Tax departments are refining their talent strategies to respond to a quickly evolving tax landscape. According to the findings of Deloitte’s Tax Transformation Trends (Trends) survey, the need for more capabilities and new ways of working is driven by an array of factors, including:

The increased velocity and complexity of regulations, such as the recently adopted OECD BEPS pillar two;

Technology innovation, including the prospect of incorporating machine learning and generative AI (Gen AI) into traditional tax activities; and

The desire for hybrid or remote work arrangements, which can affect the availability of talent generally, and impact the way recruiting and development initiatives are delivered.

How can tax organisations and professionals in their human resources function meet these expectations, maximise opportunities in today’s business environment, and pursue a talent strategy that will provide the right capabilities for today and in the future? Here are five potential ways to refine talent strategies to help you to acquire and retain the skills and resources that Deloitte research and industry practice suggest you will need.

1 Collaborate more with business operations

An organisation’s tax strategy will ultimately inform its operating model – understanding the business challenges and short-, mid-, and long-term goals should inform tax recruiting and team development strategies. This understanding to help to scope out future skills requirements and role descriptions is obtained by engaging with business operations. Deloitte’s survey on tax transformation trends found that while many tax teams are in weekly contact with technology and finance colleagues, the top two areas where tax teams needed to improve collaboration are with business operations and business leadership.

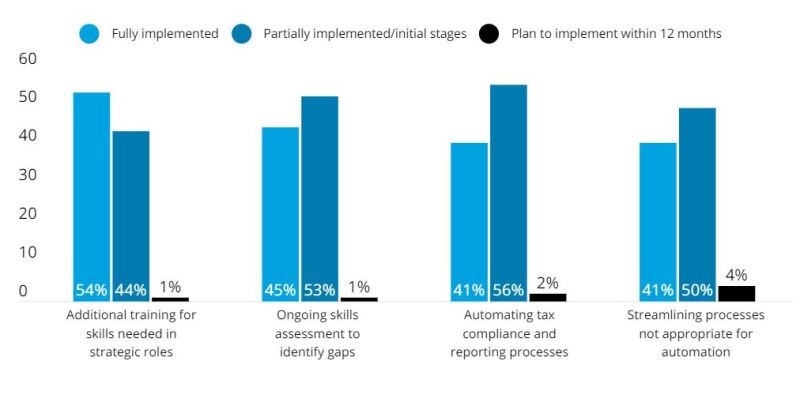

The good news: tax leaders are making progress. The Trends survey found that 98% of tax departments have fully or partially implemented ongoing skills assessments to identify gaps in their departments (Figure 1). The harder part is closing the gaps once identified. Just a little more than half (54%) of survey respondents have fully implemented training programmes for skills required in strategic roles, while 44% have partially implemented such programmes.

Figure 1: Progress made in implementing strategies or actions

Source: Tax Transformation Trends 2023, Deloitte

2 Identify skills gaps – skills needed now and in the future

Tax know-how will always be a foundational capability for a tax department. In fact, the Trends research indicates finding or accessing professionals with tax subject matter expertise is one of the top three challenges facing tax departments across Europe, North America, and Asia-Pacific. This may be surprising, but it in part reflects how quickly new tax legislation and frameworks are being adopted and the importance of keeping tax expertise up to date through continuing education. In some areas, you cannot even assume that regulations adopted three years ago are still current.

Over the past few years, more tax leaders have pivoted from reacting to specific transactions to being more strategic in how they run the tax function. An especially valuable skill, as Liliane Saiani, head of group tax at Mercado Libre, the giant Latin American e-commerce and payments firm, observed during an in-depth interview for the Trends research, is the ability to “translate all the tax technical items into business language and also to translate the business needs back to the technical team”.

Tax expertise alone, therefore, may no longer suffice to provide the assistance and insight business partners expect. As a result, many organisations look for ‘hybrid’ tax specialists who bring new capabilities. For example, skills that bridge the technology gap in areas such as machine learning, data analytics, Gen AI, and problem-solving capabilities, enhancing a tax team’s ability to look at, and analyse, data. Some organisations, such as Johnson Controls (the smart buildings company that was also interviewed as part of the Trends research), have made the strategic decision to have IT people within the tax department so that data analysis can be done efficiently and in collaboration with tax experts. Another way to accomplish this, especially for smaller teams, is through rotating current team members into technology or other areas to gain the skills and experience to bring back.

Tax leaders need to understand the role technology plays in meeting an organisation’s goals and strengthening its operating model, in part to influence technology expenditures that can help tax to deliver what is needed to the business. In the past, tax departments often had broad autonomy over technology and capital expenditures, whereas technology strategy and planning are now typically enterprise-wide endeavours and tax leaders need to know how their technology works with, or impacts, ERP systems, finance solutions, and even payroll.

Deloitte’s survey of tax leaders found that technology budgets are largely set by finance and IT with input from other functions. To ensure they have the tools required, tax leaders will need a seat at the table when, for example, ERP systems are designed to make sure they are tax ready. This, in turn, should reduce the need for tax-specific solutions but often requires senior tax resource with business know-how, the ability to articulate a compelling business case, and strong negotiation skills.

3 Invest in training programmes

The expectation to have deep knowledge of the business, as well as the organisational skills that allow for productive cross-functional collaboration, is especially true given the research finding that more than a quarter of tax work (28%) was done outside the tax department. Tax departments can partner with talent/human resources to invest in improving tax professionals’ communication skills, implement structured learning pathways, or provide opportunities to work in cross-functional teams. Developing skills in both areas allows tax team members to partner more closely with business leaders and advise them on how, and when, tax can best contribute to business success.

Training looks different in each organisation, but some have developed a more collaborative approach. Unilever, for example, revamped its training to help tax and business leaders to stay aligned on what the company is trying to achieve through extensive use of business partnering, toolkits, and sharing of best practices. Consider a combination of instructor-led and self-learning programmes. Self-guided learning allows individuals access to current information when and where they need it, and augments robust continuing education that combines webinars, off-sites, and tenure-specific or specialised training.

4 Re-evaluate the resource mix

The pace of change in tax regulations and technology means many companies will find it challenging to develop all the capabilities needed in-house or even provide all the learning opportunities needed. This is particularly the case for small or even mid-size organisations. Some companies therefore choose to ‘divide and conquer’ by keeping some activities in-house and relying on a service provider to add specific capabilities, achieve scale, or take on some areas of processing. Maintaining a network of peers can also be invaluable for discussing strategies, sharing ideas, and staying informed about best practices.

Most of the respondents (80%+) to the Trends survey said their tax departments continue to outsource transfer pricing documentation and statutory accounts, for example. A smaller but still significant percentage (62–72%) used external firms to assist with corporate tax returns, global tax provision, and indirect tax returns and payments. Over a third (38%) expect to use a lower-cost resource for tax data management over the next two years.

Outsourcing has played a critical role in tax operations at the Radisson Hotel Group, improving “cost(s), flexibility, and efficiency”, as well as quality, according to Philippe de Roose, senior vice president for tax treasury and finance administration. External firms with a global footprint can extend a tax team’s reach, becoming the tax eyes and ears of an organisation in jurisdictions where it makes little financial sense for a company to hire tax experts.

Finally, external organisations, by definition, bring different perspectives to in-house tax leaders, many of whom may have spent much of their career at one company. Collaborating with external organisations that develop relevant technology, or bring cross-sector knowledge across geographies, is particularly valuable, according to conversations Deloitte has had with its clients.

External advisers can offer approaches and options for realising strategic goals, managing the tax function, or redesigning specific tax workflows or operations. Furthermore, as an added benefit, the larger global professional services firms often have talent development and continuing tax education programmes that they will share with their clients to help to keep those organisations’ skills up to date, thereby offering flexibility and higher operating efficiency to their clients.

5 Automate, and redeploy skills for agility

Digitalisation in tax has long been in progress. Increasing automation of some tax processes not only provides tax leaders with more flexibility, but it now also supports tax activities ranging from extracting data for tax compliance and reporting preparation, to monitoring global tax developments and integrating key processes such as analytics dashboards for identifying anomalies and trends in an organisation’s global tax footprint. Automation therefore frees up time, allowing leaders to redeploy their tax professionals to where they are needed most.

Keeping up with change is an unavoidable requirement for today’s tax professionals. Those with in-demand skills beyond tax expertise have relevant, transferable capabilities that can be the basis for a long and varied career – one that can be centred on tax or not. Yet the velocity of change means that traditional members of tax teams must also be more adaptable than ever: open to upskilling; curious about, and adept with, data analysis and technology; and willing to embrace broader business goals.

Executing a talent strategy that responds to industry conditions and organisational goals is crucial. Providing continuous learning opportunities for tax professionals to become more valuable to their organisations is a benefit that today’s generation of tax professionals expect. Organisations that meet these expectations will not only further individuals’ careers and strengthen tax departments today, but will position themselves for success in the future.