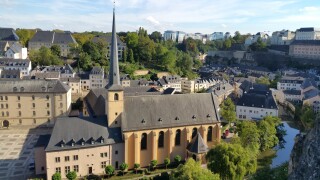

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte USRalf Heussner, Samuel Gordon, Anodri Suchdeve and Jon Gemus of Deloitte examine the transfer pricing dimension of three drivers affecting the private equity sector.

-

Sponsored by Deloitte USChristoph Mölleken and Ronny John of Deloitte Germany explain the various aspects that multinational enterprises should be aware of and provide practical recommendations on how to allow a smooth transition away from LIBOR.

-

Sponsored by Deloitte USJeremy Brown, Luke Tanner and Anodri Suchdeve of Deloitte describe how fintechs are changing the financial services industry and consider the transfer pricing aspects of intangibles used in common fintech business models.

Article list (load more 4 col) current tags