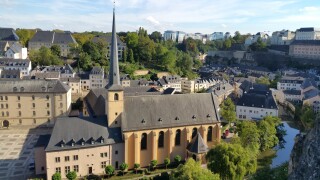

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by DS AvocatsCyril Maucour and Jessica Benchetrit of DS Avocats evaluate the effectiveness of the OECD’s new unified approach, which provides market jurisdictions greater taxing rights over residual profits.

-

Sponsored by Deloitte LuxembourgDinko Dinev and Mariana Cohen Margiotta of Deloitte Luxembourg analyse the key takeaways from the OECD’s recent TP guidelines targeted at MNEs and tax administrations.

-

Sponsored by TMF GroupITR and professional services firm TMF Group will host a webinar on March 26 on the impact of artificial intelligence on the tax industry, discussing its true definition and the steps that businesses can take to use it efficiently.

Article list (load more 4 col) current tags