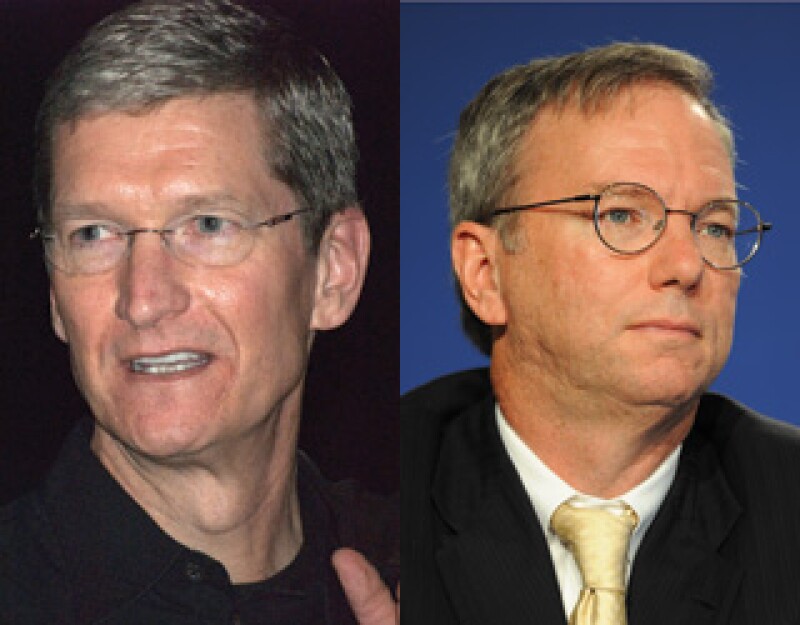

Similarly to fellow Global Tax 50 joint-entrants Max Baucus and Dave Camp, the two heads of Apple and Google have advanced the US tax reform debate in their own way. By standing firmly committed to the legitimacy of their companies’ tax practices, advocating instead for the rules they maintain they play within to be changed to match the realities of the modern world, the two men have cast a new light on the reform debate.

Through their efforts, the focus has shifted somewhat away from corporate tax practices and onto those that make the laws for companies to abide by.

In April, Schmidt defended Google’s tax policy after the company’s US stock market results showed it generated more than £3 billion ($4.6 billion) in the UK last year, but paid only £7 million in UK corporation tax.

“The most important thing to say about our taxes is that we fully comply with the law and obviously, should the law change, we will comply with that as well,” said Schmidt. “What we are doing is legal. I’m rather perplexed by this debate, which has been going on in the UK for some time, because I view taxes as not optional. I view that you pay the taxes that are legally required. It’s not a debate; you pay the taxes.”

Defences such as this have served to increase the strength of feeling that existing tax rules need to be changed, and has shifted the emphasis onto the responsibilities of lawmakers.

Cook, meanwhile, towed a similar line at his May appearance in front of the Senate’s Permanent Subcommittee on Investigations, chaired by fellow Global Tax 50 member, Carl Levin.

His defence of Apple’s taxes was purposeful and unapologetic.

“We pay all the taxes we owe, every single dollar. We not only comply with the laws, but we comply with the spirit of the laws,” Cook said, before refuting Levin’s claim that Apple depends on “tax gimmicks”.

The defence seemed to convince most of the senators present, with many actually jumping to Apple’s defence themselves. Senator Rand Paul provided a particularly alliterative argument in defence of Cook: “I am offended by the tone and tenor of this hearing. I am offended by a $4 trillion government bullying, berating and badgering one of America’s greatest success stories.”

Cook used the hearing to call for an evaluation of the US tax system, which he said has not kept pace with the advent of the digital age and the rapidly changing global economy.

But despite Cook’s May appearance on the Senate floor, Apple’s use of Ireland in its tax structuring affairs has also piqued the interest of the Italian tax authorities, who have launched an investigation into an alleged €1 billion ($1.3 billion) fraud by the company.

Regardless of the outcome in that investigation, Cook and Apple have succeeded in changing the tone and tenor of the tax reform debate, especially in the US.

Together with Google’s Schmidt, Cook has done this so successfully that Rand Paul has even gone as far as saying: “If anyone should be on trial here it should be Congress [for creating such a complex tax code]”.

Further reading |

Perceived avoiders declare support for tax reform Baucus US tax reform proposal: A warning for Apple and Google |

The Global Tax 50 2013 |

||

|---|---|---|

Pierre Collin and Nicolas Colin |

Marlies de Ruiter |

|