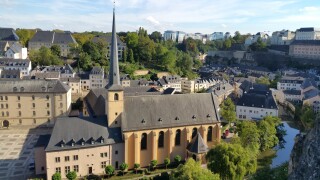

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalFred Omondi, Carlo Llanes Navarro, Anil Kumar Gupta, Lenny Saputra and Rabia Gandapur look into how developing economies across the world are embracing increasingly complex transfer pricing framework.

-

Sponsored by Deloitte Transfer Pricing GlobalPaul Riley, Shaun Austin and John Breen preview ITR’s controversy guide, produced in collaboration with global transfer pricing (TP) experts from Deloitte.

-

Sponsored by Deloitte Transfer Pricing GlobalDeloitte’s Jacqueline Doonan, Aydin Hayri, Oscar Burakoff and Clarke Norton explore the impact that the economic disruption has had on transfer pricing (TP) controversy in the hospitality, life sciences and consumer products industries.

Article list (load more 4 col) current tags