Japan

Former EY and Deloitte tax specialists will staff the new operation, which provides the firm with new offices in Tokyo and Osaka

Jaap Zwaan’s arrival continues a recent streak of A&M Tax investing in the region; in other news, the US and Japan struck a deal that significantly lowered tariff rates

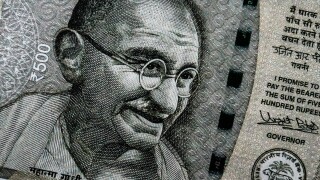

The move to a new ‘high spec’ hub is slated for 2026; in other news, India reassesses its pillar two participation following the US’s withdrawal

Jurisdictions that have ratified the global minimum tax are now in the process of making it a reality

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalKerwin Chung and Carlo Llanes Navarro of Deloitte provide an insight into ITR’s transfer pricing controversy guide, produced in collaboration with global transfer pricing experts from Deloitte.

-

Sponsored by Deloitte Transfer Pricing GlobalEdward Morris and Jamie Hawes of Deloitte discuss how the resolution of controversy has changed with the introduction of a more efficient system to handle MAPs and APAs.

-

Sponsored by Deloitte Transfer Pricing GlobalJuan Ignacio de Molina and Christine Ramsay of Deloitte consider the increased reliance of tax authorities on CbCR data and how the data reported in the CbCR during the COVID-19 pandemic could impede its use.

Article list (load more 4 col) current tags