North America

If Trump continues to poke the world’s ‘middle powers’ with a stick, he shouldn’t be surprised when they retaliate

The Netherlands-based bank was described as an ‘exemplar of total transparency’; in other news, Kirkland & Ellis made a senior tax hire in Dallas

The deal establishes Ryan’s property tax presence in Scotland and expands its ability to serve clients with complex commercial property portfolios across the UK, the firm said

Trump announced he will cut tariffs after India agreed to stop buying Russian oil; in other news, more than 300 delegates gathered at the OECD to discuss VAT fraud prevention

Sponsored

Sponsored

-

Sponsored by KPMG USMark Martin and Thomas Bettge of KPMG in the US explore the conclusion to the Tax Court litigation in the Adams Challenge case, and note key takeaways for other companies.

-

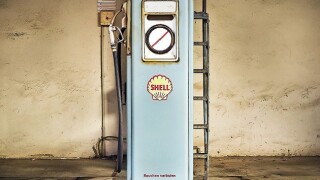

Sponsored by EY MexicoVíctor Anaya Sánchez of EY Mexico discusses how the newly introduced control system by the Mexican Tax Administration seeks to improve reporting functions related to fuel transactions.

-

Sponsored by KPMG USMark Martin and Thomas Bettge of KPMG in the US describe the OECD’s recent proposals for strengthening the Action 14 minimum standard, and explore how adopting these proposals could improve dispute resolution.

Article list (load more 4 col) current tags

North American Jurisdictions