The European Union (EU) Directive on the mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements (commonly known as DAC6) comes from the BEPS initiative, notably from the BEPS Action 12 report on the mandatory disclosure rules (MDR).

In order to reach a common goal, the avoidance of tax evasion, several measures were put in place through the EU Directive on Administrative Cooperation (DAC): DAC2 on the common reporting standard (CRS); DAC3 on the automatic exchange of rulings; DAC4 on country-by-country reporting (CbCR); and DAC6 on the automatic exchange on arrangements by intermediaries involved in such arrangements.

As the MDR rules did not appear with DAC6, some jurisdictions already had disclosure rules in place, e.g. the US, Canada, Mexico and Guernsey, along with the EU countries Ireland, Portugal and the UK, which are obliged to update their legislation to comply with DAC6.

Thanks to the previous DAC versions, the European Commission had already gathered a great deal of information regarding commonly used transactions in Europe as well as information based on key figures. However, timing remained an issue. How could authorities obtain information on transactions that could potentially be tax aggressive at the time they are ready to be implemented? The answer is by requesting information from the very people in charge of promoting these transactions.

Assessing whether a transaction is tax aggressive requires very subjective analysis, whereas objective and factual information is requested. This is why DAC6 does not ask intermediaries to analyse whether the transactions are tax aggressive; instead, it requests that transactions are reported if certain criteria are met. These criteria are briefly described below.

The EU Directive 2018/822 of May 25 2018

DAC6 covers several areas including timing, tax perimeter and geographical criteria.

Five categories of hallmarks

The main criteria to consider are five categories of hallmarks that are notably linked to cross-border transactions, automatic exchange of information and transfer pricing (TP). Some hallmarks require a main benefit test. This test is satisfied if it can be established that the main benefit (or one of the main benefits) which, having regard to all relevant facts and circumstances, a person may reasonably expect to derive from an arrangement is a tax advantage.

A cross-border arrangement limited to taxes listed in the DAC

According to DAC6, an arrangement is reportable if it is cross-border; it must involve two member states or a member state and a third party. It must also involve the taxes listed in DAC1 (dated 2011), which mainly corresponds to all taxes except VAT, customs duties, excise duties or compulsory social security contributions.

An unusual timing

Finally, a transaction is potentially reportable if it occurred after June 25 2018. This retroactivity, also called the 'backlog', is quite unusual in tax matters. While the legislative bodies of some EU member states noted their surprise or disagreed with this retroactivity during the legislative process of transposition in domestic laws, the retroactivity has still been confirmed and transposed in all EU member states that have finished their transposition process.

All DAC6 reporting (except for the backlog) needs to take place within 30 days beginning, whichever occurs first, on:

The day after the reportable cross-border arrangement is made available for implementation;

The day after the reportable cross-border arrangement is ready for implementation; or

When the first step in the implementation of the reportable cross-border arrangement has been made.

The reporting phase was set to begin on July 1 2020, with a specific reporting date of August 31 2020 for arrangements that occurred during the backlog, i.e. between June 25 2018 and June 30 2020.

However, despite the Council of the EU being close to formally adopting the amended version of DAC6 and the text soon to be published in the Official Journal of the European Union, the European Commission has released a proposal granting an extension to DAC6 reporting deadlines due to COVID-19. This is because EU member states were left with too little room to carry out an appropriate implementation process before the initially scheduled effective date of July 1 2020.

In practical terms, the updated deadlines to report cross-border arrangements for intermediaries (and relevant taxpayers), which could be adopted at the option of any EU member states, would be the following:

The reportable cross-border arrangements where the first step was implemented between June 25 2018 and June 30 2020 would need to be reported by February 28 2021 (and not August 31 2020).

Any reportable cross-border arrangements where a triggering-date criterion takes place between July 1 2020 and December 31 2020, and as from January 1 2021, would need to be reported within 30 days starting from January 1 2021.

The notion of an intermediary

Reportable information includes the identification of the intermediaries and relevant taxpayers involved and the description of the arrangement or the national provisions that form the basis of the arrangement. This directive primarily focuses on intermediaries, defined as any person that designs, markets, organises or makes available for implementation or manages the implementation of a reportable cross-border arrangement. Such intermediaries, or so-called promoters, include notably the Big Four, accounting and law firms, as well as private bankers, wealth planners, trust companies, etc.

It also includes any person who knows or could be reasonably expected to know that they have undertaken to provide, directly or by means of other persons, aid, assistance or advice with respect to designing, marketing, organising, making available for implementation or managing the implementation of a reportable cross-border arrangement. Notably, this definition may also include all types of banks, insurance companies, investment funds as well as their satellites such as transfer agents, management companies, promoters, etc.

These intermediaries also must either:

Be resident for tax purposes in a member state;

Have a permanent establishment (PE) in a member state through which the services with respect to the arrangement are provided;

Be incorporated in, or governed by the laws of a member state; or

Be registered with a professional association related to legal, taxation or consultancy services in a member state.

Finally, a legal professional privilege can apply to some specific intermediaries, meaning that these reporting obligations do not apply to them. Instead, they are obliged to notify another intermediary. Or, in the case that no other intermediary exists, they must notify the relevant taxpayer, which is any person to whom either a reportable cross-border arrangement is made available for implementation, or is ready to implement a reportable cross-border arrangement, or has implemented the first step of such an arrangement.

As this automatic exchange is mandatory, DAC6 sets out penalties for non-compliance, which vary greatly from one country to another.

A long transposition process in EU member states

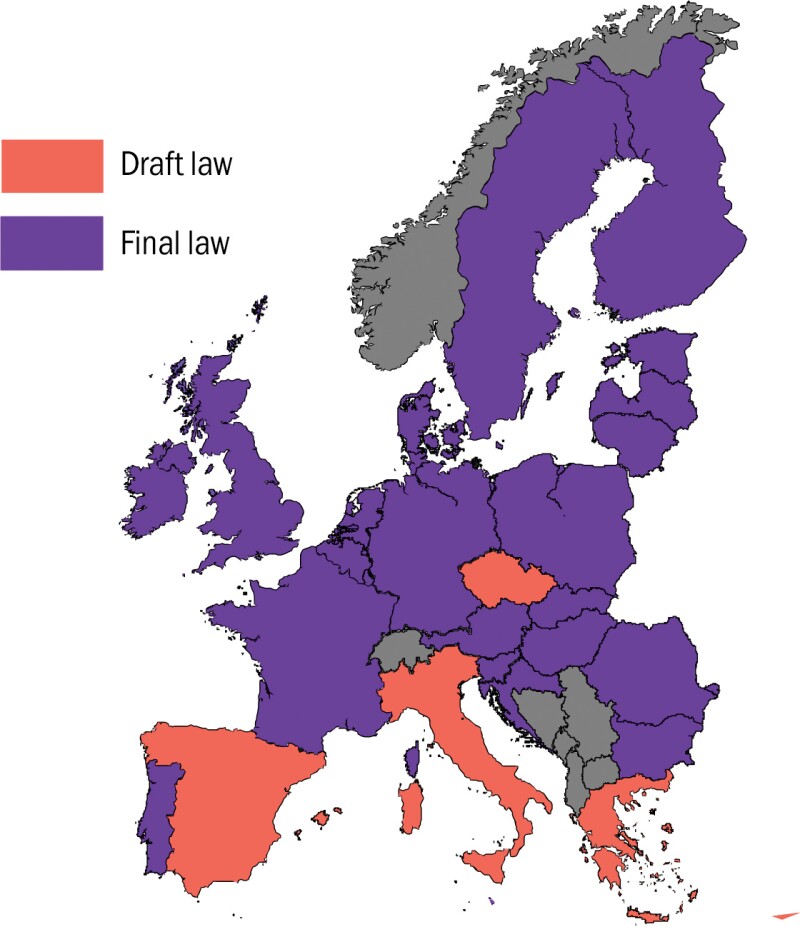

EU member states had until December 31 2019 to transpose DAC6 in their domestic legislation. In January 2020, only 16 countries had transposed the directive, eight countries had published a draft law, and the remaining three countries had not yet revealed their proposal to introduce DAC6 in their domestic laws.

On January 24 2020, the European Commission sent formal notices to Belgium, Cyprus, Czech Republic, Estonia, France, Greece, Italy, Latvia, Luxembourg, Poland, Portugal, Romania, Spain, Sweden and the UK regarding the implementation of DAC6. Some of these formal notices were sent because the directive was not transposed in time, although, the letters have not yet been made public. If these countries did not follow up on the formal notices within two months, the Commission said it would issue a reasoned opinion.

In May 2020, 21 countries had transposed the directive while six were in the draft process. Greece remains the only country without draft legislation.

Figure 1: Progress of adopting DAC6 across the EU

The first country to transpose the directive was Poland because it had already decided to begin the reporting process from 2019 onwards. Some countries tried to quickly provide guidelines after implementation of the directive into domestic legislation, for example the UK, closely followed by Germany, Finland and France (France issued two series of guidelines, the second focused on hallmarks). Luxembourg issued guidelines in May 2020 that mainly reflected the comments received during the legislative process, notably from the Council of State.

Several transpositions in EU member states

While some parts of the directive must be transposed, others are optional or can be transposed at the discretion of each EU member state.

This is notably the case for penalties; the directive states they must be dissuasive and proportionate, which provides EU member states with some latitude. For example, France has set its cap at €100,000 ($112,180) per year and per intermediary; Luxembourg has set penalties for up to €250,000 per reporting; the Netherlands has set a maximum of €830,000; and Bulgaria has set limits of up to €2,552. Some countries have put individual responsibility in place, including Poland, Spain and, in certain cases, the Netherlands.

The scope of reportable transactions is also quite different. While DAC6 limits reportable transactions to those cross-border arrangements having impact on the taxes already covered in DAC1, some countries have decided to go beyond this. For example, Poland and Sweden have included pure domestic arrangements and Poland and Portugal have added VAT to the taxes covered. For other countries that have closely followed DAC6's scope on taxes, DAC7 seems to be in preparation and may include VAT.

The definition of an intermediary also differs across EU member states. For example, a financial institution could benefit from the legal professional privilege in Slovakia (and also, based on draft guidelines, potentially France). A client may also be able to waive this privilege in France and Austria.

Due to these different interpretations, having a presence in several EU countries will certainly not help the analysis of intermediaries and taxpayers.

It is even worse in the case of PEs, as it is not clearly defined whether the PE needs to report in its country of location (as with CRS) or the country of residence of its head office. While most countries support the latter, France clearly mentioned the first one entailing cases of potential no reporting or double reporting. Besides this, tax authorities are analysing the modalities of reporting. While it seems that an xml file would be the most common approach, each country may still have its own process.

A lot of questions still remain regarding DAC6. Meanwhile, time continues to fly by; the date for the first reporting is almost upon us, which may still be postponed due to the COVID-19 situation. This is a novel tax and compliance risk area as penalties could be high.

Click here to read the entire 2020 Deloitte/ITR Financial Services Guide

Eric Centi |

|

|---|---|

|

Partner Deloitte Luxembourg T: +352 45145 2162 Eric Centi is a partner who leads the financial services industry tax practice at Deloitte Luxembourg. He advises and assists financial institutions on various tax-related topics including DAC6, tax reclaims/relief at source, US Foreign Account Tax Compliance Act (FATCA)/CRS and qualified intermediary (QI) matters. Eric is also one of the conducting officers of Deloitte Solutions, a Luxembourg regulated entity with a support professionals of the financial sector (PFS) status, whose aim is to act as a reliable partner for global financial reporting services. |

Julien Lamotte |

|

|---|---|

|

Partner Deloitte Luxembourg T: +352 45145 3336 Julien Lamotte is a partner at Deloitte Luxembourg, who has sound experience in providing corporate tax advice for financial services players (e.g. banks, fintech, asset managers and insurance/reinsurance) and in the structuring of investments through (un)regulated investment funds/platforms in Luxembourg. Julien also assists groups in understanding the tax implications of BEPS and EU state aid on their business/organisation. He participates in various professional committees and regularly contributes to several tax journals. |

Carole Hein |

|

|---|---|

|

Director Deloitte Luxembourg T: +352 45145 5646 Carole Hein is a director who works in the financial services industry (FSI) tax practice at Deloitte Luxembourg. She specialises in the assistance of financial institutions such as banks, professionals in the financial sector, management companies and insurance companies. She notably assists clients on various taxation issues including corporate taxation, TP, tax accounting and tax compliance. Carole has gained strong expertise in tax consulting notably through the assistance of financial services market player reorganisations, involvement in due diligence and tax advice for international clients in the financial services sector. Carole also follows the impact of DAC6 on financial services clients and actively participates in conferences on that topic. She has more than 19 years of Luxembourg tax practice experience in tax advisory for financial services players. |