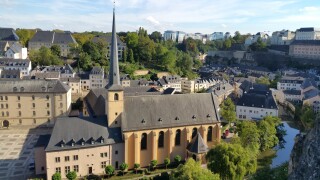

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte LuxembourgNavigating the adversarial principle in Luxembourg tax procedure: key Administrative Court takeawaysEdouard Authamayou and Christelle Larcher of Deloitte Luxembourg explore the adversarial principle in tax audits, highlighting key court rulings that clarify taxpayer rights and the Luxembourg tax authorities’ obligations to ensure procedural fairness

-

Sponsored by Deloitte LuxembourgBalazs Majoros of Deloitte Luxembourg provides an update on the transfer pricing landscape in the grand duchy against a backdrop of opposition to a draft bill and winds of change from the EU

-

Sponsored by Deloitte LuxembourgDinko Dinev and Ismail Candan of Deloitte Luxembourg explain how tailored transfer pricing policies can underpin success as the increasing complexity of debt investment instruments and heightened regulatory oversight demand enhanced tax compliance measures

Article list (load more 4 col) current tags