The replacement of existing IBORs with alternative reference rates (ARRs) is one of the most complex regulatory transformation programmes in recent times, affecting financial firms, corporations and credit market participants with IBOR exposure alike.

IBORs serve as an interest rate benchmark for trillions of dollars of financial instruments and are used as both performance and risk benchmarks. IBORs are closely embedded in the day-to-day activities of both providers and users of financial services, affecting existing and new financial products alike that range from derivatives, securitisations, mortgages, loans and bonds to floating rate notes.

In Europe, the Euro interbank offered rate (EURIBOR) and the Euro overnight index average (EONIA) have already started to transition to the Euro short-term rate (€STER), while the transition in other jurisdictions begins in 2021. In some markets, ARRs are already in use ahead of the transition deadlines and a significant share of debt issuances already refer to ARRs.

The ongoing COVID-19 pandemic, and the resulting market volatility and liquidity issues, has diverted attention from the IBOR transition. Regulators have acknowledged the challenges, but there are no indications of any plans to delay the transition or upcoming deadlines.

This article provides a TP perspective on the ongoing IBOR transition that focuses on the key challenges for related parties under common control and important takeaways for transition planning.

Reconciling between IBORs and ARRs

The IBOR transition is complex because of significant differences between ARRs and IBORs.

Typically, IBORs are unsecured interbank lending rates published for different maturity periods. IBORs are forward-looking rates, meaning that a borrower knows the interest rate on a loan at the beginning of the interest period. In contrast, ARRs are overnight indices, implying they are backward-looking and, therefore, lack a term rate structure and a yield curve.

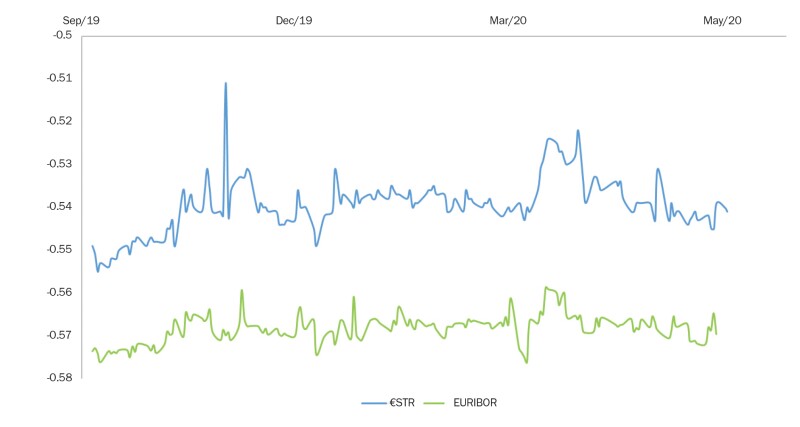

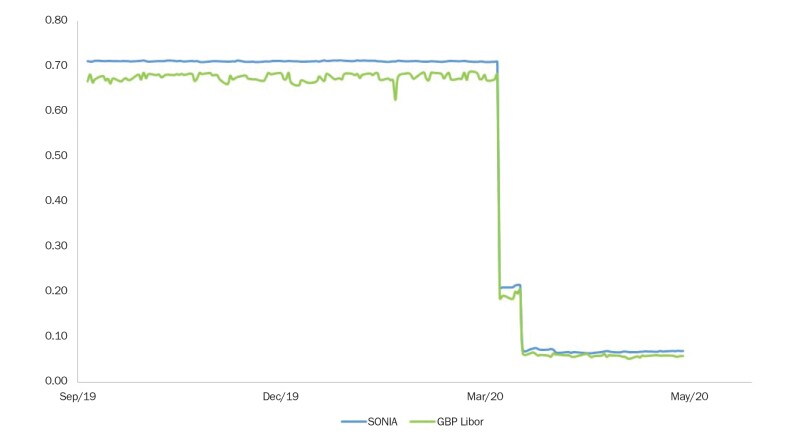

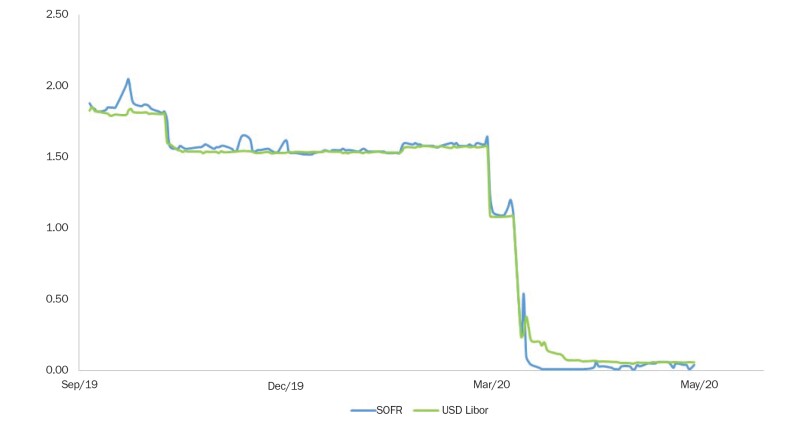

Considering the novelty of ARRs and how they are constructed, financial regulators anticipate periods of market volatility and liquidity issues. Examples of this ARR volatility in three base rates, and a liquidity induced spike in the secured overnight financing rate (SOFR) market, are shown in Figures 1 through 3.

These differences could result in tax risks, especially in situations where applying ARRs to legacy products/contracts leads to differences in valuations and, as such, triggers a cross-border transfer of value between different related taxpayers.

Figure 1: Comparison – EURIBOR to €STR

Figure 2: Comparison – London interbank offered rate (LIBOR) to sterling overnight index average (SONIA)

Figure 3: Comparison LIBOR to SOFR

Challenge one: Lack of a credit component

A key feature of IBORs is that they comprise both a risk-free rate and a credit risk premium that reflects the perceived credit risk of the panel banks that contribute to the published IBORs. This credit risk premium can also be described as a common bank funding cost.

One of the main technical questions of the IBOR transition is how to properly incorporate the bank risk premium into the ARRs for legacy contracts, given the lack of underlying credit transactions. The absence of a dynamic credit component for ARRs implies that ARRs are usually lower than IBORs (assuming the rate is term adjusted, unless the ARR is an unsecured rate). This difference will directly impact expected cash flows from legacy contracts/products on which they are based, i.e. a trade transitioning to ARRs may have a different market value over time than if it had been priced on IBOR. This will require changes to valuation tools, product design, hedging strategies and funding sources.

At this point, the International Swaps and Derivatives Association (ISDA) has been the only body to address the topic of the credit risk component by soliciting feedback from market participants on potential remediation strategies. On January 13 2020, the ISDA published a fallback rate adjustments proposal that addressed issues arising from the key adjustments necessary to apply ARR fallbacks to existing IBOR contracts. The proposal is based on using historic data, with one option using five years of credit spreads before fallback provisions are triggered, to build a credit risk premium into ARRs.

The discussion on the credit risk component shows the technical complexity inherent to the IBOR transition. It is critical that taxpayers review existing financial products/contracts, not just with customers but also any group-internal arrangements. For any legacy products/contracts, a strategy must be determined on how to deal with the credit risk adjustment to avoid a potential valuation impact.

In addition, internal funding arrangements and funds transfer pricing (FTP) models also need to be revisited given their reliance on existing IBORs and the impact of the bank credit risk component.

Challenge two: Different term structure

IBORs are forward-looking by nature; also known as term rates, they are quoted for a basket of five currencies (USD, GBP, CHF, JPY and EUR) and seven tenors (overnight/spot next, one week, one month, two months, three months, six months and 12 months). As such, the IBOR is known at the start of the relevant interest period.

In contrast, ARRs are overnight rates published the following day and, therefore, are not known in advance. This means that determining a term rate based on ARRs requires significantly different mechanics to those used to determine IBORs.

Since 2019, the key focus by regulators, central banks and other bodies has been on whether it is possible to develop term rates derived from overnight ARRs. However, the Financial Stability Board (FSB) reiterated earlier this year that there are limitations to ARR-derived term rates, which may mean they are not the best choice for some markets. Several authorities have already emphasised that market participants should not delay their transition planning for a forward-looking term structure on ARRs to emerge, which is under discussion across key jurisdictions with potential proposals (mainly on compounded rates and indices) expected in 2021.

Similarly to the point mentioned earlier, it is also essential that banks review their internal funding arrangements and FTP models, given the uncertainty surrounding the term structure on ARRs, and how to properly reflect this in the pricing of maturity transformations.

Challenge three: Inter-company agreements and fallback clauses

The transition will give rise to practical challenges regarding how to (re)calibrate legacy contracts and inter-company agreements. This includes potential fallback provisions and the replacement of existing IBORs with ARRs (or transitional rates).

A fallback provision is a contract clause that determines what rate parties should use if the initially agreed upon benchmark rate (e.g. EURIBOR) is no longer available (either permanently or temporarily). Without a fallback, a party tied to a contract could potentially dispute actions taken in response to the unavailability of the referenced benchmark rate.

Fallback provisions are typically defined by the following three key elements that determine the application and the conditions applicable to the provision:

The trigger event defines the event (both permanent and temporary cessation events) and date when the fallback will be applied;

The fallback rate identifies the updated base reference rate; and

If the updated fallback rate provides an economically different outcome to the original rate, a spread adjustment needs to be included to avoid or minimise the transfer of value.

First, action is needed to address legacy contracts that do not contain any fallback clauses or do not have any mechanisms to efficiently allow for revising fallback language. Second, relying on fallback provisions may change product economics and create financial and operational risk, because such provisions are typically designed to deal with the temporary unavailability of reference rates, rather than their permanent cessation. Relying on updated fallback clauses could create operational risks (ranging from new/different fallback formulae to calculation of new interest payments and valuations).

Another key question is whether any amendments made to existing contracts (repapering) and the underlying financial instruments, whether the conversion of an IBOR-referencing contract to an ARR or the insertion of a new or adjusted fallback clause, would be considered as creating a new contract. This could be another key trigger for potential tax risks related to the potential exchange or realisation event for financial instruments, which must be monitored closely by taxpayers in the context of the IBOR transition.

Tax authority readiness

On October 8 2019, the US Treasury Department and the Internal Revenue Service (IRS) were the first to release proposed regulations (REG-118784-18) (Proposed Regulations) providing guidance and relief on the tax consequences related to the IBOR transition. The Proposed Regulations primarily address whether changes to debt instruments and non-debt contracts that alter the reference rate (or include a fallback provision) trigger a deemed exchange of such debt instrument or non-debt contract that results in a tax-related realisation event.

Since the release of the Proposed Regulations, consultations have been ongoing but no specific progress has been made. Taxpayers should closely monitor any developments at the level of the local tax authorities on potential safe harbours or relief measures.

Transition planning

In order to manage the IBOR transition successfully, financial institutions should develop a transition plan. The following checklist is a starting point for key stakeholders across management, the business side, tax and legal.

Existing financial products or financing arrangements

Take an inventory of existing financial products (products sold to clients and/or hedging instruments) or financing arrangements that reference IBORs (if on floating rate basis). Differentiate between arrangements that mature before the transition at the end of 2021 and those that are affected by the transition (depending on underlying IBOR and potential transitional arrangements provided by regulators).

Examine legal agreements/contracts concerning fallback clauses

Perform an impact assessment and determine the possible change in value from the transition from IBOR to new risk-free rates.

Consider broader impact on treasury/asset and liability management (ALM) functions of banks concerning FTP.

Re-assessment of spreads considering differences between IBOR and ARRs, different term structures and compounding with potential impact on loan/product value.

Consider option for transition of floating into fixed-rate financing arrangements.

Consider the impact on financial accounts (fair value calculation, hedge accounting under proposed International Financial Reporting Standard (IFRS) 9).

New financing arrangements

Use new ARRs for new financial products (products sold to clients and/or hedging instruments) or financing arrangements.

Alert legal departments about appropriate adjustments to existing contracts for financial products or financing arrangements.

Other considerations

Check if using IBORs for price-testing purposes: the transition will produce practical challenges because historical data is not yet available for the new ARRs, while data for traditional IBORs will soon no longer be available.

Assess local tax authorities' response to the IBOR transition and potential guidance on tax implications.

Assess how to treat costs related to the IBOR transition for tax purposes and potential cost allocations between related parties to the transactions.

Consider how to treat costs related to the IBOR transition, since it will likely require significant investments in information technology/enterprise resource planning (IT/ERP) infrastructure, external advisors and internal projects. Financial services firms and corporations alike will need to determine the tax treatment of the transition costs, where/how to capture and allocate relevant costs, and what mark-ups to apply. They will also need to establish the legal basis for recharges between affiliates and update relevant TP documentation.

Conclusion

The transition from IBORs to ARRs is one of the most complex financial market transformation programmes in recent times. Considering that IBORs are so firmly embedded in the day-to-day activities of both providers and users of financial services (regulated and unregulated), all stakeholders must be involved in developing a transition plan.

The key technical challenges that need to be addressed relate to the differences in credit risk and term structure between IBORs, which impact the valuation of securities based on IBORs when pricing on the new ARRs, and the contractual basis of financial products/financing arrangements regarding fallback clauses in agreements.

Click here to read the entire 2020 Deloitte/ITR Financial Services Guide

Stan Hales |

|

|---|---|

|

Partner Deloitte Australia T: +61 2 9322 5500 Stan Hales is a TP economist and tax partner at Deloitte Australia. With more than 20 years of experience in Australia, US, and Brazil, he specialises in the financial services industry collaborating with banks, insurers, investment managers, and private equity investors for TP matters between related parties. Stan has several years of experience in tax valuation, TP controversy, negotiations of advance pricing agreements (APA) with revenue authorities, and TP documentation. Over the years, he has published articles covering TP topics in publications including ITR and Euromoney. He has also commented on tax and TP legislation and/or guidance and draft rulings submitted to the IRS, the Australian Taxation Office (ATO), and the OECD. Stan has taught university-level courses in economics, statistics, money and banking and TP. He was a doctoral fellow at the Rheinische Friedrich-Wilhelms-Universität Bonn and earned MA and PhD degrees in economics from the Ohio State University of Columbus, with a primary focus on the valuation of foreign currency futures options. |

Ralf Heussner |

|

|---|---|

|

Partner Deloitte Luxembourg T: +352 45145 3313 Ralf Heussner is a partner with Deloitte based in Luxembourg. He specialises in the financial services sector and is part of Deloitte's global financial services leadership team. He has worked for many of the key players in the asset management industry (ranging from the traditional sector to private equity, real estate, and hedge funds), banking, and insurance during his prior tenure in Tokyo, Hong Kong SAR and Frankfurt. Over the past 18 years, Ralf gained extensive experience advising clients on a range of tax, TP, valuations, and controversy-related engagements. His experience covers TP planning and policy setting, risk reviews, operationalisation, documentation, restructurings, and dispute resolution engagements. He has worked on more than 35 APAs and numerous high-profile controversies on both the local and competent authority levels with authorities in China, the EU, Japan, the US, and other key jurisdictions. Ralf is a frequent speaker at tax seminars, has participated in consultation projects with various governments about tax reform, and has contributed to thought leadership on TP issues in various publications. |