Between January and March 2020, ITR ran a survey to find out how diverse people believe the tax sector to be. Tax professionals across more than 35 countries responded, sharing their views on a range of questions covering their companies, experience and if they think the environment is changing or not.

In addition, ITR did some of its own research, looking into how gender diverse a range of accounting and law firms were, as well as examining whether or not there are an equal number of men and women choosing to study tax.

Sadly, many accounting and law firms approached by ITR were reluctant to share data that offered a gender breakdown of their tax practices in specific countries. Some firms said this information was not available specifically for the tax practice or risked breaching data confidentiality rules, while others just refused to participate. This suggests that there is cause for concern and indicates a lack of gender equality within their firms, especially at senior level.

"It must be the case that the tax sector, like so many professions, is lacking in other diversity areas; the stats alone prove that, as well as it's really clear when you attend events like tax conferences," says one vice principal of tax at a large business.

For one man, who comes from an ethnic minority background, based in the UK: "Tax is still an 'old school' industry which is slowly improving in diversity but has a long way still to go."

The respondent, who is the head of transfer pricing (TP) at a UK-headquartered multinational enterprise (MNE), says that when you compare the diversity mix at graduate level vs director/partner level in a Big Four firm, this issue becomes obvious.

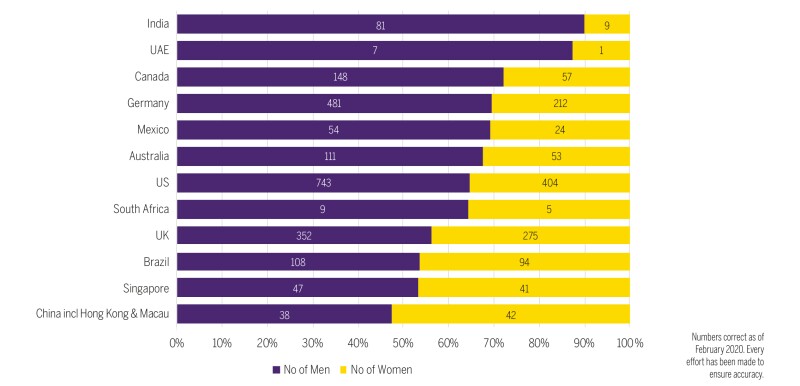

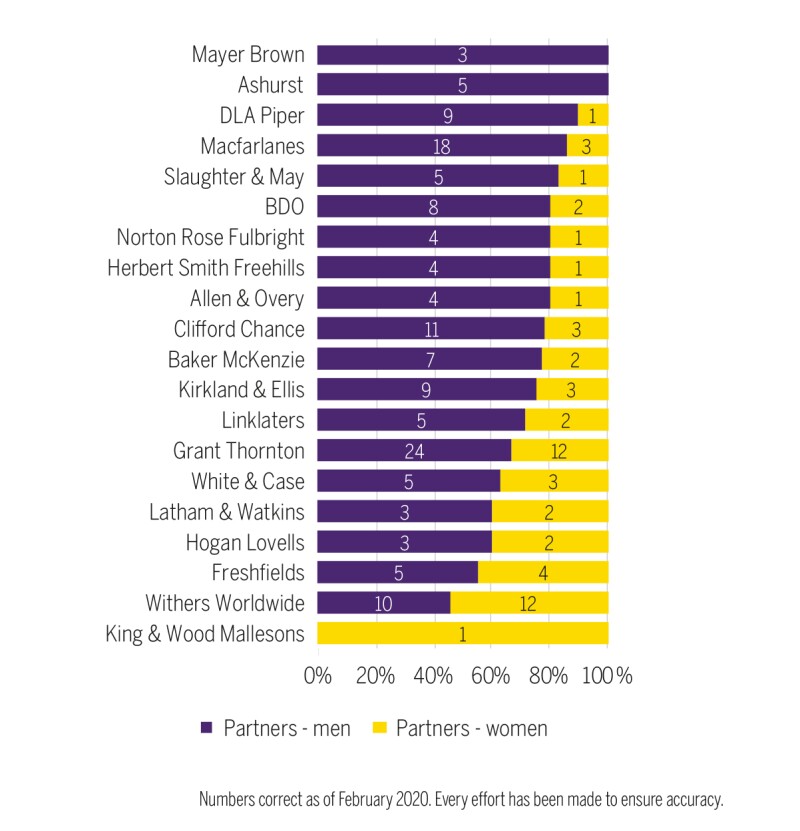

No of men and women across 26 law firms

Not all 26 law firms are represented in each jurisdiction

"There have been better improvements in gender diversity than in ethnic diversity owing to a conscious push to encourage more women at senior grades," the TP head of tax says.

However, one senior manager from a Big Four firm counters that, despite the awareness of gender inequality and women in tax groups and events many women are "stuck" at the senior manager level because of personal priorities, describing it as a "motherhood penalty".

"After a certain level, male candidates seem to be selected for a job," says one Finnish tax executive working within an MNE tax function.

For those firms that provided information on the gender breakdown of their tax practices, or had the information available on their websites, it is clear that there are not enough women at partner level, nor is there much diversity on the basis of race or ethnicity.

One male tax advisor from an ethnic minority background based in the US remarks: "Public accounting is all white with only 1% or 2% from other races/ethnic groups."

Discrimination occurs often

Out of the 170 qualifying responses received in the survey from people who work within MNEs, law firms, tax accounting firms and tax-specific areas of other businesses and organisations, 135 people said discrimination still exists in the tax sector.

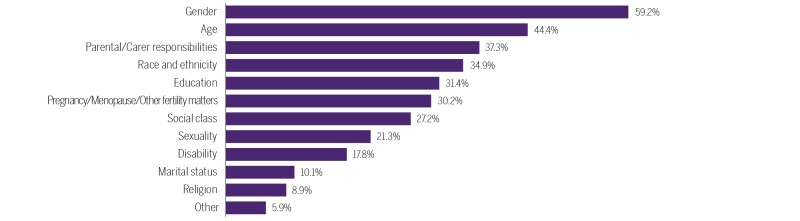

Gender discrimination disadvantages individuals the most, closely followed by discrimination because of age, parental/carer responsibilities, race and ethnicity, education and social class.

"Discrimination is very personal and it's not always easy to challenge," says one tax professional from Toronto who participated in the survey. They say that even when someone is not a direct victim of discrimination, it is about how someone feels when they observe other majority or homogenous groups react negatively towards a person from, for example, a different race, ethnicity, gender or sexual orientation.

Many survey respondents who had been the victim of discrimination in the past say they have not witnessed any such behaviour over the past 12 months, suggesting matters may be improving, but this appears to be both slow and limited.

One female head of tax from the UK says she has not witnessed any discrimination in tax since the late 1990s. However, the same person believes that if she were a man, her job title would be "director of tax" rather than "head of tax" and would likely receive a "more generous benefits package".

A common complaint among respondents was their belief that they had missed a job or promotion opportunity because of some kind of discrimination.

One woman working at an MNE, who applied for a promotion, says gender was a significant reason why she did not get the role.

"There was too much unconscious emphasis placed on my gender and my age when being considered for promotion – and the same for another female colleague," the woman in tax says. "An external candidate (male), who was a younger version of the boss, was given the role instead."

Many of the factors that drive unconscious discriminatory behaviour in relation to jobs and promotions, stems originally from society. For example, most societies perceive women to be the primary carer of children, while men are often considered to have the characteristics of leaders.

Alluding to this fact, one senior tax manager says that while her firm makes "a lot of noise" about diversity and inclusion, the practice is very different.

"It's very much about who earned the most money and who brought in the most business," says the tax manager. "More female characteristics around caring and developing and nurturing tend to not be recognised as much, and it does tend to come down to the more male metrics" when assessing individuals for promotion. "It's those subtle messages that nobody would ever say, but when you look at the reality, that's the thing that is actually valued," she adds.

"I've been a tax professional for 22 years," says another tax executive. "It's somewhat to be expected that in a 22-year period I might have suffered from these incidences [of sexism and discrimination]. However, I feel fortunate as each incident propelled me to effect a change and to find my voice, such that the occurrence of incidents diminish as I progress."

"Learning to dust yourself off and spot the signs, speak out, address discrimination proactively – they're the learnings from those low points," she continues. "So the majority of my 22 years are positive experiences."

Just like 'me'

A common interest in tax, whether it is a career or vocation, binds everyone in the tax community. However, within this ecosystem, there are many who share other values or backgrounds, and these factors, subconsciously or unconsciously, influence decisions.

"I was at an industry dinner about a year ago and there was a target there who I had been trying to approach for a while," says one tax consultant. "I ended up sitting opposite him at dinner and it turned out that we both went to the same university," she continues, saying that she felt like she could hold a conversation with this potential client only because they had a university in common.

"On the back of that conversation, I did win some work, but I was very conscious that there were probably a lot of people who couldn't have had that same level of conversation and might then not have won the work," the tax consultant says. "So, although I didn't suffer from discrimination, I was conscious that we built a rapport that was, perhaps, based on privilege."

The issues are not only confined to those working at advisory firms, or within corporate tax departments.

One tax professional who was building a career as a tax professor in the Netherlands told ITR that his ethnic background – and the fact that he was the only non-white, non-native individual in the faculty – caused numerous career problems, forcing him to work harder than his white counterparts and almost ended his career in tax because he could not challenge his superiors on discrimination.

"I needed a home loan after working for nearly five years at [a university]. They said they wouldn't give me a document to buy a house for my family, but when it came to a white person who only joined the university two months ago, that person was immediately given a document to secure a home loan. And that's where the problems basically started," he says.

"I found out that I was being paid a lot less than a counterpart who was white. He was put in a different pay scale because they completely ignored my 14 years of experience, putting me on the base scale of somebody who has no work experience and has just finished a PhD," says the former tax professor. "The moment I started protesting about these things, they basically made my life miserable at the faculty and basically shoved me out."

The individual says even less-experienced professionals were often promoted quickly because they were white and from the region. When he tried to pursue promotions, they said there was not enough funding.

"If I were to go to a court of law and sue, that would make me a pariah," he says, pointing out that this is not an option. "I would not find another job," he says. "The moment I sue, I will become unemployable in tax academia [because people will think I am hard to work with]."

Some survey respondents also remarked on the high risk of dealing with discrimination through official channels. One advisor based at a UK Big Four firm says getting informal help is easy, but her experience has shown that getting formal help "is not a safe process".

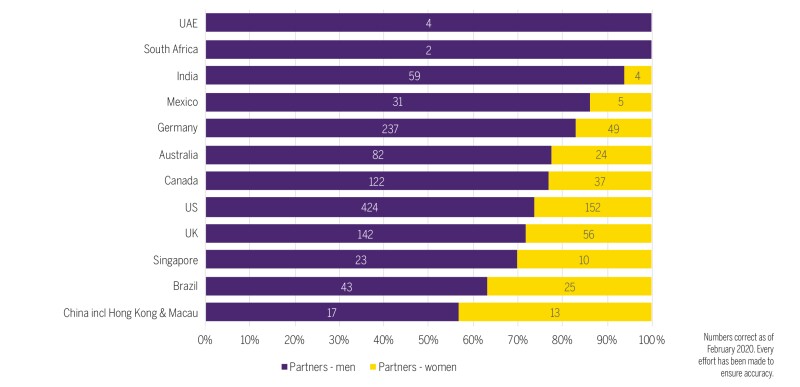

No of male and female partners across 26 law firms

Not all 26 law firms are represented in each jurisdiction

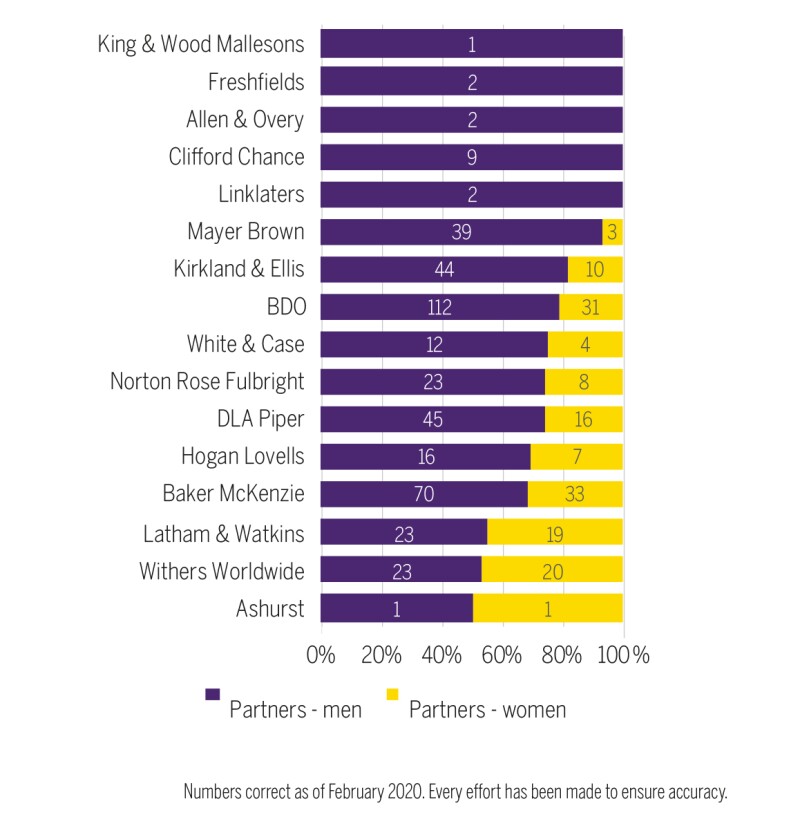

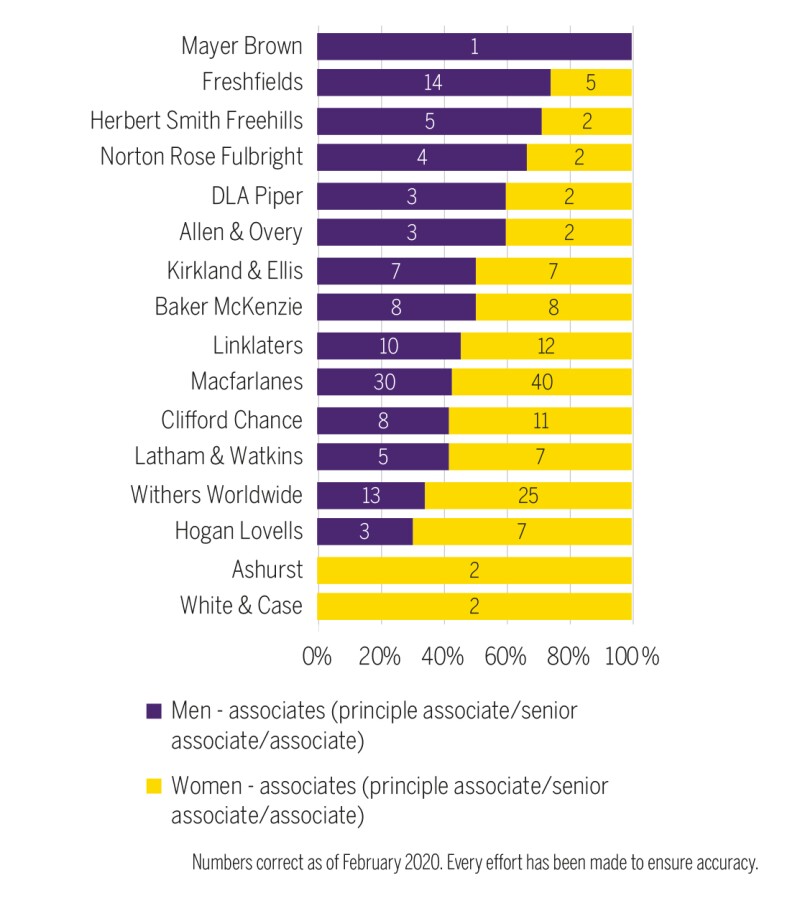

US firm partners – men vs women

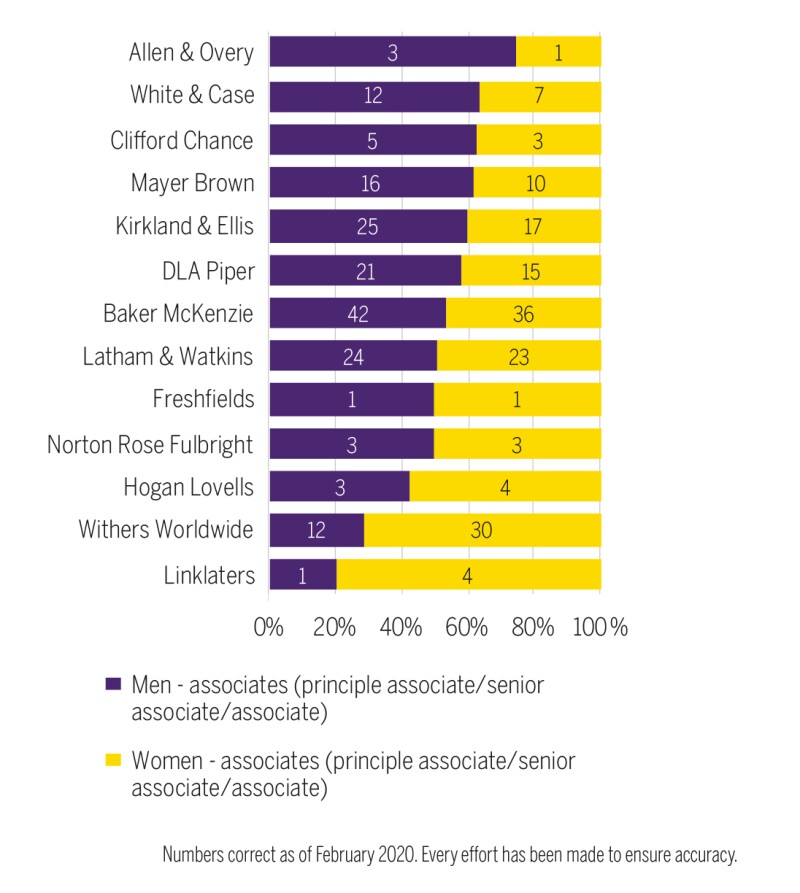

US firm associates – men vs women

However, one lawyer has proven that it is possible to challenge discrimination in the courts and win. Armando Ocampo Zambrano successfully sued Mexican law firm Chevez Ruiz Zamarripa y Cía over acts of discrimination, winning his case in 2019. The case was noted by a local news publication as one of 10 "big leaps" that Mexico took in LBGT+ rights during the year.

However, he did have to give up his career choice after the case. "Since I sued them [Chevez], my professional career in large corporations was stuck and blocked," Ocampo tells ITR. "It took four years for me to develop myself and then I became a civil and criminal rights lawyer defending the LGBT community".

"Now I am the First Executive Victim Commissioner for Mexico City," he continues.

Ocampo's advice to anyone that is being discriminated by a law firm is that the firm is not worthy of you as an employee. "Trust in yourself, life will lead you to a better place to achieve your dreams and manage an extraordinary career," he says.

Another woman in senior management at a Big Four firm in the US remarks that while court cases are rare, settlements are more common.

"At a prior employer, something happened, and some of it got on the news, and what didn't get on the news was allegedly resolved via settlements," the senior manager says.

"I have known of other colleagues in other workplaces where I was not working, who have told me things that happened, so it is different in different work environments," she adds.

For some, witnessing discrimination, or hearing from their peers that it is happening, is enough to leave a role or avoid a new one at particular companies. Bullying and stress were other reasons some respondents gave for considering leaving their job.

One problem with building teams of similar people, skills or personalities is that innovation suffers. Much like tax executive Giles Parsons' ITR article on embracing a 'not like us' vision, tax departments have to diversify to improve efficiencies and be attractive to future employees.

Recruitment remains a barrier to progress

As humans, we all try to find a common factor to help us connect with each other, but the subconscious and unconscious bias this creates during the recruitment process is significantly harming progress in the tax industry.

Recruitment is often the first interaction between a potential employee and employer than offers a glimpse into how a prospective manager and company may treat its staff. In many cases, it is women who recognise the faults, as gender is one aspect that attracts discrimination at interview stage. However, that is not say men have not suffered either.

For one man in Sweden working within an in-house tax department, job opportunities have been limited because he is not "native" enough, he says. "By being a foreigner, even though white and male, the preference for 'real' locals is strong," he tells ITR.

In Poland, one tax professional says nationality plays a part when companies are recruiting for a role within the tax departments of regional or headquarter offices. They say there is "a clear distinction between Eastern and Western Europeans" in such cases.

Similarly, a tax executive from Thailand says she was struggling to be recognised for her work while employed because she was not in the same geographical location as her managers and they only awarded those at the headquarter offices.

"I had to say something so I could be recognised for all the hard work I was doing," she says, because I am a woman and Asian, I wasn't recognised at all until I said something."

"During several job interviews, one interviewer asked if I wanted to get married, have kids, etc. because they wanted someone flexible," says a woman tax professional working at an NGO in Belgium.

Career disadvantages because some who are parents, recently married, or have other personal commitments was a common theme among respondents who said they lost at least one opportunity. However, another area that several people commented on was disability and education.

"Disability tends to be discriminated against in almost all jobs, so this is not specific to tax, but education is discriminated against due to the prevalence of graduate courses, and 'intellectual' requirements in job descriptions," says one tax advisor from the UK.

"I feel most 'office' or 'financial services' jobs discriminate in matters of education," he continues, adding that "parental responsibilities are likewise discriminated against in many jobs, especially with people making assumptions that someone who does not work full time is not committed to a career or their job".

Darren Burns, operations director at recruitment company Morgan McKinley UK, says the "route to both achieving gender equality in the workplace, and ensuring those within businesses feel there is a commitment to this, is a deep-rooted issue which is clearly still some way off from being completely rectified". However, change is occurring.

For one tax director at a US headquartered MNE, recruitment is not about ticking a box on diversity, but employing someone with the right skills. He says he has 20 tax employees in the New York office with a wide range of ages and nationalities and are divided almost equally by gender.

"I'd say a third of my workforce in the department is foreign born," the tax director says. "If I was some sort of guy who said, 'all I want to hire are white males of a certain age group,' I'd be sitting here by myself because that labour pool just doesn't exist anymore."

When he recruits externally, the tax director says his decisions are influenced by what is happening in the labour market.

"The labour market is very diverse with people of all different backgrounds, nationalities, and age groups and I'm always looking for the best person," the tax director says. "That, invariably, brings in somebody of Asian background or experience, gender or nationality that that may not have been a part of the labour pool in the past. The pool of talent that we have here today is a great thing because we bring in a lot of people with different ideas."

However, when it comes to promoting within, his decisions are influenced by how invested a person is in their career. He believes that a good tax professional should educate themselves throughout their career because laws and practices are constantly changing and those working in-house need to have the ability to recognise issues quickly.

"A lot of people don't see a lot of value in training these days, but I feel that there's a lot to be gained," he says. He stresses that it is important to continue educating yourself, attending conferences and interacting with former colleagues because when he is assessing his employees for promotion, he is looking at those that have given themselves the edge.

UK firm partners – men vs women

UK firm associates – men vs women

Building a 'safe' place of work

There are many businesses that are responding to the types of discrimination noted above so as to ensure they attract the right people to their business.

Companies have various diversity groups, awareness days, blind CV recruitment policies and, in some cases, gender quotas. Most also have official diversity and inclusion (D&I) policies that require employees to create a fair recruitment process, work environment and access to training and opportunities.

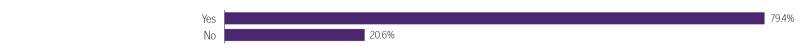

Although 152 respondents said their company has a diversity and inclusion (D&I) policy, less than 50% of overall respondents said their company does enough to promote it.

"Wellbeing and mental health is done only really during mental health week," says one tax advisor. "The company is currently improving its D&I policies and so the initiatives that currently exist are quite new. There is an initiative regarding mentoring for employees. The D&I committee are looking at initiatives for recruiting a more diverse talent pool."

Another tax professional working in a consultancy firm says that, although her company has a D&I policy and does well to promote it through a number of initiatives, it could go further, suggesting there could be groups that "link" the minority groups.

"We have a network that brings together men and women who are balancing different aspects of their lives with work," says one advisor from the UK. "It brings together many of the initiatives listed above rather than separating them."

However, diversity groups are often not enough. One tax manager at a Big Four firm says there is a problem of perception that needs to be addressed within some diverse groups themselves.

"For individuals who identify themselves with a diversity group, such as LGBT, there is a concern they will be treated/perceived differently. There is an internal fear within themselves, often based on their background, culture or family values," the tax manager says.

"Even in the LGBT community, there is discrimination," the tax manager continues. "For example, a gay white male will be treated more favourably than a lesbian black female in a wheelchair who is pregnant," noting that a LGBT comic also alludes to these differences.

He says the important factor is for businesses to create a "safe" workplace environment where everyone can bring their whole selves to work. For example, using pride month to send internal newsletters on people's coming out stories has been a positive change at his firm, allowing there to be visibility of the topic across the firm.

One VP of tax says organisations like hers, and many large accountancy and law firms – the larger ones with an already more diverse and therefore progressive leadership board – are consciously addressing discrimination and diversity in areas like recruitment, retention, promotion, reward, training.

"I do believe that if you resolve the imbalance of equality between the genders, other inequalities will also get redressed as a natural consequence of people focusing on real ability and not any inherited, genetic or other personal attributes," she says.

In the UK, for instance, insurance companies LV and Openwork pledged to improve the careers of women on International Women's Day. Joining other 19 insurance firms, the two companies signed up to the flexible working and inclusive customer financial lives pledge that commits firms to help their colleagues to understand and manage the long-term financial implications of flexible working.

However, the job is not done yet. Companies and managers need to ensure they are creating safe spaces to empower their employees and feel confident in their workplace to be innovative and build a career. That requires an environment where they feel supported.

Accounting and law firms have a large part to play in this because they are the institutions where most tax professionals will begin their careers and they need to ensure the language within the working environments is changed to eliminate the use of 'masculine characteristics' and qualities that many believe are necessary to create leaders and tax experts.

Furthermore, all organisations can also ensure that at conferences and other events, they are encouraging the most talented individuals to come forward and represent the company, and not just those at the most senior level, or men.

Individuals also have a part to play in this movement. How you treat others reflects the way others think of you and the values you hold, as well as the organisations you represent. In addition, there are many tax organisations built around improving tax diversity that are allowing, for example, women to empower each other.

Nevertheless, as one tax manager put it, the tax sector will only have achieved true equality and inclusiveness when diversity committees or groups no longer need to exist.

Report for Diversity in Tax

1. Do you think your company does enough to promote diversity and inclusion? (212 responses)

2. Do you think discrimination (of any nature) still exists across the tax sector, which disadvantages individuals or certain groups of people? (170 responses)

3. What kind of discrimination do you think happens the most within the tax sector regardless of whether you have experienced it or not?

4. During your tax career, have you been negatively discriminated against? (171 responses)

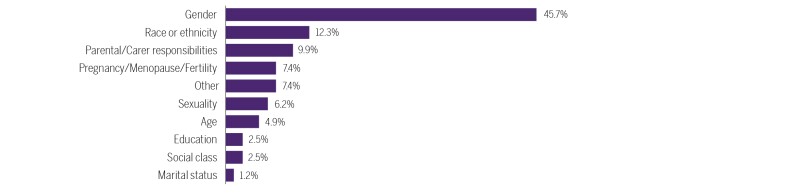

5. For what reason were you discriminated against? (81 responses)

6. During your tax career, do you believe you have missed an opportunity because you have been negatively discriminated against? (171 responses)

7. Have you ever felt like you have been included in a matter at work so that the business can appear inclusive and diverse, rather than exclusively for your skills and knowledge? (171 responses)