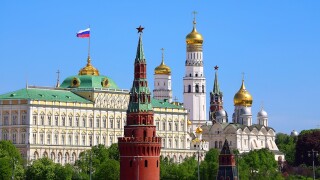

Russia

The country’s chancellor appears to have backtracked from previous pillar two scepticism; in other news, Donald Trump threatened Russia with 100% tariffs

Authorities must ensure that Russian firms do not use transfer pricing schemes to increase profits made from oil sold in different markets, advocacy organisations have argued

Russia suspended 38 tax treaties in response to the EU blacklisting the country after the 2022 invasion of Ukraine.

Russia will further its own economic isolation by suspending tax treaties with former allies, but this is part of Putin’s long-term mission.

Sponsored

Sponsored

-

Sponsored by Deloitte Transfer Pricing GlobalVrajesh Dutia and Ananthanarayanan R of Deloitte analyse the results of a TP controversy survey, involving TP practitioners across the globe, which seeks to gain a better understanding of the ever-evolving TP landscape.

-

Sponsored by Deloitte Transfer Pricing GlobalKerwin Chung and Howard Osawa of Deloitte preview ITR’s upcoming transfer pricing controversy guide, produced in collaboration with global transfer pricing experts from Deloitte.

-

Sponsored by KPMG RussiaStanislav Denisenko of KPMG Russia explains the controversy surrounding Article 54.1 of the Tax Code of the Russian Federation and why key questions remain unanswered.

Article list (load more 4 col) current tags