How is your organisation placed as pillar two enters a new phase? Rather than looming as an almost mythical monster on the horizon, the rules are now in play and the nature of the beast has changed. Sixty jurisdictions have implemented or produced draft legislation at the time of writing, and still more are consulting on the topic.

This creates a valuable perspective. As Ross Robertson, an international tax partner at BDO, says in a recent webinar held by the accountancy and business advisory firm: “We now have significant practical experience of some of the challenges arising on application of the rules.”

The fluidity of those rules, differing territorial interpretations, and a lag in the local adoption of OECD guidance have long been among the issues, as brought into sharp relief by BDO’s implementation tracker. But what are the main pain points as tax functions grapple with legislative changes across jurisdictions?

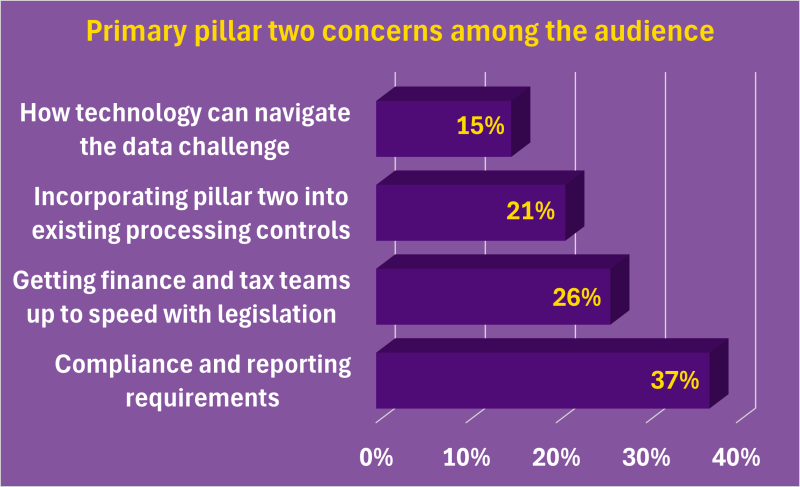

The webinar’s attendees indicate the concerns are not limited to a single area, as shown in the poll results below.

The speakers provide context for the above figures by drawing on their recent experience, and address the following topics:

Establishing an effective pillar two process;

Applying safe harbours;

Operating models and technology solutions; and

The importance of governance.

Working towards a process framework for pillar two

When faced with the multifaceted challenge of pillar two, it is perhaps comforting to remember the proverb that the journey of a thousand miles begins with a single step. Drawing that out, the 21-stage approach presented in the webinar is designed to create a repeatable start-to-finish process that mitigates risks such as missing an amount in the calculations, and, crucially, provides an auditable trail for the numerous stakeholders.

Scott Klein, an international tax principal in BDO’s US practice, explains the rationale. “It would be too overwhelming to prepare pillar two calculations without an organised and comprehensive process in place,” he says. “We’ve designed our pillar two calculation engine based on process. If you’ve heard the expression ‘garbage in results in garbage out’, we chose to focus on minimising the garbage in, to best prepare for eliminating the garbage out.”

The two checklists in the above approach, relating to the transitional country-by-country report [CBCR] safe harbour and the full GloBE calculation requirements, help to identify the ‘garbage’. Such tools could have an added benefit. “These checklists are an auditor’s favourite and support a company’s internal control process,” Klein says. “All the financial statement auditors for my clients want to see a detailed process to support how you have qualified financial statements if you’re applying a transitional safe harbour.”

Navigating safe harbours

Qualifying CBCRs have proven to be a particular challenge, which has been accentuated by the demands of revised administrative guidance from the OECD. Hetal Chandaria, a director at BDO UK, says: “Producing a qualifying CBCR is the area we are finding most groups are struggling with. A qualifying CBCR is more than producing a set of qualified financial statements. There are multiple elements to this process. Fixing the issues will involve consideration outside the local tax team; it requires wider stakeholder input, and remediating them will not be easy.”

Frederik Boulogne, a partner at BDO Netherlands, identifies the four areas typically examined in financial statements to assess if they are qualifying, and emphasises that once out means always out in terms of safe harbour eligibility.

Common issues and the dangers of disqualification from the ability to elect into a transitional CBCR safe harbour in a jurisdiction if the entity in question does not meet the requirements are also highlighted. However, the webinar presents a testing template that is aimed at tackling the issue.

Another takeaway is that tax authorities in different jurisdictions may scrutinise safe harbour calculations independently. “You could be a UK group that has centrally prepared safe harbour calculations,” Boulogne says. “You’re filing a GIR in the UK, but the Dutch tax authorities could look at those numbers and may identify certain things that they think are worth clarifying from your side because they could have a material effect on the outcomes. The Dutch tax inspector may reject your safe harbour application for the Netherlands. He is not even bound to prove any under-taxation in the Netherlands.”

Managing pillar two data: operating models and technology partners

There are two unavoidable questions for groups addressing the challenge of collating and processing the data required for pillar two: what operating model to deploy and, in most cases, what tax technology provider to use.

“There has been more interest in insourcing and co-sourcing [rather than outsourcing], and I think partly the reason for that is it’s all about the data,” Ian Bowden, a partner at BDO UK, says. “With 200, 300 new data points to collect, there is work only you can do. Outsourcing everything still means you need to get the right data, and usually the best people to make a start on that data aren’t an outsourcing firm, so your business needs to put in place a process to gather and validate that data.

“Co-sourcing is for those that perhaps need a little extra assurance without necessarily the full cost of outsourcing. Can someone double check your homework and possibly help you file it if needed?”

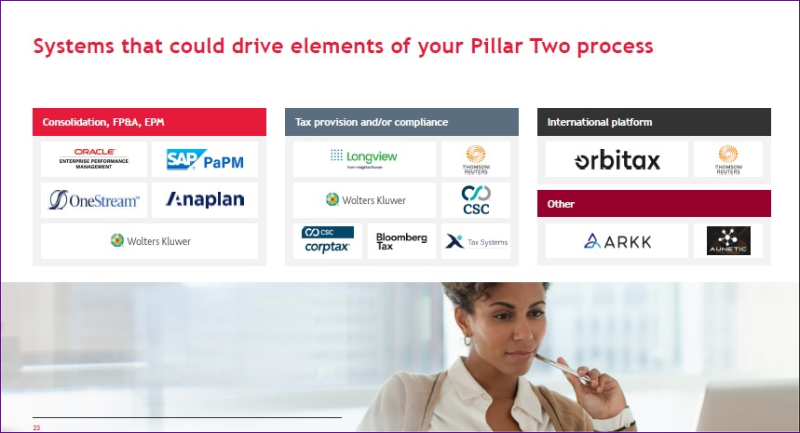

As well as deciding upon an operating model, an equally important question is what tax technology provider to opt for, if that is the route chosen. Bowden provides a summary of several players in the space, from well-established offerings to new entrants, as illustrated.

Tax governance: ensuring controls are in place

Governance principles underpin all the above considerations, according to Jason Land, a tax principal at BDO UK. And while you may think that you have finished with the days of showing your working, that may not be the case. “Scott, Frederik, and Hetal talk about what’s required from a process perspective, but you need to wrap that in governance and controls, so that by the time you get to those underlying tax disclosures and returns, you’re in a position to evidence what you’ve done and the basis for it,” he says.

That is supported by an observation that the UK’s tax authority is enhancing its scrutiny in this area. “In the UK, we’re seeing a renewed focus on controls and embedded risk management across all the taxes, and pillar two is just another part of that,” Land says. “HMRC have published about 10 documents that are guidelines for compliance in different areas that drive the control, the governance, so this is complicated.”

External pressures for tax functions are a given, but internal pressures are an increasing factor in the new reality. “Tax teams may feel a little bit siloed,” Land says. “Moving away from that is going to be key. We have seen some issues where there are conflicts where people didn’t want to share data internally, and that’s something that needs to be smooth, so how we make sure that the processes work and come together effectively is important.”

As tax functions consider how best to manage the evolving demands of pillar two, however, Robertson finds cause for optimism. “Despite all the complexity,” he says. “Pillar two is a tameable beast through a methodical, well-planned process.”