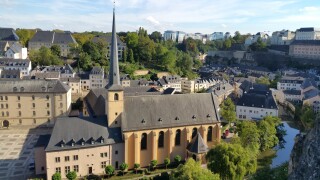

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalTehmina Sharma and Riddhi Shah of Deloitte India examine the industrial products and construction sector, where digitalisation is upending traditional business and supply chains.

-

Sponsored by Deloitte LuxembourgMichel Lambion and Christian Deglas of Deloitte Luxembourg analyse a CJEU decision which rules that the one month deadline for responding to a request for information when seeking a VAT refund is not mandatory.

-

Sponsored by Deloitte LuxembourgLuxembourg’s stability and innovative culture has made it a global leader in the financial services sector. However, the greater interaction between the tax and regulatory dimension is creating complex tax governance and controversy challenges. Deloitte Luxembourg’s Ralf Heussner and Enrique Marchesi-Herce explore the impact BEPS changes will have on Luxembourg and its financial services sector

Article list (load more 4 col) current tags