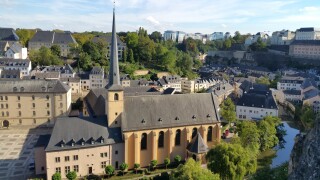

Luxembourg

Using tax to enhance its standing as a funds location is behind Luxembourg’s measures aimed at clarifying ATAD 2 and making its carried interest regime more attractive

Luxembourg’s reform agenda continues at pace in 2025, with targeted measures for start-ups and alternative investment funds

The new framework simplifies the process of relocating eligible employees to Luxembourg and offers a ‘clear and streamlined benefit’, says Alexandra Clouté of Ashurst

The Luxembourg-based TP leader tells ITR about relishing the intellectual challenge of his practice, his admiration for Stephen Hawking, and what makes tax cool

Sponsored

Sponsored

-

Sponsored by Deloitte LuxembourgDinko Dinev and Iva Gyurova of Deloitte Luxembourg analyse a landmark ruling on how economic substance plays a key role in determining whether interest-free loans from indirect shareholders constitute debt or equity for Luxembourg tax purposes

-

Sponsored by Deloitte LuxembourgEdouard Authamayou of Deloitte Luxembourg examines a tribunal ruling on hidden contributions and profit distributions that highlights the importance of robust evidence supporting the arm’s-length principle in intragroup financing arrangements and interest rate waivers

-

Sponsored by Deloitte LuxembourgEdouard Authamayou and Christelle Larcher of Deloitte Luxembourg explain how several recent rulings have clarified the Administrative Court’s stance on the application of ex officio taxation in the grand duchy

Article list (load more 4 col) current tags