In Argentina, the tax authority keeps pushing a compliance campaign of transparency to make more information public. One of the greatest challenges facing tax administrations around the world is the lack of timely, exhaustive and relevant information on tax planning strategies, which allows governments to identify risk areas quickly.

Considering these implications, the Argentine Federal Tax Authorities (AFIP) have issued General Resolution No. 4838/2020 (published in the Official Gazette on October 20 2020), which establishes a mandatory reporting regime for domestic and international arrangements to crack down on tax evasion by companies and individuals.

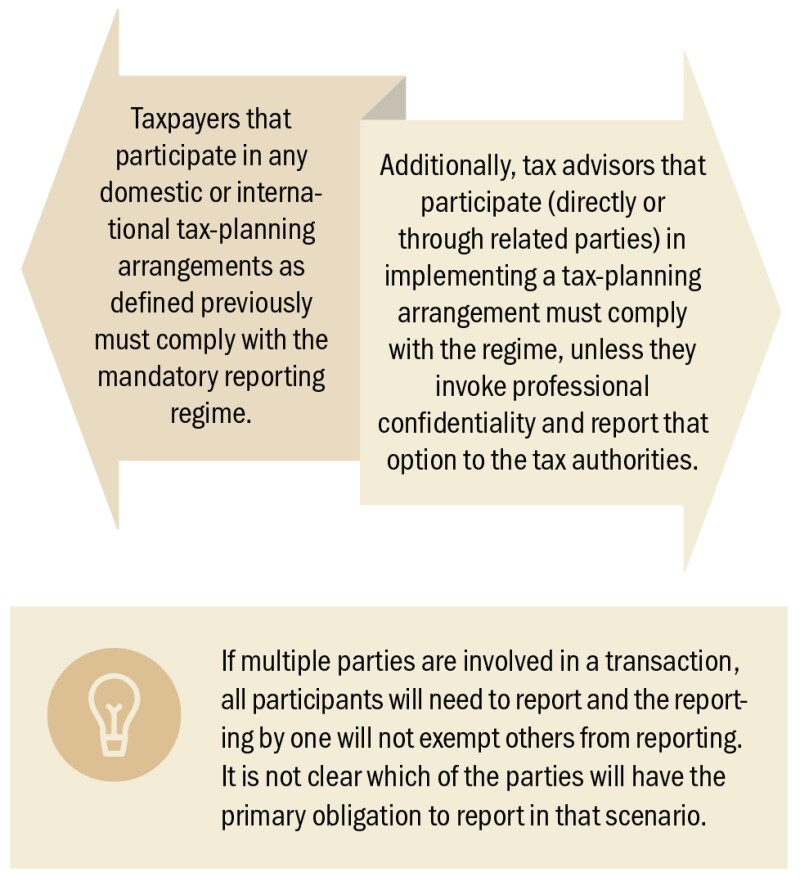

Argentine taxpayers and their tax advisors will have to comply with a reporting regime for local and international tax planning arrangements. Information and documentation around the implementation of any such planning must be submitted to the IPF regime, providing clear, precise and enough information on the nature of the planning and any tax advantage or benefit that can be expected to arise from it.

The rule also considers obtaining early information and the objective of evaluating the tax risks derived from the tax planning implemented by taxpayers, also highlighting the experiences of countries (it quotes specifically the experiences of the US (Office of Tax Shelter Analysis – OTSA), UK (Disclosure of tax avoidance schemes – DOTAS), Ireland, Portugal, Canada, South Africa, Mexico and Chile) that have information regimes of this type, which indicate that they have achieved the intended objectives.

Please note that this provision finds its origin in Action 12 of BEPS, an international policy born under the umbrella of the OECD whose purpose is the disclosure of aggressive tax planning practices. However, this is not mentioned in the aforementioned general resolution.

Failure to comply could lead to penalties and sanctions as set out in Argentina’s tax procedure law (Law No. 11,683). As well as aiding in the prevention of tax evasion, AFIP has stated that it hopes the IPF regime will allow them to flag any potentially high-risk fiscal planning with taxpayers in good time, encouraging future compliance.

Reportable arrangements

In accordance with the resolution, the following arrangements must be reported:

Domestic arrangements |

International arrangements |

Any agreement, plan or any other action through which a taxpayer obtains fiscal advantages or other tax benefits (i.e. any reduction in the taxable base of the taxpayer or related entities) in Argentina with respect to federal taxes or informative regimes. Specifically, taxpayers and tax advisors must report arrangements included on the microsite ‘Tax Arrangements Information Regime’ (Régimen de Información de Planificaciones Fiscales), on the AFIP’s website. |

Any agreement, plan or any other action through which a taxpayer obtains tax advantages or other tax benefits in Argentina and any other jurisdiction. Taxpayers and tax advisors must report international arrangements involving the following: • Legal entities used to obtain double tax treaty benefits; • Strategies adopted to avoid triggering a permanent establishment; • An arrangement resulting in double international non-taxation; • An intention to avoid compliance with an informative regime; • The involvement of a non-cooperating jurisdiction or a low- or no-tax jurisdiction; • A mismatch between two or more jurisdictions regarding the tax treatment of an entity or agreement that results in a tax advantage or other tax benefits; • A foreign individual or entity holding double tax residency; • A taxpayer who is the beneficiary, grantor or trustee (or has similar characteristics as those taxpayers) of non-Argentine trusts, non-Argentine private foundations or any other non Argentine business; and • An arrangement specifically listed on the AFIP’s tax arrangements microsite. |

Reporting parties

Characteristics of the information required and filing procedure

Taxpayers and tax advisors must include a complete description of the relevant facts, details on the parties involved, and any other significant element or transaction regarding the tax-planning arrangement. They also must include a detailed analysis of the rules – including if applicable, foreign legislation – that apply to the arrangements. The information must be reported electronically on the AFIP’s website.

Reporting due dates

Taxpayers and tax advisors must report domestic tax planning arrangements implemented since October 20 2020, in the month following the end of the tax year in which the arrangements were realised.

Furthermore, they must report international tax-planning arrangements executed since October 20 2020, within 10 business days counting from the day in which the implementation begins (i.e. when the first step is taken).

Domestic and International tax planning arrangements applied from January 1 2019 to October 19 2020 or implemented before January 1 2019 but still in effect on October 20 2020, should have been informed no later than January 29 2021.

Penalties

As mentioned before, taxpayers and tax advisors that do not comply with this regime may be subject to fines as set out in the Tax Procedural Law. They also could be excluded from tax registries that provide tax benefits and barred from obtaining tax credit certificates. In addition, their risk of being assessed or audited, as determined by the tax authorities under the ‘Risk Perception System’ – SIPER – could upsurge.

Up-to-date status

In December 2020, the Argentine Professional Councils of Economic Sciences filed an administrative claim before AFIP requesting the repeal of General Resolution No. 4838/2020 and the suspension of the Tax Planning Information Regime. They have argued that it would have been appropriate to pass through by the Argentine Congress this new rule, as is the case in several countries that have implemented analogous regimes.

Other considerations

Compliance of this regime will not entail the Tax Office to accept or reject the tax planning implemented. This resolution places Argentina at the vanguard of information availability as well as several EU countries.

The data collected may be object of information exchange with the jurisdictions with which the country has such agreements. However, unlike EU countries, Argentina has not made information publicly available.

Please note that taxpayers and tax advisors should carefully review transactions carried out in 2020 and previous years to be determined to ascertain whether any of the transactions give rise to a reporting obligation. Transactions performed before 2020 that result in tax benefits must be also disclosed.

Tax planning is a legal practice. This means that taxpayers must organise their activities to have a fair taxation according to the norms in force. Nevertheless, this information regime is based on Action 12 of BEPS guidelines of which the Argentine Republic is part.

Argentina takes those recommendations and widens the scope of transactions, seeking to encompass the greatest number of operations possible.

Winds of change: Uncertainties and opportunities in Chile

Chile has recently gone through numerous events that transformed social, political and economic environments. Some of these events are purely local, such as the so-called ‘social unrest’ that took place at the end of 2019.

Although the protests were motivated by varied causes, they ended up being subsumed in one paradigmatic process: the constitutional reform that is currently underway.

|

|

“Argentina aligned with European countries on tax planning reporting” |

|

|

In this context, the COVID outbreak increased the perceived economic inequality, which has become the central element of the political discourse. As a result, different public policy proposals have been put in place to address the issue of inequality. This is evident in most, if not all, of the electoral platforms of the presidential candidates for the upcoming elections.

Tax reform is a key component of those proposals, mainly aiming for increasing taxes through different mechanisms: mining-specific taxes, a wealth tax, the elimination of existing exemptions, a VAT refund on first-necessity products, etc.

In this ever-evolving environment, with a new constitution underway, social unrest, potential tax reform, and a forthcoming presidential election, transfer pricing (TP) has not remained static. On the one hand, new regulations have been implemented, creating a stricter local compliance environment. On the other, TP has become a tool to diversify risks and create value in times of uncertainty.

New TP Obligations

The first of a series of changes related to local TP regulations occurred in February 2020. Chile’s passed a brand new tax reform and Article 41 E of the Income Tax Law – which regulates inter-company cross border transactions since 2012 – is subtly modified.

The term ‘[TP] return’ is changed to ‘[TP] returns’. The effects of what could have been seen as a minor modification were not fully acknowledged until August 31 2020, when Resolution 101 was issued.

Resolution 101 clarified the term ‘returns’ and aligned Chilean TP rules with the OECD’s BEPS Action 13. Resolution 101 implemented the obligation of preparing and submitting the local version of the master file and local file, applicable for Fiscal Year 2020 onwards. Both local file and master file include a return, a report and supporting documentation, as explained below.

Return 1950/masterfile

Return 1950 must be submitted by the parent or controlling entity of a multinational group of companies, provided it is considered domiciled in Chile for tax purposes. For the obligation to apply, the group’s consolidated income as of December 31 of the reporting year should be no lower than €750 million ($888,765 approximately). The return consists of several parts:

• The return itself, which should include information on inter-company agreements, advance pricing agreements (APAs), the percentage of ownership of the parent company of group in each of its affiliates (either direct or indirect);

• The master file report, which contains the same information as the one suggested by the BEPS Action 13; and

• The annexes, which includes a comprehensive list of supporting information that must be submitted along with the return and the report. These documents include r corporate organisational chart, inter-company agreements, APAs or tax rulings, consolidated financial statements.

Form 1951/local file

Return 1951 must be prepared and submitted by taxpayers who meet concurrently the following criteria:

• Are classified as large companies by the Chilean tax authority;

• Its parent company has to prepare a country-by-country Report; and

• Has carried out (i) one or more transactions with foreign-related parties (or unrelated parties domiciled in tax havens) for amounts greater than 200,000,000 pesos ($258,000 approximately); or (ii) one or more inter-company financing transactions.

Similar to Return 1950, Return 1951 includes the following components:

• The return itself, which should include information on the related parties to the inter-company transactions, the respective amounts, whether there are inter-company agreements in place to memorialise the transactions, the year in which those agreements were signed, the interquartile range use to test the transactions, the number of comparable observations, whether comparability adjustments were applied, and whether the results were tested on a segmented or global basis;

• The local file report, which should include functional and economic analyses by transaction, segmented results; and

• The annexes, which includes documents such as an organisational structure, inter-company arrangements, amortisation tables for financing transactions, APAs, individual financial statements, reconciliation between the financial statements and the segmented information used in the economic analyses, and financial information of the comparable companies.

For Latin American standards, the new requirements are more or less ‘normal’ or ‘standard’. As a matter of fact, tax authorities across the region have started requesting similar information for some years now. Nevertheless, the implementation of the new rules was an important milestone in terms of local TP requirements.

Until fiscal year 2019, only one return (i.e. Form 1907), the preparation of a contemporaneous TP report and, if applicable, a country-by-country report sufficed to comply with local requirements.

Diversification strategy

Considering the above scenario, -this is the uncertainty of an electoral year, the multiple tax proposals aimed at increasing taxes and reducing inequality, and the constitutional reform process- as well as accelerated changes in companies’ value chains as a consequence of the COVID-19 pandemic, multinational groups and entire industries have been forced to reinvent themselves to survive.

In this environment, the emphasis of the new TP regulations in transparency and economic substance has also shed light on the importance of aligning TP and business models. It is precisely in this context that TP planning tools – particularly, value chain alignment solutions (VCA) – have become key for Chilean multinational groups that are aiming to diversify their business and geographic footprints while creating value in a tax efficient manner.

Pillar one and pillar two

In order to conclude with the summary of the TP changes that have recently been implemented in Chile, it is important to mention the country position with respect to pillar one and pillar two. At the time of writing, Chile joined the group of 130 countries and jurisdictions that agreed to support the OECD’s Inclusive Framework.

The Chilean situation is plenty of local and international variables that are transforming the society, the economy, the law and taxation. This scenario can be perceived as an uncertain business environment, nevertheless uncertainty is the key to identify unexploited opportunities.

Click here to read all the chapters from ITR's Latin America Special Focus

Horacio Dinice |

|

|---|---|

|

Partner Deloitte, Argentina T: +54 11 4321 3002 Horacio Dinice is a partner of Deloitte Argentina. He is engaged mainly in international tax consulting and TP matters. Horacio’s experience covers a wide range of industries, but he has been centred on the pharmaceutical and consumer business sector for many years. He advices multinational corporations on tax implications of cross-border acquisitions/transactions, establishment of foreign operations in the Latin American region, business restructuring and international tax planning. Horacio graduated as acertified public accountant from the University of Buenos Aires. He is a member of the AAEF (International Fiscal Association member) and part of the TP Commission. |

Silvana Blanco |

|

|---|---|

|

Partner Deloitte, Argentina T: +54 11 4320 4046 Silvana Blanco is a partner of Deloitte Argentina, who works in the TP team. Silvana has more than 21 years’ experience in the application of tax, economic and financial criteria in TP, valuation analysis of intangibles, planning, business model optimisation, structuring and economic consulting. She has significant experience in the coordination of multi-country TP assignments for multinational groups, the optimisation of tax burden, and information requests posed by tax authorities in key industries such as the automotive industry, the oil seeds industry and the pharmaceutical industry. Silvana graduated as a certified public accountant from Salvador University and holds a master’s degree in strategic business administration and marketing from the Universidad de Ciencias Empresariales y Sociales (UCES). |

Vanesa Lanciotti |

|

|---|---|

|

Partner Deloitte, Chile T: + 56 227 297 356 Vanesa Lanciotti is a partner and leader of Deloitte’s TP practice in Chile. She has 11 years’ TP experience in Argentina, Italy and Chile. Vanesa advises across a variety of industry sectors, with a focus on airlines, mining, energy, retail and consumer goods. She has extensive experience in financial inter-company transactions and valuation. Vanesa is a professor of TP at the Universidad de Santiago de Chile. She holds an economics degree from the Faculty of Economic Sciences and Statistics, National University of Rosario, Argentina, as well as a postgraduate in organisational cognitive neuroscience (neuroeconomics), National University of La Plata, Argentina. Vanesa obtained a master’s degree in finance from the Universidad Adolfo Ibañez, Chile. |