Today, organisations are required to report more and more information to both tax and regulatory authorities, and to the public. Tax reporting is increasingly required to be digitally submitted, with increased transactional details and in real time.

At the same time, governments and the public are expecting increased transparency. The focus on social responsibility and the rise of environmental, social and governance (ESG) reporting are also adding the volume of reporting required.

Moreover, with the OECD’s BEPS 2.0 proposals on profit allocation and global minimum tax calculations, companies will need to perform more calculations and, hence, require better access to financial information globally.

In December 2020, the OECD published ‘Tax administration 3.0: The digital transformation of tax administration’, which points towards a data-driven, event-based and real-time data focused tax administration. In this paper, the OECD introduced the concept of natural systems – namely, leveraging a taxpayer’s enterprise technologies. The paper gives a vision of how “[a]dapting taxation processes to fit in with taxpayers’ natural systems will facilitate compliance by design and ‘tax just happening’”.

With this environment as the backdrop, organisations need to build an intelligent tax function – transforming the tax function’s operations, processes and talents, underpinned by modern technology and a data-focused approach.

|

|

“There is a trend of moving away from traditional standalone or ‘bolt-on’ tax technologies towards leveraging enterprise systems.” |

|

|

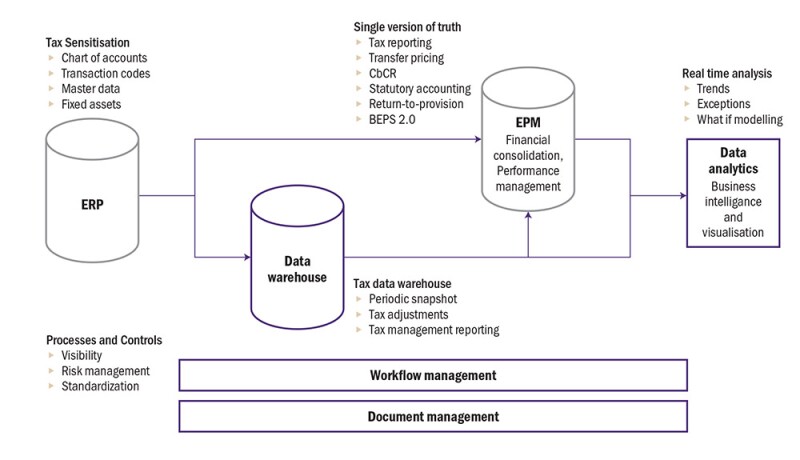

Since, many of the calculations and reporting requirements leverage data from financial statements or trial balance, the focus on natural systems is an opportunity. Calculations and reporting obligations like income tax reporting, country-by-country reporting, or BEPS 2.0 pillar two, could start from these natural systems – that is, an organisation’s enterprise systems such as enterprise resource planning (ERP), enterprise performance management (EPM) and other enterprise productivity platforms (such as Microsoft 365).

Furthermore, to maintain the agility of the businesses in a rapid changing world, an intelligent tax function can leverage enterprise systems to support a fast-close and provide management with real time reports and visualisation so they can make informed business decisions.

In the 2020 Global EY Tax Technology and Transformation Survey, it was found that up to 70% of tax function’s time was spent on data cleansing as 93% of companies were dealing with multiple ERP systems.

There is a trend of moving away from traditional standalone or ‘bolt-on’ tax technologies towards leveraging enterprise systems. This trend has been driven by saving on license costs, reducing spreadsheets and manual efforts and increasing functionality of enterprise systems. Whilst it is intuitive that source systems need to be set up correctly to avoid ‘garbage in, garbage out’, many companies have not set up their ERPs properly for tax.

Many companies are considering EPMs recently for both tax and finance functions. While EPMs have been used by companies for financial consolidation, and planning, budgeting and forecasting, they have been underutilised for tax.

Enterprise technologies are becoming more popular for tax reporting. In particular, many organisations have discovered that their EPM platforms find good use for tax processes. As a single source of truth for financial information, they can be the core tax platform for income tax reporting, return to provision calculations (RTP), country-by-country reporting (CbCR), transfer pricing (TP), global minimum tax calculations and even ESG reporting, just to name a few use cases.

All reports could be drilled down and linked back to the source, thus providing data consistency across reports and real time data analysis for management decisions.

Enterprise technology

What are EPM platforms?

EPM platforms sit a layer above ERPs and other source systems. They are used traditionally by finance teams for planning, budgeting, modelling and performance reporting, consolidating data from general ledgers (balances), sub-ledgers (transactions), data warehouses, front and back office applications and manual inputs.

Why use EPMs for tax reporting?

EPMs are used by companies for finance processes, like financial consolidation, and planning, budgeting and forecasting, reporting and analytics. As many tax processes use the same data as financial reporting and often involve consolidating information globally, EPMs are naturally useful for tax reporting and provide a number of benefits.

1. Single version of the truth

Finance organises data in multiple dimensions, such as time periods, segments, regions, countries, entities, and products, and tax calculations can be performed in the same dimensions, thereby leveraging the single version of the truth of the data.

Relevant financial data is already pre-loaded, saving time integrating data and reconciling against latest numbers, and shortening response times in a fast-close process.

2. Standardised processes and workpapers

For transformations of tax accounting teams, knowledge transfer frequently emphasises ‘what’ rather than ‘why’, eroding technical capabilities offshore. Complex work papers completed by inexperienced staff multiply errors and rework at the headquarters.

EPM workflows provide checklists and guardrails for staff ensuring process steps are followed. Flexible templates can switch-off or hide the complexity for non-material entities or low-risk jurisdictions, hiding non-relevant line items. Finally, users are forced to fix errors before sign-off.

3. Fully integrated TP data and calculations

Transfer pricing policies for profit allocation and cost recharges can be implemented within EPM systems, fully integrating TP models with the latest data (actual/forecast), and tax provisioning calculations.

With finance and headcount data already stored within the EPM, tax can rapidly develop and deploy CbCR solutions. Upcoming BEPS 2.0 proposals for minimum tax calculation will require a partial consolidation which lends well to EPM core functionality.

4. Maintaining calculations as business legal and reporting structures change

Traditional tax provision software may struggle as business transformations cause divisions to appear, disappear or be merged. Tax may baulk at an expensive re-implementation, so tactical workarounds using spreadsheet software becomes embedded in the process.

EPM vendors encourage users to become self-sufficient, providing online training to create and maintain models and foster thriving developer communities online. An internal team may already exist for supporting finance applications, thus reducing resourcing risk for tax.

5. Global standardisation with local customisation

Group tax provisioning solutions generally use standardised global templates. Complex country-specific ‘tax adjustments’ use offline spreadsheet work papers, with hardcoded numbers reducing transparency for the headquarters.

EPMs take a different approach, allowing localisations for complex countries, providing a mixture of standardisation and customisation. Group tax imposes its own terminology to describe tax adjustments, to harmonise the review process at the headquarters. However, local descriptions are ultimately used in the tax computation, complicating cross-comparison when performing RTP adjustments.

EPMs can implement different hierarchies for local and group reporting, essentially giving local teams the ability to define adjustments in their own language, while retaining a common group standard.

EPMs: A foundation for intelligent tax reporting

EPM platforms show great potential to transform tax provisions, TP and other tax processes, and BEPS 2.0. Tax teams should understand whether their finance teams already use, or plan to upgrade to these tools, and consider how EPMs could be used for tax.

Building an intelligent tax function allows organisations to minimise manual low value work to focus more on value added activities such as analysis and risk management.

Click here to read EY's Asia-Pacific Guide 2021

Albert Lee |

|

|---|---|

|

Partner Hong Kong, Hong Kong SAR T: +852 2629 3318 Albert Lee is the global leader of EY’s tax technology and transformation (TTT) practice in the Asia-Pacific. Albert has three decades of experience in international taxation, working both in the profession and industry, with a distinctive combination of tax, and process and technology skills. With experience working in major global markets, leveraging proven methodologies, and having in-depth knowledge of tax technologies, he helps clients build sound reporting foundations, effective risk management protocols, and a higher-performing tax organisation. Albert has a masters of commerce degree in taxation from the University of New South Wales and a further masters of taxation degree in law from the University of Sydney. |

Carina Ngai |

|

|---|---|

|

Manager Hong Kong, Hong Kong SAR T: +852 2846 9673 Carina Ngai is a manager in EY’s TTT practice, where she is also the EY global operations lead. Carina has extensive functional experience gained on large scale client implementations for tax transformation, experience in tax processes transformation leveraging EPM technologies, change management, project leadership and business development. With over 9 years of experience, she is passionate about digital transformation of tax functions to drive operational efficiencies and cash tax savings within a risk-focused framework strategy. Carina is a graduate of accounting and finance from Durham University. |