The Madras High Court delivered a judgment on tax avoidance in the case of Redington India Limited (company) on December 10 2020. The company had transferred its entire holding in an overseas company to another newly incorporated step-down overseas subsidiary without consideration. It claimed the transaction as a gift and, thus, non-taxable under domestic tax law.

The case before the Madras High Court mainly involved whether the transaction was a valid gift as per domestic laws, and hence out of the scope of capital gains tax, and the applicability of transfer pricing laws to the transaction.

Facts of the case

Headquartered in Chennai, India, Redington provides global end-to-end supply chain solutions for all IT, telecom, lifestyle, healthcare, and solar products.

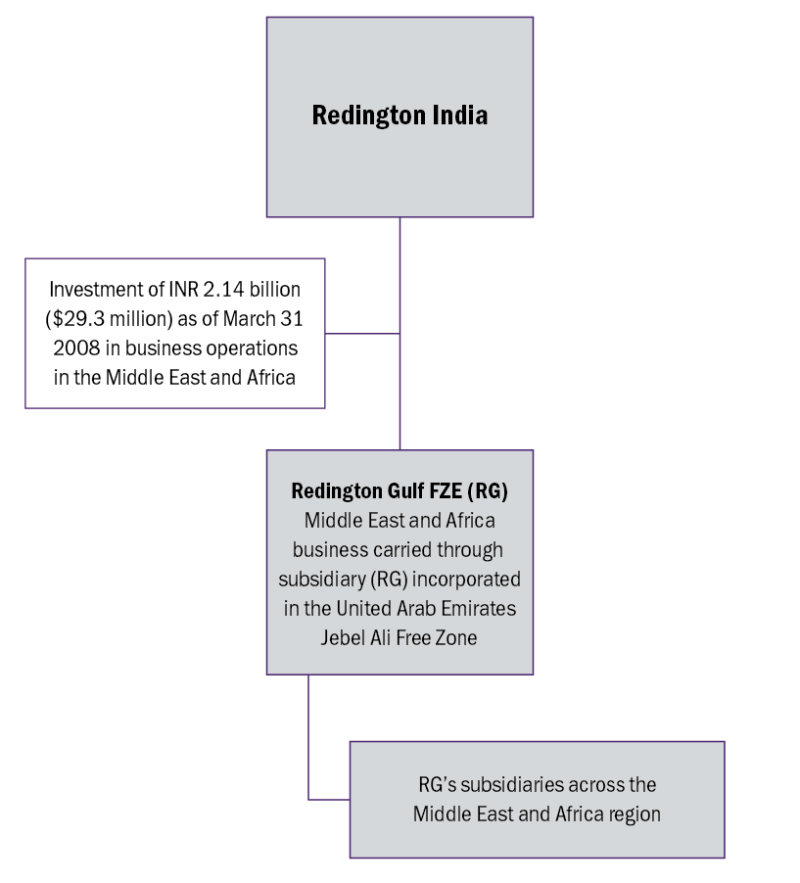

Redington’s business operations in the Middle East and Africa region were carried through wholly-owned subsidiary Redington Gulf FZE (RG) incorporated in the United Arab Emirates Jebel Ali Free Zone since 2004. RG, in turn, had subsidiaries located in different countries across the region. Redington’s total investment in RG was INR 2.14 billion ($29.3 million) as of March 31 2008.

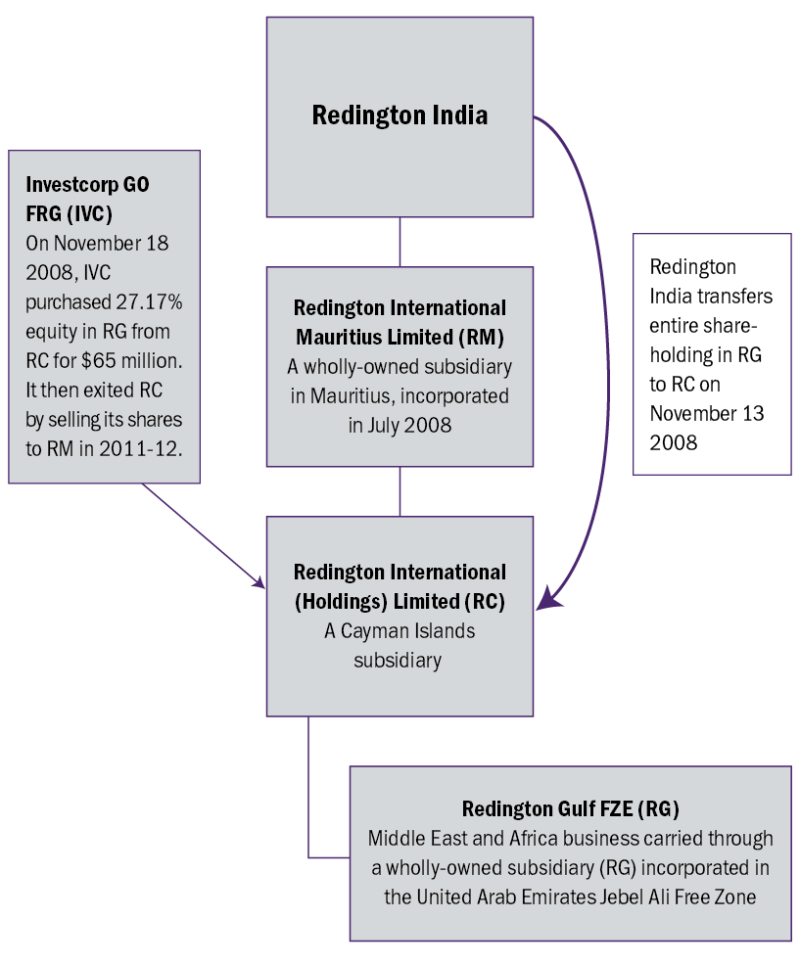

The group intended to raise capital overseas to expand its business. To meet the requirement of a prospective investor, which was a Cayman Islands headquartered private equity fund, the company also incorporated a wholly-owned subsidiary in Mauritius, known as Redington International Mauritius Limited (RM) in July 2008, which in turn held another newly incorporated company in the Cayman Islands, known as Redington International (Holdings) Limited (RC).

On November 13 2008, the company transferred without consideration its entire shareholding in RG to RC. RC only held investments in RG after its transfer of shares, and it did not have any other assets or income. The company in the UAE free trade zone (RG) became a direct subsidiary of RC and a step-down subsidiary of the company indirectly held through the Mauritius and Cayman Islands companies.

The value of RC increased after RG transferred its shares to the Cayman Islands entity. On November 18 2008, the private equity fund purchased 27.17% equity of RC for $65 million. On that date, RG’s value was stated to be $239 million.

The arrangement allowed the private equity fund in the Cayman Islands (the investor) to purchase the shares held by RC in the Middle East and Africa business. This arrangement, therefore, enabled Redington India to raise capital through the future sale of shares without them being taxable in India or in the Cayman Islands (the Cayman Islands did not have corporate tax).

Subsequently, during the year 2011-2012, the private equity fund in the Cayman Islands exited the RC by selling its shares to RM. This transaction occurred because the Redington group could not fulfil the conditions of the share purchase agreement including the listing of RG at a recognised stock exchange.

Concerning the taxation of the transfer of shares, Remington India claimed that the transfer was a gift which was not taxable as a capital gain under section 47(iii) of India’s Income Tax Act, 1961. The company claimed that a share transfer is not a disposal of investment and the company continues to have effective control over all the subsidiaries and all the economic benefits which accrue to it.

The revenue authority’s view

Upon review, the assessing Indian tax officer held that incorporating RM and RC just before the share transfer was a means to avoid capital gains tax, and these two entities did not have any commercial substance on their own and were used as a conduit to avoid tax.

The transfer pricing officer also denied the claim of characterisation of the sale of shares as a gift and the transfer of shares was held to be a taxable transaction. The transaction was also determined to be an international transaction, and the arm’s-length price was determined.

The tax officer also held that by transferring the shares, the company shifted income from any future alienation of the asset to a country outside India and dividend income to a country outside India and this arrangement led to shifting the tax base out of India.

The first appellate authority (Dispute Resolution Panel) confirmed the decision of the tax officer.

However, the Income Tax Appellate Tribunal, the second level appellate body, accepted the taxpayer’s contentions, treating the transfer of shares as a valid gift and approved the non-taxability of the transaction for capital gains under section 47 (iii) of the Income Tax Act. The share transfer was also held as not being an international transaction subject to transfer pricing law.

Aggrieved with the tribunal order, the revenue authority took the matter to the High Court. Before the court, the revenue authority, among other points, contended that the transaction was done only as a restructuring of the assessee and the transaction as a gift was never in the company's mind when the board's approval was taken.

The company contested the assessing tax officer’s decision on various grounds including that RM and RC were set up for commercial reasons, transfer pricing provisions apply only when there is income, the gift of shares are exempt from the definition of a transfer, and the transfer of shares as a gift had a commercial purpose.

The High Court’s view

The High Court considered contemporaneous documents like minutes of a board meeting, the share transfer deeds, chief financial officer statements, correspondence with the Central Bank, and domestic law dealing with property transfer and various judicial pronouncements and reversed the tribunal’s order. The court held that the transaction did not satisfy any of the tests of a valid gift as required by section 125 of the Transfer of Property Act, such as being voluntary, without consideration and acceptance by the donee.

The High Court also considered the title of the document, substance and intention behind the transaction, the events which occurred before the board approving the share transfer and executing the share transfer deeds.

The High Court referred to the decision of the Supreme Court in the case of Mc Dowell & Co. Limited, where the court said tax planning may be legitimate, provided it is within the framework of the law. The court held that tax authorities are required to examine whether the taxpayer had adopted any ingenious methods to avoid taxation and they are entitled to go behind the veil to examine the real intention of the parties.

“Thus, if the chain of events is considered, it is evidently clear that the incorporation of the company in Mauritius and Cayman Islands just before the transfer of shares is undoubtedly a means to avoid taxation in India and the said two companies had been used as conduits to avoid income tax,” observed the court.

The incorporation by the company of two overseas subsidiaries and transfer of shares favouring a third-party investor within a short span of less than a week for a stake sale of more than 27% and surrounding circumstances categorise the transaction as a capital asset transfer. The High Court said the two companies incorporated as a subsidiary and step-down subsidiary were to create a conduit to avoid tax.

The transaction relates to 2008, and during that year, India’s general anti-avoidance rule (GAAR) was not applicable. The court went by the substance of the transaction and events leading to the transaction.

It may be noted that India and the UAE amended their tax treaty with effect from April 1 2008, through a protocol signed on March 26 2007. The amended treaty provided that the gains from the disposal of shares in a company may be taxed in its country of residence. The taxation of the transaction as per provisions of the tax treaty was neither considered by the tax officer nor claimed by the taxpayer.

It could have been challenging to prove that RG was a tax resident of the UAE and capital gains were taxable in the UAE (though the UAE did not impose tax) because for a company to be resident in a country, it must be incorporated in that country, and its control and management should also be in that country.

Key takeaways

The court laid great emphasis on the documents, the intention of the taxpayer at the time of the transaction, and chain of events leading to the investment by a private equity investor. The decision suggests that the principle of substance over form continues to be a guiding principle for the courts.

A taxpayer would be advised to prepare and maintain contemporaneous documentation to support any claim of a tax benefit or characterisation of a transaction. The tax administration is more likely to challenge the unsupported claims by a taxpayer.