On December 15 2021, the Federal Administrative Court of Switzerland (FAC) ruled in its decision A_4265/2019 and confirmed the view of the Swiss Federal Tax Authority (SFTA) that management fees paid by a Swiss real estate company to a related foreign investment adviser, amounting to roughly 20% of the rental fees, did not comply with the arm’s-length principle. Hence they were treated largely as non-tax deductible, resulting in a respective hidden profit distribution triggering Swiss withholding taxes of 35%.

The case in question is of valuable importance given that it concerns a rather common setup in Switzerland: a foreign fund investing in Swiss real estate through a Swiss special purpose vehicle (SPV) where the SPV is charged a management fee for asset management services.

The confirmation or rebuttal of this decision by the highest court could represent a landmark case with respect to the deductibility of management fees and to the arm’s-length determination of the latter. The decision deserves a thorough analysis of the challenges made by the SFTA and of the FAC’s arguments.

Legal basis and definition of management fees of a real estate company

According to Swiss tax provisions all costs are tax deductible as long as they are justified by commercial reasons (article 59 of the Federal Tax Act and article 25 of the Federal Law on harmonisation of the cantonal and communal taxes). The same tax provisions create the legal basis for the application of the arm’s-length principle. With the adoption of the transfer pricing (TP) report of July 13 1995 in the OECD Council, Switzerland undertook to comply with the recommendations contained therein. In a letter dated March 4 1997, the director of the SFTA instructed the cantonal tax administrations to observe the rules and recommendations contained in the OECD Transfer Pricing Guidelines (OECD TP Guidelines) when assessing multinational companies domiciled in their canton and when making any tax adjustments. This principle was also adhered to in the circular issued by the SFTA of March 19 2004 on the taxation of service companies.

The costs under dispute – whose arm’s-length nature is relevant – are intercompany management fees in the context of real estate. Management fees for a real estate company can include investment fees, portfolio management fees, [property] asset management fees or facility management fees. Behind each different type of management fees there is a different service rendered. A thorough definition of the fee at stake allows a correct delineation of the services for which that fee is charged, and vice versa. Only then can its arm’s-length nature be properly assessed.

Facts at hand of the court decision of December 15 2021

The case concerns a Swiss real estate company (“GmbH”) resident in the canton of Geneva owning only one property and having only one tenant.

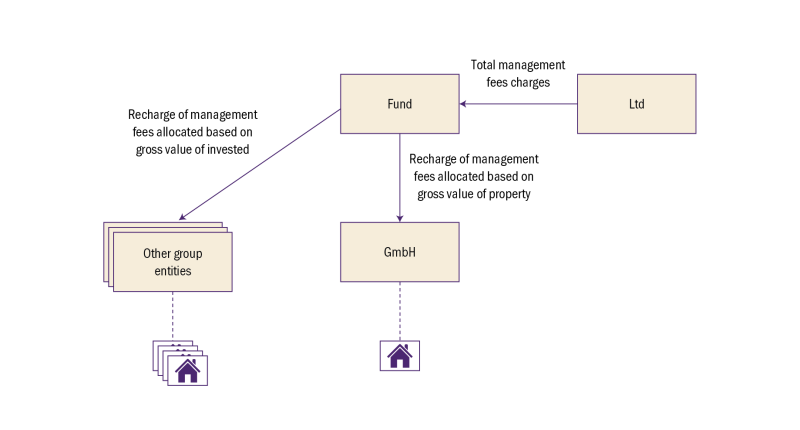

The GmbH is owned – through two foreign conduit companies – by a holding company abroad (“the Holding”), both the Holding and the conduit companies do not have any functional substance. The Holding is owned by an investment Fund (“the Fund”). The investor of the Fund is a pension fund. The Fund is managed by a foreign third-party investment management company (“Ltd”).

The GmbH is subject to a yearly management fee payment equal to approximately 20% of its gross rent. These fees are paid by the Fund to the Ltd and the Fund recharges these fees to the GmbH. The total fees received by the Ltd are paid for the management of the Fund as well as for the supervisory and management of eight real estate properties that the Fund is holding via several legal entities in several jurisdictions. The cost allocation to various legal entities is made according to the gross value of the respective property. The fees were paid on the basis of a legal agreement entered between the Fund and the Ltd. The GmbH is not party to the agreement but mentioned as one of the investment subsidiaries of the Fund. A simplified structure chart/payment diagram of the situation at hand is shown in Figure 1.

Diagram 1

The SFTA claimed, following a tax audit of the GmbH covering the fiscal years 2011 to 2015, that the management fee payments made from the GmbH to the Fund were not at arm’s length. The appeal filed by the GmbH regarding the formal decision of the SFTA was denied. However the arguments of the compliant GmbH are not discussed in detail in the FAC’s decision. What can be learned from the decision is that the GmbH pointed out that it received financing services by the Ltd (not defined more in detail in the decision): services that could not have been provided by a local service provider.

The total deductions of management fees for the five years corresponded to approximately CHF 5 million ($5.14 million). In its decision, the SFTA allowed CHF 200,000 per year (representing approximately 5% of its rental turnover) while considering the residual – i.e. CHF 4 million – a hidden profit distribution on which a 35% Swiss withholding tax was claimed.

The GmbH filed an appeal to the FAC rejecting the decision and eventually requesting the admission of management fees equal to 1.5% of the net asset value (NAV).

The decision of the Federal Administrative Court

The FAC ruled in favour of the FTA. The 20% management fees were deemed not to be at arm’s length since they would concern two portions of services not benefitting the GmbH:

The portion of the work consisting of the management of the fund that constitutes a service to the fund itself that cannot be borne by the Swiss SPV; and

The supervision and day-to-day management services of the eight properties indirectly held by the Fund through various entities in different countries. The court rejected the indirect allocation of the costs based on the respective gross value of the eight properties and asserted that the costs should have been allocated directly: costs would have to be broken down by the work done for each building.

Additionally, the court argued that there was no legal agreement between the GmbH and the Ltd regarding the management fees. There was only a legal agreement between the Fund and the Ltd, where the GmbH is mentioned as investment subsidiary.

In conclusion – according to the FAC – such services would have never been paid in the amount of approximately 20% of gross rent to a third-party foreign provider, in addition to what the GmbH already paid to local administrative service providers. The FAC limited the annual management fees that the GmbH is entitled to pay to 5% of the gross annual rental income. This rate is considered by the Court in line with practice. Notably it refers to Article 269 of the Swiss Code of Obligations regarding abusive rents (and the limitation of administrative costs to the extent of 5% of the gross rents according to practice). The GmbH now lodged an appeal with the Highest Court.

Observations on the decision

The contractual arrangements are important to crystalise the intention of the parties in a contemporaneous manner, i.e. at the time the transaction was undertaken. An agreement was made, however, between the Ltd and the Fund, and not between the GmbH and the Fund. Despite the agreement stating the possibility of invoicing the benefiting investment subsidiaries directly, these provisions were not sufficient for the FAC. Indeed the intention of the GmbH is missing in this legal arrangement. However in view of the substance-over-form approach, this cannot be the reason for rejecting the at arm’s-length nature of a payment.

|

|

“The confirmation or rebuttal of this decision by the highest court could represent a landmark case with respect to the deductibility of management fees and to the arm’s-length determination of the latter.” |

|

|

Surprisingly the Lower Court does not make one single reference to the OECD TP Guidelines, despite the dispute concerning a cross-border intercompany transaction, and it is officially confirmed that the OECD TP Guidelines are to be applied in Switzerland.

The court in its decision does not refer – as one would expect – to the notion of benefit test, to functions, assets and risks of the parties of the transaction or to third-party reference for the management fees under dispute. On the contrary the court referred to article 269 of the Swiss Code of Obligations that has no direct link to the arm’s-length nature of controlled transactions.

Based on the OECD TP Guidelines, the commercial and financial circumstances of the parties should have been reviewed. Further the actual transaction would have been delineated by analysing the economically-relevant characteristics on the basis of a functional analysis. Neither the FTA nor the FAC seem to have followed such an approach.

A real estate company owning only one single tenant asset might also require constant supervision and day-to-day management services for which correspondent property asset management fees have to be paid. Whether these services were provided by a local or foreign advisor should not be relevant, as long as duplication of services cannot be argued and the benefit from receiving these services can be supported.

An OECD-compliant approach would have analysed in detail which services were provided. In particular it would need to be reviewed to which extent the Ltd provided fund management services for the benefit of the Fund and/or for the benefit of the GmbH and/or supervision and day-to-day management services to the GmbH and the other real estate group companies for their benefit (i.e. property asset or facility management).

For rebutting the approximately 20% management fees, the court, rather than using comparable third-party pricing, referred to Article 269 of the Swiss Code of Obligations stating that the management fees allowed in practice amounts to a maximum of 5% of the rental income.

By doing so the court did not follow the OECD TP Guidelines on the application of the arm’s-length principle and disregarded the common practice in the property asset management industry whereby fees are not determined based on rental income, rather on the real estate value held by the SPV. Also the FAC rejects the allocation key used for the asset management fees based on the real estate value held by each real estate company and the notion that a fee can also be payable if a service is not constantly rendered but rather provided on demand.

The final assessment of the Federal Supreme Court is something to look forward to. It will be interesting to see whether more space will be given to an OECD TP compliant approach for reviewing and judging the facts and circumstances of this case.

Click here to read all the chapters from ITR's TP Special Focus

Monika Bieri |

|

|---|---|

|

Senior advisor Tax Partner AG – Taxand Switzerland T: +41 44 215 77 34 Monika Bieri is a senior advisor at Tax Partner AG – Taxand Switzerland. She has over 15 years’ experience in national and international tax matters. Monika began her career in a Big Four firm and later gained experience in the tax department of a multinational. In 2016 she joined Tax Partner as a consultant on national and international corporate tax law. Her focus is on corporate tax advisory for finance and real estate companies as well as TP. Monika is the author of various publications and holds an LLM in international taxation. |

Caterina Colling Russo |

|

|---|---|

|

Senior advisor Tax Partner AG – Taxand Switzerland T: +41 44 215 77 56 E: caterina.collingrusso@taxpartner.ch Caterina Colling Russo is a senior advisor at Tax Partner AG – Taxand Switzerland. She has more than 15 years’ experience in TP consulting. Before joining Tax Partner AG in 2016, Caterina has held specialist TP positions within global international tax and TP firms. She has worked in Amsterdam, London and Rome. She is a TP adviser for listed and non-listed Swiss and international multinationals. Caterina is a speaker at tax seminars, and has published various articles and books on TP. Tax Partner is a leading tax firm in Switzerland. With a team of approximately 45 professionals, the firm advises multinational and national corporate clients as well as individuals in all tax areas. In 2005 Tax Partner co-founded Taxand – the first global network of tax advisory firms with more than 550 tax partners and over 2,500 tax advisers from independent member firms in 50 countries. |