As technological advancement becomes more crucial to economic growth and competitiveness, countries around the world are focusing their policy efforts, including their tax incentive policies, to ensure that they are at the forefront of next-era advances. Attention is focused on building leading positions in innovative technologies such as genetic editing, quantum and artificial intelligence, information technology, new energy and advanced manufacturing.

Table 1 shows data from RDmag, a leading authoritative journal of science and technology in the US, setting out R&D investment levels in 2018 in major jurisdictions; amounts are expressed in purchasing power parity (PPP) terms. As can be seen, the US and China lead the table, although China's research and development (R&D) investment is growing at a faster rate.

Table 1:The top five countries for R&D investment (PPP values) |

|||||

Ranking |

Countries |

R&D investment (USD bn) |

Annual growth |

% of GDP |

% of global R&D investment |

1 |

US |

553 |

2.90% |

2.80% |

25.30% |

2 |

China |

474.8 |

6.70% |

2.00% |

21.70% |

3 |

Japan |

186.6 |

0.60% |

3.50% |

8.50% |

4 |

Germany |

116.6 |

1.50% |

2.80% |

5.30% |

5 |

Korea |

88.2 |

3.30% |

4.30% |

4.00% |

Source: RDmag |

|||||

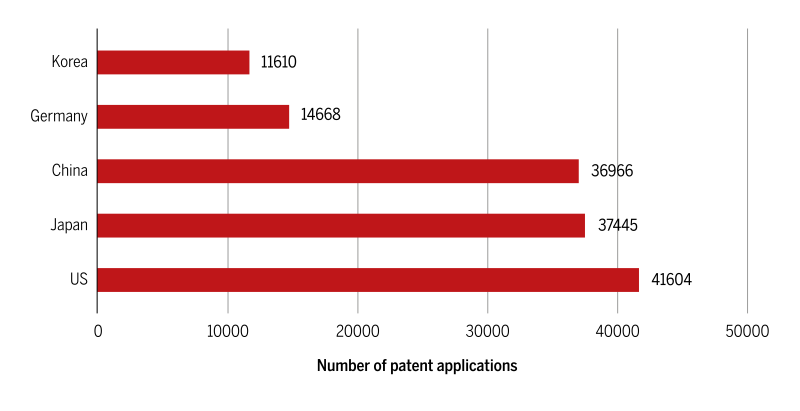

Table 2: Top five countries for PCT applications Jan-Sep 2018

Source: WIPO

This increased investment in technological innovation is yielding a greater number of recorded patents worldwide. World Intellectual Property Organisation (WIPO) data from 2018 showed that total new patent application numbers, as recognised under the Patent Cooperation Treaty (PCT), increased by 3% year-on-year. As shown in Table 2, the US has the largest number of patent applications, with Japan second. China is narrowing the gap, however, with its rapid growth rate.

China's advances in this space are driven by its continually refined innovation tax policies. Its two major innovation tax incentives, the high and new technology enterprise (HNTE) incentive and the R&D expense super deduction have, in 2019, entered their 11th year of operation. Since 2018, the super deduction has been applied nationwide at 175% of the incurred R&D expense; this followed an increase from 150% to 175% for small enterprises in 2017. Many local tax authorities actively encourage applications for the R&D tax incentives, and the amount claimed continues to rise.

Furthermore, in May 2019, China clarified that integrated circuit design companies and software companies can continue to enjoy the so-called 'two-year exemption and three-year 50% reduction' corporate income tax (CIT) incentive, which has now been extended. Also in early 2019, the Shanghai Stock Exchange's Science and Technology Innovation Board (STAR Board) for stock listing of technology enterprises was established. This provides a further valuable access point to the capital markets for China's high-tech and strategic emerging industries.

These core incentives and new regulatory innovations are complemented by an array of other policies, such as the preferential VAT treatments (since 2016) for technology transfers and technology development services, accelerated tax depreciation for R&D fixed assets (since 2014), and a large number of more localised policies, for example preferential individual income tax (IIT) policies for highly skilled tech staff in the free trade zones.

While the government has prioritised policies to stimulate innovative activity, at the same time, and particularly from late 2018 onwards, a more rigorous approach has been taken in policing the proper use of the HNTE incentive. In particular, local departments of science and technology in various regions are taking a more stringent approach to reviewing HNTE recognition applications. This involves carrying out inspections for existing HNTEs to see if the HNTE recognition had been improperly granted in the past, and cancelling HNTE qualifications where they were found not to be merited.

Incentivising R&D and software

In September 2018, the Ministry of Finance (MOF), the State Taxation Administration (STA) and the Ministry of Science and Technology (MOST) jointly issued a notice to increase the R&D expense super deduction to 175% on a nationwide basis. It was also provided that payments made to overseas R&D contractors could qualify for the super deduction. The super deduction can only be claimed in respect of 80% of the actual amount incurred. Furthermore, foreign outsourcing expenses must not exceed two thirds of the qualifying R&D expenses incurred locally in China. However, this is still a significant improvement on the prior position whereby these expenses were completely excluded from the super deduction.

According to STA data released in May 2019, the R&D super deduction provided a total tax reduction of RMB 279.4 billion ($39.7 billion) for 2018. RMB 87.8 billion of this is attributable to the increase in the deduction rate from 150% to 175%.

In the past, the super deduction claim process required advance project assessment by the local tax bureau, and detailed record filing by the taxpayer. From 2018 onwards, the process was changed and a self-assessment system now applies. The focus of the tax authorities is no longer on up-front assessment of the tenability of the claim. Rather, authorities will conduct post-filing inspection and follow up with the taxpayer where they have queries/concerns on the relief claim.

This new approach reduces the formalities companies need to comply with to enjoy the tax incentives but also imposes the risk on the taxpayer of tax authorities later disputing claims made earlier. Claiming companies must be sure that they fully understand the rules for the super deduction and have sound systems for the management, tracking and classification of R&D projects and expenses. Where post-inspection is failed, companies will have to pay back the tax incentives received, with late payment surcharges.

In practice, the post-inspection processes followed by local tax authorities and local science and technology authorities vary. Consequently, it is necessary for companies to remain aware of local standards and processes to control filing risks.

In the software industry, special CIT treatment has been available for software companies for many years. This provides qualified new software companies that meet the requirements with a CIT exemption for their first and second years in business, and a 50% reduction on the CIT rate for the third to fifth years (generally referred to as the 'two-year exemption and three-year 50% reduction' incentive). The existing policy was set out in the 'Notice on CIT Policies regarding Further Encouraging the Development of the Software Industry and the Integrated Circuit Industry' (Cai Shui (2012) No. 27) and was set to expire in December 2017.

Extension of this policy beyond 2017, while long discussed, was only finally announced in May 2019 in MOF/STA Announcement No. 68. While this covers companies that were already profitable in 2018, it is still uncertain whether companies that become profitable (or are established) from 2019 onwards will be able to enjoy these CIT incentives.

Increasingly stringent supervision

The HNTE incentive, now in its 11th year, continues to be a success. Its principal advantage is that it provides for a low 15% CIT rate, compared with the standard rate of 25%. In 2018, 48,000 HNTEs were newly recognised, the highest for any year to date. There were 180,000 in total by December 2018, with Guangdong, Beijing and Jiangsu ranked as the top three HNTE locations.

Table 3: Growth of HNTEs |

||

Year |

Total HNTEs |

Growth rate |

2014 |

63,000 |

22% |

2015 |

76,000 |

31% |

2016 |

100,000 |

31% |

2017 |

131,000 |

39% |

2018 |

181,000 |

38% |

At the same time, the HNTE programme has entered an era of more stringent supervision. Local departments of science and technology in various regions are carrying out inspections for existing HNTEs to see if the HNTE recognition had been improperly granted in the past, and cancelling HNTE qualifications where they were found not to be merited.

In April and May 2019, the Guangdong HNTE cancelled the HNTE qualifications of 54 companies, including 24 businesses engaged in the electronic information industry and 14 in the manufacturing industry. This accounted for 44% and 26% of the total previously qualified enterprises, respectively.

There are six key criteria which must be satisfied to obtain HNTE status:

Intellectual property (IP) ownership: The company must own the core technological IP which plays the key role in supporting its main products (services).

Industrial field: The main products (services) of the company should fall within one of the eight specified industrial fields.

R&D expenses: The ratio of qualifying R&D expenses to the total sales of the applicant in the preceding three fiscal years should meet the relevant minimum ratio: 3%, 4%, or 5% for different sales volume levels.

HNTE revenue: The proportion of the revenue derived from high and new technology products (services) to the total revenue of the enterprise is more than 60%.

Personnel: The ratio of science and technology personnel engaged in R&D and related technology innovation activities should be no less than 10% of total employees of the company for the year.

Innovation scorecard: A calculation of points is conducted using four assessment criteria for the HNTE candidate's operations. A company needs 71 points or more to qualify for the HNTE incentive.

In order to ensure the sustainability of HNTE claims, it is imperative that enterprises maintain robust R&D management systems, allowing them to cope with new strict application reviews and random inspections afterwards.

Support from the STAR Board

The establishment of the STAR Board in Shanghai in 2019 provides a significant boost to innovative Chinese enterprises looking to raise capital for investment. The key announcement in this regard was the issuance by the China Securities Regulatory Commission (CSRC) of the Implementation Opinions on Establishing a Science and Technology Board and Pilot Registration System on the Shanghai Stock Exchange on March 3 2019. The regulations for listing demand evidence of the innovative activities conducted by listing applicants. In this regard, the R&D management systems used for supporting tax incentive applications can prove themselves of double usefulness.

In the Guidelines for Enterprises Listing on Shanghai Stock Exchange's Science and Technology Innovation Board, companies in six high-tech sectors are considered eligible for listing. This includes new generation information technology, biomedicine, new materials, new energy, energy conservation and high-end equipment. The guidelines clarify the criteria used to assess the technological innovation capability of applicant enterprises, for example applicant enterprises must possess exclusive IP rights over the core technologies used in their business.

Listing review involves a strict audit of R&D investment internal controls. Consequently, it is crucial to establish a comprehensive R&D management system that can both support access to tax incentives and meet the requirements for listing on the STAR Board.

The Chinese government is steadily increasing its support for R&D and innovation through R&D tax incentives, subsidies, and a more supportive regulatory framework. Accessing these increases the requirements for effective and granular management of enterprise R&D activities. This must be a focus for all enterprises seeking competitive advantage through innovation.

The authors would like to thank Jacqueline Mai, KPMG China senior manager, for her contribution to this article.

Bin Yang |

|

|---|---|

|

Partner, Tax KPMG China Guangzhou Tel: + 86 20 3813 8605 Bin Yang worked for the Guangdong government and a multinational foreign investment company for 14 years before he joined KPMG. When working for the government, he was responsible for regulation consultation and project management regarding foreign investment in China. Bin joined KPMG Guangzhou in 2006. He has extensive experience in corporate compliance and corporate structure advisory. He has successfully assisted many multinationals, as well as medium and small companies, from manufacturing, trading, property, and service industries to enter the China market and improve their company structure. Bin is the leader of the research and development (R&D) team of KPMG China. He has abundant experience in R&D services, including high and new-technology enterprise (HNTE) assessments, R&D expense super deductions, assisting clients in the development of R&D management systems and defending their HNTE status. As a key contact between KPMG and the government R&D department, Bin has maintained strong relationships and communication with related departments and provides advice on policy planning. In addition, Bin has an MBA. |

Nicole Cao |

|

|---|---|

|

Director, Tax KPMG China Guangzhou Tel: + 86 20 3813 8619 Nicole Cao has extensive experience in providing China tax planning services to foreign multinationals and domestic enterprises, with a focus on securing tax incentives. Her clients operate in a wide range of industries, including nuclear power, chemicals, logistics, medical, aviation, machinery, IT, automobile, food, and finance, and include both MNEs and domestic enterprise groups. As a core member of KPMG China's R&D practice, she has assisted enterprises in supply chain planning and R&D tax incentives application. She has extensive experience in high and new technology enterprise (HNTE) qualification review, application and audit defence. She also assists clients with R&D super deduction applications, establishment of R&D management systems, and with applications for government financial subsidies. Nicole maintains strong relationships with government authorities and provides clients with advice on policy matters. She is a regular speaker at KPMG seminars. |