Tax automation: No longer the future

During 2020, the Luxembourg tax authorities received a total of 317,944 files for natural persons, 306,506 files for legal entities, and 1,329,808 tax forms, and they exchanged more than three million reports with other tax authorities around the world (Rapport d’activité du Ministère des finances Exercice 2020).

Needless to say, in order to process this massive amount of information, tax authorities around the globe are beefing up their automation technologies, focusing on a range of different resources, such as the intensive use of robotic process automation (RPA), extract, transform, and load (ETL), and machine learning (ML).

What are these technologies?

RPA is the use of software to automate high-volume, repetitive tasks. In tax, RPA refers to software used to create automations, or robots (bots), that are configured to execute repetitive processes, such as submitting filings to tax authorities’ web portals. RPA is best suited to processes that are transactional and repetitive in nature, high in volume, time-consuming, and well-documented, have low error rates or process variations and have decision-making processes that can be codified, and use structured electronic data (Deloitte, RPA for Tax, 2021.).

ETL is the process by which data is extracted from different sources, transformed into a usable and trusted resource, and subsequently loaded onto systems that end-users can access and use downstream to solve relevant business problems.

ML is a technology associated with artificial intelligence (AI). The concept was coined by Arthur Samuel in 1959 and refers to the study of computer algorithms that can improve automatically through experience and use of data. ML algorithms build a model based on sample data, known as training data, in order to make predictions or decisions without being explicitly programmed to do so.

How are they used?

Have you or your company recently received a communication from your tax authorities? Chances are that it was drafted using RPA. Indeed, RPA has already been used by both tax authorities and tax practitioners for some time. For instance, tax preparers often receive pertinent financial information, including tax reporting forms, in a PDF format. Traditionally, preparers spent a significant amount of time manually extracting data from these PDFs and loading it into spreadsheets and systems.

Now, there are already bots in place that automatically read and extract data from such PDF files, freeing up time for more strategic, valuable activities such as review and analysis. The impact of this improved process can quickly be translated into hours saved, enhanced quality, and reduced risk of manual errors. It is a simple yet powerful example of how RPA can streamline a structured process, creating efficiencies for the tax function.

Many tax practitioners will relate to the use of spreadsheets or macros with a high risk of manual error and running time-intensive calculations multiple times. However, greatly advanced tax teams are already applying ETL to the tax function, aiming to minimise or even eliminate manual data input.

Most compliance tax advisors have experienced how data is one of the biggest pain points during compliance season. The process for gathering data can be cumbersome and manual processes are often required to obtain calculation-ready data (Deloitte, Tax Analytics: Why is Mastery of Tax Data More Important Than Ownership? 2016.). ETL solutions are already in place to extract data from disparate sources and aggregate it into the format required to complete tax return calculations, potentially resulting in real-time, calculation-ready data with less risk as well as modeling capabilities that allow the technology to re-run calculations in real time. Indeed, an ETL solution that accounts for complexities and interdependencies can bring agility to the tax function in an ever-changing tax environment.

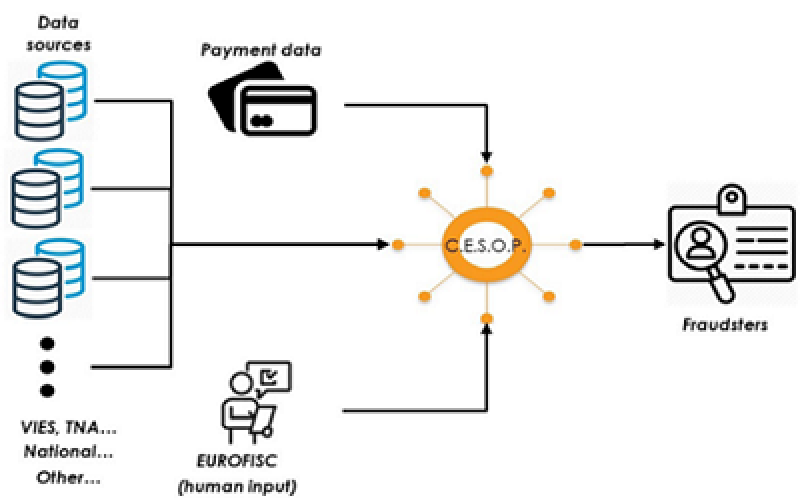

A further example of the use of new technologies in the tax environment is the European Commission’s 2020 legislative proposal aimed at enhancing data collection about e-commercial transactions. In order to fight e-commerce VAT fraud, payment service providers (e.g. banks and e-wallets) now transfer information to EU member states about cross-border payments received by economic operators. This information will then be centralised in a European database, the Central European System of Payment information (CESOP).

The objective of this new measure is to give member states’ tax authorities the right instruments to detect possible e-commerce VAT fraud carried out by sellers established in another member state or a non-EU country. CESOP will offer tax administrations a unified and evolving platform that allows advanced analytics operations on available data sources to detect VAT fraud. CESOP will receive billions of payments per quarter and will process this information meaningfully, providing new self-learned indicators, predictive analysis, and future fraud trend forecasting.

Figure 1: Central European System of Payment information (CESOP)

Source: IOTA (2020).

Certain models are already in place helping tax authorities to check tax compliance at the individual level, such as by detecting changes in residence and jurisdiction. For example, it has been publicly acknowledged that the Norwegian tax administration formulated an ML model so that it can automatically detect Norwegian residents who have emigrated from the country without notifying the tax administration and the central government. The model was built using 200 anonymised variables for pre-processing, and the test model achieves a 68% confidence level in identifying those who did leave Norway (true positives) and a 99.5% confidence level in identifying those who did not leave (true negatives). This proof of concept resulted in a list of 23,000 people whom the model estimates would have left Norway without paying their annual taxes.

Why does it matter?

Automation technologies are already a reality of the taxpaying landscape. Although there is no doubt of the benefits that RPA, ETL, and ML are bringing to the table for organisations to optimise the use of their resources and leverage technology for their processes, the fact that tax authorities are already heavily investing and leveraging these technologies has moved them from a ‘nice to have’ to a ‘must have’.

To help CFOs and tax managers navigate through those challenges, Deloitte Luxembourg’s Tax Digital Factory has developed tax-specific digital solutions for alternative investment fund (AIF) reports, standard audit file for tax (FAIA or SAF-T), DAC6, and many other tax compliance requirements.

These technologies are the stepping-stones to future tax application developments, something for which taxpayers and tax authorities alike should be preparing – starting with the use of RPA, ETL, and ML.

Fateh Amroune

Director, Deloitte Luxembourg

Sergio Ruiz de Gracia

Assistant Manager, Deloitte Luxembourg