest is ignored.

Whether a portfolio interest is held by a group entity for a continuous period of at least one year is determined on the basis of beneficial ownership at the time of vesting of the dividend or distribution. Beneficial ownership exists when the group entity is entitled to all or substantially all of the benefits and burdens of ownership, including the right to the profits, capital or reserves associated with that interest.

In summary, the treatment of dividends under pillar two is as follows:

Dividends or other distributions obtained in or attributable to a reporting year from an: | Portfolio interest (MNE group holds less than 10% of profit rights, capital interests, reserves or voting rights) | Non-portfolio interest (MNE group holds 10% or more of profit rights, capital interests, reserves or voting rights) |

Interest held for less than one year at time of distribution by group entity | Included when calculating qualifying pillar two income or loss | Excluded from qualifying pillar two income or loss |

Interest held for more than one year at time of distribution by group entity | Excluded from qualifying pillar two income or loss | Excluded from qualifying pillar two income or loss |

Mismatch with domestic participation exemptions

Participation exemptions within various domestic tax regimes also provide for a corporate income tax exemption on dividends and capital gains on disposals of equity interests between group companies. However, this can give rise to a mismatch in situations where the pillar two dividend exclusion does not fully align with the treatment of the same dividends under domestic tax laws.

If dividends or other distributions are exempt under domestic participation exemptions but do not meet the pillar two criteria for excluded dividends, there will be a higher amount of net qualifying income but no corresponding tax in the respective jurisdiction.

For example, in the Netherlands and France, a minimum shareholding percentage of 5% is required to apply the domestic participation exemption, but this does not meet the pillar two criteria for excluded dividends. This may result in a group entity being classified as a low-tax group entity so that additional tax could be due under pillar two.

Practical guidance

If dividends or other profit distributions are exempt under domestic participation exemptions but do not meet the pillar two criteria for excluded dividends, additional tax could be due under this new legislation.

This mismatch in the exemption criteria and the potential classification as a low-tax group entity could lower the ETR and lead to top-up tax liability. Careful consideration and strategic planning are crucial to mitigating such risks.

Situations like this may arise in joint ventures, where a person's shareholding may be below 10%, either wholly or as a result of share transfers. In such a case, the minority shareholder may want to defer receipt of a dividend until it has a qualifying interest for pillar two purposes.

To secure exemption under pillar two, companies must ensure that dividends or other distributions fulfil the criteria for being classified as excluded dividends. This necessitates confirming that on the vesting date of the dividend or distribution, the group’s members, between them, have qualifying interests that entitle them to 10% or more of the entity’s profits, capital, reserves, and voting rights. This interest must also have been held (without any intra-group transfer) for at least one year.

It is worth noting that, even if the 10% criterion is not initially met, dividends or other distributions can still qualify as excluded dividends if paid when the interest has been held for one year. This means that dividends can be paid after the one-year period, allowing the dividend to be considered an excluded dividend for tax purposes.

This strategic approach ensures not only compliance but also reduces the risk of additional taxation.