A comprehensive survey conducted by Euromoney’s Legal Media Group (LMG), which includes ITR, IFLR, MIP and Euromoney Thought Leadership Consulting, found that in-house legal and tax departments will ask their advisors to tackle the problems created by the COVID-19 pandemic.

In May 435 senior legal and company officials from a range of countries and industries responded to LMG’s survey about the impact of COVID-19. Nearly a third (31%) of respondents said they will be keeping advisors busy with litigation and dispute resolution matters.

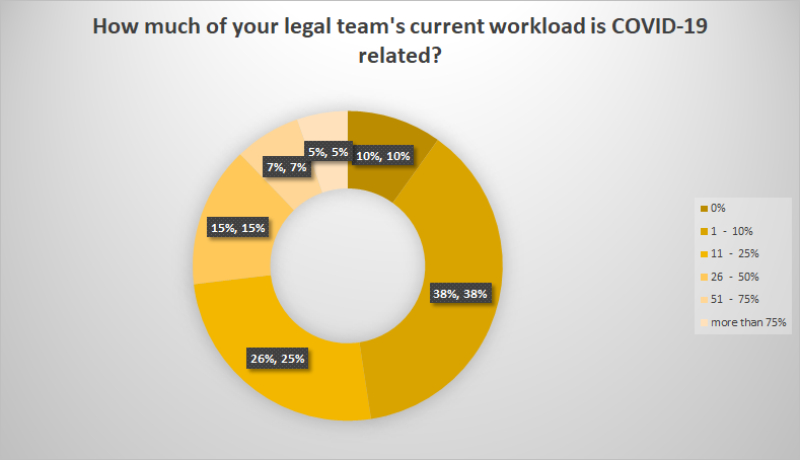

To understand the pandemic’s impact on legal teams, the survey asked respondents how much of their workload is related to COVID-19 – and the overwhelming majority (90%) said they have been affected.

Regarding the amount of work being sent to external law firms, 20% of respondents said they have “somewhat increased” it, despite only 8% of those surveyed seeing an increase in their legal outsourcing budget.

Overall, two thirds of respondents (66%) said that their legal budgets have been unaffected by COVID-19, with nearly a fifth (18%) revealing theirs has been “somewhat reduced” and 7% answering “significantly reduced”. Just 8% said they have seen an increase.

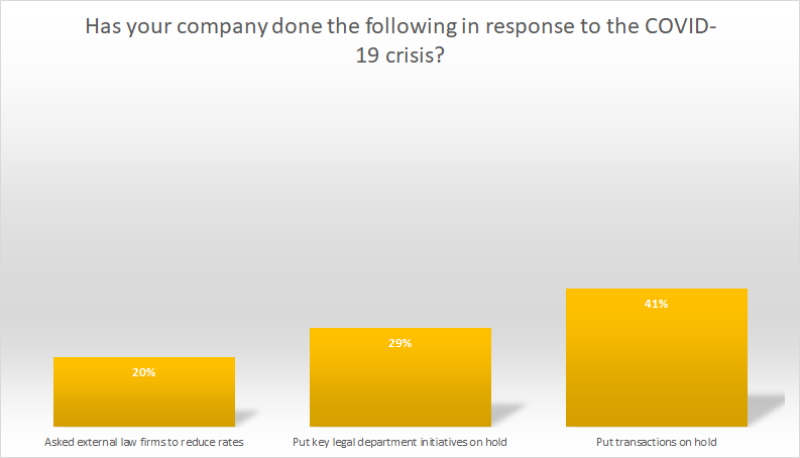

One third (33%) of respondents said they have asked external law firms to reduce their rates. The above-mentioned discrepancy between budgets and workload suggests that some firms have obliged. In addition, two thirds (67%) said they have put transactions on hold, while nearly half (47%) have stalled key legal department initiatives.

However, while not all budgets have been slashed just yet, companies have not seen anywhere near the full economic impact of COVID-19, making it feasible that over the next six months to a year, these figures will look very different.

Although the workload for legal advisors is likely to rise, the lack of increase in corporate budgets to outsource this work suggests that some firms are potentially taking on extra work at reduced rates, or even for free.

In the UK, a number of law firms and accountancy firms have been threatened by the economic impact of COVID-19. With the profits of many firms being hit partners have had to take a salary cut in the form of withheld profits in many cases and firms have frozen recruitment or used furlough schemes.

A BDO spokesperson told ITR that the COVID-19 pandemic has had a significant impact and the firm has implemented “a package of temporary measures to ensure our business can weather the current storm”.

“As well as a reduction in partner pay and a freeze on payment of the quarterly dividend, we placed 700 people on furlough at the end of April with the aim to protect their jobs for the future. These were predominantly first year trainees, who have been using the time productively to study for their exams while on full pay,” the spokesperson said.

They added that their client services have been fully managed with the use of technology. “Teams will also be retrained and redeployed as required to support areas of our business in particularly high demand – such as forensics, global outsourcing and business restructuring – to ensure we can continue to meet the evolving needs of our clients,” the spokesperson said.

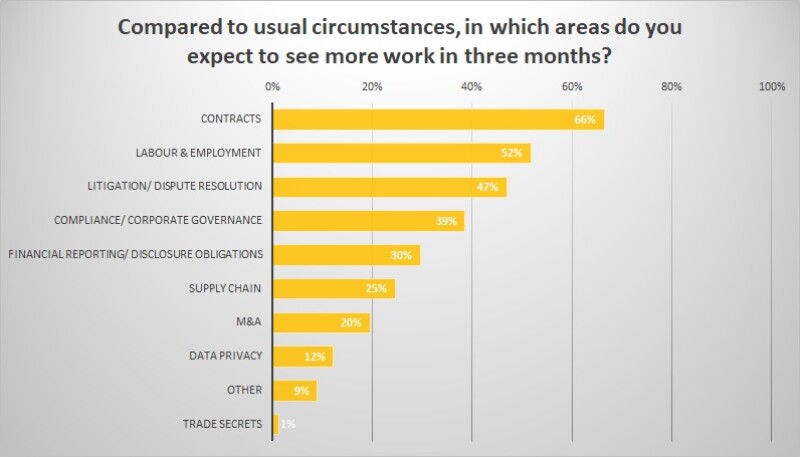

With COVID-19 reshaping business and society, the type of work that in-house counsel are doing is also changing. According to a majority of respondents (64%), the extra work created since the pandemic began is on contracts. Next was labour and employment (55%), and the third most popular answer was compliance/corporate governance, at just under half (48%). There was then a fairly even spread among the other options, including financial reporting/disclosure obligations, litigation/dispute resolution, and supply chains.

The findings are also supported by other industry surveys taking place during the pandemic. For example, a survey by EY found that nearly all those organisations surveyed (Asean 96%, global 99%) said that they plan to transform their tax and finance operating models. Also, 70% of Asean organisations (global 73%) said they are likely to co-source critical activities within the next 24 months to relieve the growing pressures created by digital tax filings, numerous legislative and regulatory changes, all of which have been magnified by COVID-19.

Chia Seng Chye, EY partner and technology sector leader, said: “The heavy demands on the tax function and tax professionals are unprecedented in the last three years and these will increase exponentially going forward. Particularly in situations such as the current COVID-19 pandemic, corporations are compelled to adopt telecommuting.”

“Companies can face challenges in seemingly simple tasks like accessing records and documents, which are in physical copies kept in offices instead of electronic copies stored on servers or the cloud,” Chia continued.

“These are real-life situations that should bring forward discussions on the ‘tax function of tomorrow’ with senior management and the board of directors. It will not be business as usual post the COVID-19 crisis,” he added.

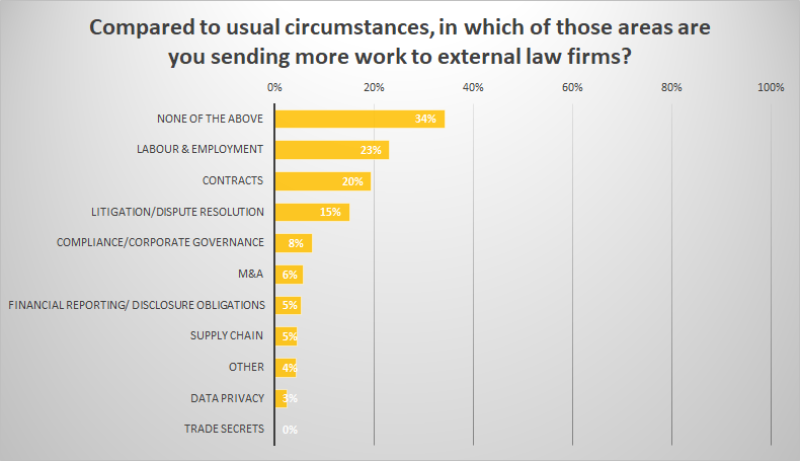

Keeping advisers busy

Illustrating how the extra work largely tallies with new work being sent to external lawyers, LMG’s survey found that labour and employment (23%), and contracts (20%) both account for the largest new workloads that counsel are shipping out. However, there is a large discrepancy between extra work on contracts (64%) and that being sent to law firms (20%), possibly suggesting that contractual work gets stuck in-house before needing expert advice.

“Businesses are wrestling with a choice between building out their own capabilities – utilising the right people and technology to keep up with change – or working with a third-party provider that is 100% focused on the task and has the scale to succeed,” noted Kate Barton, EY global vice chair of tax.

“The demands on today’s tax professionals have also increased. They not only need to have world-class tax technical knowledge, but a deep understanding of data and science, with proficiency in tools such as artificial intelligence, automation, machine learning, data governance and analytics,” Barton added.

Compliance/corporate governance accounted for just 8% of the new work for external firms, despite being the third most popular new work stream overall (48%), according to LMG’s survey.

While 30% of respondents said they are doing more litigation/dispute resolution work, just 15% said they are sending this work to external firms. Presumably this means that in some cases, in-house counsel are not sending litigation work out just yet, perhaps because these disputes are in the early stages where negotiations are ongoing.

Three months’ time

When asked about expected increases in work in the next three months, litigation/dispute resolution came third with 47%, which is 13% higher than for the current situation.

It sparks the key question of why companies expect more disputes in three months. One possible answer is that litigation is on the rise because of tensions in a number of industries. In addition, many business are anticipating tax authorities to become increasingly aggressive in audits as they look for way to plug the revenue gap left by government spending during the pandemic. Another answer is that in-house counsel may be expecting to send the existing litigation work (which is perhaps in the early stages) to external firms soon – a finding seemingly backed up by the result that shows 31% will be handing disputes over to external firms within three months.

The other notable change is the six percentile rise in expected M&A work – from 14% today to 20% in three months. And this looks likely to be transferred to external advisers, as M&A work sent to law firms will spike (from 6% to 12% of the vote) according to our findings. In three months’ time, law firms can also expect to get more contractual work (28% of the vote, up eight percentage points from today) and labour and employment matters (25%, a rise of two percentage points).

As law firms prepare for more work in certain areas, it would seem that keeping clients abreast of the latest COVID developments won’t do anything to harm them. According to our survey, respondents were indifferent when asked whether there is too much COVID-19 content from firms, and most said that it is at an appropriate level.

For more ITR perspectives on COVID-19, see ITR's COVID-19 hub here.